November was a pretty good month for us. Why? Well we were in Italy for a couple weeks of it. Italy is a magical place where climate, landscape, food, culture and history all come together to make an incredible place to visit. There is no doubt why it is one of the most visited countries in the world and it did not disappoint.

We stayed in Florence, Venice and Rome and we also had a nice day trip to Cinque Terre. Rome and Venice were repeats for us. Rome is fine, I’m sure we will visit again, but I’m amazed by how much we’ve enjoyed Venice. Before we went the first time, I thought Venice would feel extremely touristy. It turned out to be quite different than I imagined. It really felt more authentic than the other places we visited. That being said, I think we spent more time on the side streets away from the tourist traps than the other cities we visited. It’s a reminder to us to actively get away from the main tourist areas of a city.

I’m determined to revisit Cinque Terre, hopefully for a few days. I’d love to hike the trail between the five towns and really spend some time exploring each of them. A day trip just wasn’t enough to fully appreciate Cinque Terre. As far as Florence is concerned, it’s the most beautiful city I’ve visited thus far, but even during the off-peak travel season, it seemed overrun with tourists. I might have appreciated Florence more if we would have wandered out of the main tourist areas.

A Couple of Redemptions

We have three trips planned for next year. The first is a spring break trip to spend a week on the Portuguese route of the Camino de Santiago de Compostella. The second trip is a summer trip where we haven’t determined locations or dates. The third is a trip to Nice France to participate in a UTMB trail running event where Jenn and our friends Bill and Theresa will be doing the 22 kilometer race and I will be participating in the 54 kilometer race.

In November, we started the planning of these trips by booking a flight from Chicago to Porto. Virgin Atlantic was charging 12,000 miles and $175 per ticket to book the flight but with a 40% transfer bonus from Chase it ended up costing us 35,000 Chase Ultimate Reward points and around $700 for four tickets.

In cash, those flights would have cost $433 each. That means that we ended up getting a little over $1000 value for those 35,000 Ultimate Rewards points. That works out to 2.9 cents per point value, when Chase Ultimate Rewards points are typically valued at 2 cents per point so I’m pretty happy with the redemption.

We also used 38,000 Capital One miles to wipe out the cost of some train tickets from our trip to Italy. This isn’t the best use of Capital One miles, because we just get one cent per point on reimbursement for travel purchases. However, my goal is to use all of Jenn’s Capital One miles so she can cancel her Venture Card and then I will apply for one. Capital One allows people to get a bonus every four years so I think with the two of us working together, the smart thing is for us to alternate every two years who is carrying a Venture Card. That will allow us to maximize signup bonuses for Venture cards.

Barclays Aviator Red Bonus

I had one signup bonus hit in November. I received the 70,000 American Airlines mile bonus for signing up with the Barclays Aviator Red card, which is scheduled to no longer be with Barclays in 2026. This is part of an exclusive deal between American Airlines and Citibank, making Citibank the exclusive bank of all of the American Airlines credit cards moving forward. Customers who hold American Airlines cards issued by Barclays will probably be transferred to Citibank and I would assume that the Aviator Red card will no longer be taking new applicants. Therefore if you if you want sign up for the Aviator Red card, the clock is ticking, and I would assume that some time soon, Barclays will no longer be taking new applications.

On to the Point Check

I’ve been working on a signup bonus for my US Bank Triple Cash card and I had some issues with it that really boils down to me not paying attention to what I was doing. Without getting into the boring details of it, I’m an idiot and I ended up having to get new credit cards issued, with the correct business name on it. This happened right before we went to Europe, so I basically wasn’t using the card for most of the November billing period.

| Card Used | Spend | Points Earned | Point Value | Points Per $ | Return on Spend |

| Amex Business Gold | $889 | 1401 | $28.02 | 1.6 | 3.1% |

| Amex Gold | $817 | 2,148 | $42.96 | 2.6 | 5.3% |

| Venture | $752 | 1,504 | $27.82 | 2.0 | 3.7% |

| Citibusiness AAdvantage | $698 | 698 | $11.17 | 1.0 | 1.6% |

| Ink Cash | $459 | 2,298 | $47.11 | 5.0 | 10.3% |

| Wyndham Business Earner | $422 | 2,288 | $25.17 | 5.4 | 6.0% |

| Total | $4,046 | 10,337 | $182.25 | 2.6 | 4.5% |

My spending primarily got put on my Amex Gold and the Citibusiness AAdvantange, where they didn’t take American Express, which was in a lot of places in Italy. It wasn’t really ideal, and that’s why my non-bonus spend only returned a disappointing 4.5% last month. I ended up spending less than $500 on my Triple Cash card and earned about $8 in cash back.

Jenn has been working on her bonus for her Citi Strata Premier card and spent less than $1,500, earning over 2,500 Citi Thank You points.

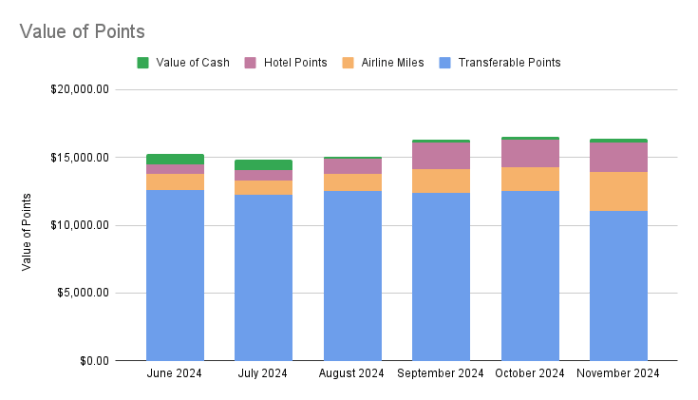

Between the points earned this month and the redemptions the total value of our points went down slightly. We finished the month with:

- 298,200 American Express Membership Rewards Points

- 175,700 American Airlines Miles

- 174,300 Chase Ultimate Reward Points

- 142,300 IHG Points

- 71,900 Marriott Bonvoy Points

- 48,900 Capital One Venture Miles

- 47,100 Wyndham Points

- 19,600 Hyatt Points

- 5,000 Delta Skymiles

- 2,700 United Miles

- $227 in Cash Back

All of these miles, when using the Points Guy’s valuations, add up to around $15,600. That should give me plenty of room to do all of the travel planning that I need to do for 2025. That’s the fun stuff, I can’t wait!