Jenn asked what she thought was a simple question the other day – “I have a friend who is interested in getting two award flights to Germany, but doesn’t want to open a bunch of new cards, which single card should she pick?” My immediate answer was “Of course, the Chase Sapphire Preferred.” But now I’m second guessing that answer

The reason for my answer was fairly simple, Chase Ultimate Reward points transfer to a number of great airline programs many of whom serve Germany well, especially United Airlines. It’s a pretty good earning card and the transfer partners for Chase are great.

Then I questioned myself, because the Amex Gold card has tremendous points earning potential and some pretty good transfer partners as well. It’s flagship airline partner is Delta, which is not the best way to redeem points to Europe, but it could be a possibility.

Let’s run the numbers and see which of these two cards would be the best fit for a single reward card for redeeming points for two flights to Germany.

The Assumptions for this Comparison

The only categories of spending that are important for the Amex Gold and Chase Sapphire Preferred are groceries, restaurants and travel. The Chase Sapphire Preferred is 3x on dining, 2x on travel and 1x on groceries. The Amex Gold is 4x on groceries, 4x on dining and 3x on travel. Both cards earn one point per dollar on everything else.

The person we are comparing these cards for has a family of 4, and for the purpose of this comparison we will say that she spends $1,000 per month on groceries, $500 per month on dining and $2,500 on everything else, with no real spending on travel. I know $2,500 sounds like a lot, but when you figure that you can charge virtually everything, including shopping, insurance, gas, utilities, etc. that adds up quick when you have a family of 4.

Signup Bonuses

I always start with the Frequent Miler best offer page when I’m determining which credit card I want to sign up for, since it always posts the best publicly available offer. In this case, the Chase Sapphire Preferred is offering a 60,000 point bonus when the card holder spends $4,000 in 3 months. The Amex Gold is offering a 75,000 point bonus when the card holder spends $6,000 in 6 months as well as 20% back on dining up to $250 back. We are going to ignore the 20% back on dining, because that isn’t terribly common for Amex to offer that, but it is a fantastic deal. Neither one of those spend requirements will be a challenge for this card holder to reach.

Everyday Spend

So for this example, we are going to use the assumptions set earlier, $1,000 per month on groceries, $500 per month dining and $2,500 per month on everything else. The other assumption here is that she will use this card exclusively for 1 year. So which one will earn more points?

| Category | Chase Sapphire Preferred | American Express Gold |

| Groceries | 12,000 | 48,000 |

| Dining | 18,000 | 24,000 |

| Everything Else | 30,000 | 30,000 |

| Signup Bonus | 60,000 | 75,000 |

| Total | 120,000 | 177,000 |

I’m going to be honest, I thought the Amex Gold card would earn more points over the course of a year, but I didn’t think it would be that much more. The Chase Sapphire Preferred card is a very beloved card in the travel hacking world and to see it get outperformed by 57,000 points by the Amex Gold was a little shocking.

That being said, the Amex Gold does have a $250 annual fee compared to Chase Sapphire Preferred’s $95 annual fee. In the case of someone who is using it in this manner, the Amex Gold definitely is worth the extra $155 in annual fees though, which may not be the case for someone like me who churns and burns a lot of cards.

Comparing Flagship Partners

When comparing points you have to consider the most important transfer partner. In this case, Amex has Delta Airlines and Chase has United Airlines. Since the person in question here was looking for 2 tickets to Munich, with flexible dates, in the summer, let’s look to see what these points can get.

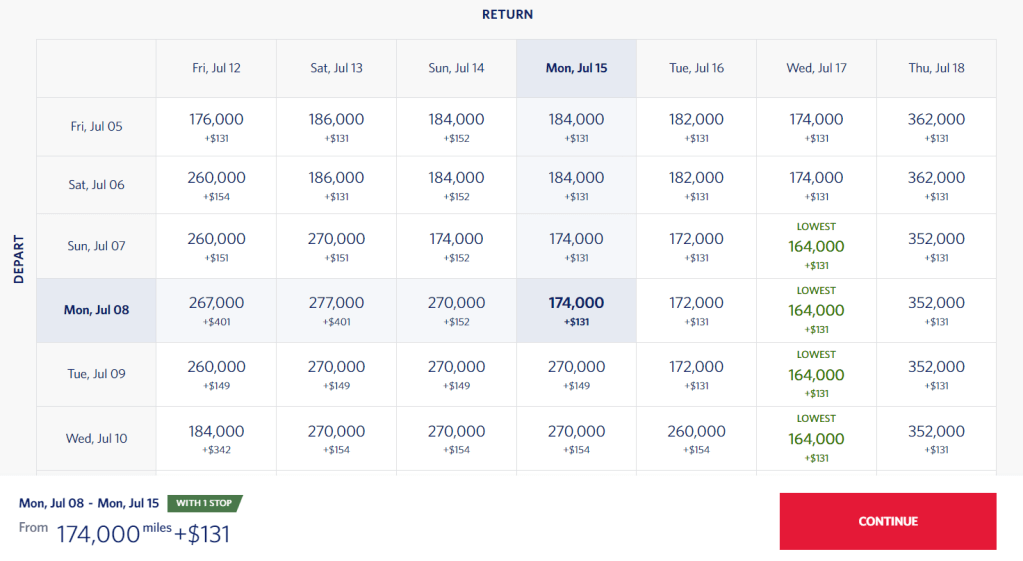

With Delta, the points calendar from Chicago to Munich in July looks like this.

The lowest available round trip is 164,000 miles. That would essentially eat up all of the points earned from the Amex Gold with one round trip ticket when the points are transferred to Delta. That’s not great.

With United Airlines, it’s a bit better with round trip tickets available in the summer for 80,000 United miles.

In this comparison, you would be better off with 120,000 Chase Ultimate Reward points than you would with the 177,000 Amex Membership Reward points, because on the flagship partners, the points go much further on United than on Delta. Neither one was able to get the cardholder to 2 roundtrip tickets to Munich, though. Luckily, those aren’t the only transfer partners for Amex and Chase.

Does Chase or Amex Have Better Airline Transfer Partners?

On the face of it, Amex has more airline partners, but as we all know, quantity doesn’t necessarily mean quality. In the chart below, Amex has 15 airline partners while Chase has 9. There are some key overlaps for trips to Europe, namely Avios, Flying Blue, Virgin Atlantic and Air Canada. Amex has Avianca Lifemiles, which I have used before, and I like due to their low taxes and fees. Chase and Amex both have JetBlue but Chase has a better transfer rate than Amex. Chase also has Southwest Airlines, which is a great partner, but it’s irrelevant for flights to Europe.

| Airline Partner | Transfer Rate | Chase Ultimate Rewards | Amex Membership Rewards |

| Avios (Aer Lingus, Iberia, British Airways) | 1:1 | Yes | Yes |

| Aeromexico | 1:1.6 | No | Yes |

| Air Canada Aeroplan | 1:1 | Yes | Yes |

| ANA | 1:1 | No | Yes |

| Avianca Lifemiles | 1:1 | No | Yes |

| Cathay Pacific | 1:1 | No | Yes |

| Delta Airlines | 1:1 | No | Yes |

| Emirates | 1:1 | Yes | Yes |

| Etihad | 1:1 | No | Yes |

| Flying Blue (KLM, Air France) | 1:1 | Yes | Yes |

| Hawaiian | 1:1 | No | Yes |

| JetBlue | 1:0.8,1:1 | Yes (1:1) | Yes (1:0.8) |

| Quantas | 1:1 | No | Yes |

| Singapore Airlines | 1:1 | Yes | Yes |

| Southwest Airlines | 1:1 | Yes | No |

| United Airlines | 1:1 | Yes | No |

| Virgin Atlantic | 1:1 | Yes | Yes |

A Quick look at Pointsyeah!

We need to talk a little bit about PointsYeah. This is a fairly new website that allows you to search available airline award space across 14 different airline programs. It also shows you which transferable points transfer to those programs as they display the results of the search. It’s an unbelievable free tool that is making searching for award flights super easy. There are other tools out there like Point.me and Seats.aero, so it’s a matter of preference, but my favorite right now is PointsYeah.

Searching on PointsYeah and using flexible dates in July, I was able to find these award flights from Chicago to Munich with the dates of July 1st through July 4th:

- 20,000 Flying Blue Miles and $105.38

- 24,500 Avianca Lifemiles and $26.70

- 26,500 Virgin Atlantic Miles and $149.40

- 30,000 Iberia Avios and $231.20

- 40,000 United Miles and $5.60

- 63,000 JetBlue Miles and $42.80

- 160,000 Delta Miles and $5.60

Returning, the flights from Munich to Chicago with the dates of July 8th through July 11th were:

- 22,000 Flying Blue Miles and $223.20

- 28,250 Iberia Avios and $237.60

- 30,000 Avianca Lifemiles and $109.30

- 43,900 United Miles and $124.60

- 63,000 JetBlue Miles and $156.20

- 160,000 Delta Skymiles and $288.21

Since there is no real penalty for booking one-way award flights, this is really like picking a first course/second course to piece together the round trip. If you are really trying to conserve points you could go with the two Flying Blue awards and pay 42,000 Flying Blue miles and $328.58 in taxes and fuel surcharges. Both Chase Ultimate Rewards and Amex Membership Rewards to Flying Blue so in this case, it wouldn’t matter if Jenn’s friend picked the Chase Sapphire or the Amex Gold. Either way it would cost a grand total of 84,000 Chase Ultimate Rewards or Amex Membership Rewards and $657.16. In either case, Jenn’s friend would have points to spare, but $657 is a lot of taxes and fuel surcharges for 2 economy tickets.

I would be tempted to go with Avianca Lifemiles both ways which would cost 54,500 miles and $136.00 in taxes and fuel surcharges round-trip. Avianca has a $25 fee for booking, so I think you would have to tack on an additional $100 for the two round trip fares. Avianca transfers from Amex Membership Rewards, and not Chase Ultimate Rewards so the total for the two flights to Munich would be 109,000 Membership Reward points and $372.00. That’s not too bad for flights in the summer.

You could also do a flight out using United miles and back using Flying Blue miles. That would only be available with Chase Ultimate Rewards, since United is a Chase partner and not an Amex partner. It would cost 62,000 Ultimate Reward points and $228.80 in taxes and fuel surcharges each. For two tickets, it would cost 124,000 Ultimate Reward points and $457.60. In this scenerio, there wouldn’t be enough Chase points available in one year, so this would have to take 13 months to earn the points for this trip instead of 12.

Disclaimer

There are a lot of factors at work here, including the fact that if you wanted to use Iberia Avios, for example, you would try to find the best times to get the best prices for those flights. I just used a random stretch of days in July, so you would most likely do better than this if you were searching over a longer period of time. There are also occasional transfer bonuses, so you can sometimes transfer points from Chase Sapphire Preferred or Amex Membership Rewards and get more than a 1:1 ratio, making your points work harder. Also, just because Flying Blue is offering great prices now doesn’t mean they will in six months, and just because United is charging 40,000 for a saver fare now doesn’t mean they won’t offer a flight for 30,000 later. Change is the only constant in miles and points.

What Wins – Chase Sapphire Preferred or Amex Gold?

In this case, I would say hands down the Amex Gold wins. This is simply because Amex, for someone with a decent amount of grocery and dining spend, earns a lot of points. This is also because with Amex Membership Rewards points, they could book the Avianca Lifemiles example or the Flying Blue example. In the Flying Blue example, they would be left with 93,000 Membership Rewards points that could be used on a different trip. In the Avianca Lifemiles example, with lower fees, they would be left with 68,000 membership rewards points after booking the trip.

With Chase Sapphire Preferred there was enough points to book the Flying Blue example and would be left with 36,000 Chase Ultimate Reward points after booking the two flights. They didn’t have quite have enough points after one year to book the United/Flying Blue combo with lower taxes and fees.

Conclusion

Honestly, I’m a little surprised that Amex Gold outperformed Chase Sapphire so easily in this comparison. That being said, this is a narrow comparison with a mid-summer trip from Chicago to Munich, these things vary wildly based on destination and timing. There are plenty of circumstances when you would be thrilled to have access to United miles or Southwest Airlines miles and you don’t have that access with Amex. However, doing this kind of search ahead of time can help you determine the best credit cards to sign up for before you potentially make a mistake.