Sometime this last winter, Jenn was talking about wanting to take a Girls’ trip (with her Mom and her Sister) to celebrate a milestone birthday for her Sister. We had basically just completed booking our European vacation just a couple of months earlier and we had learned a valuable lesson from that booking that we didn’t want to repeat – don’t be dependent on one way to book.

What I mean by that is that when we booked our flights to Europe, all we had was United miles, and that was our only option. If the flights weren’t cheap enough on United, we weren’t going or we were paying cash. So the solution to this issue was to find multiple ways of booking flights on points and make sure that we stockpile points in multiple areas.

The Power of Stockpiling Points

Jenn had already begun to accumulate Ultimate Reward points by taking advantage of two 90k bonuses for Chase Ink cards as well as a 60k Chase Sapphire bonus. Since they were thinking Mexico or the Caribbean, Chase Ultimate Reward points, having the ability to transfer to Southwest Airlines or United Airlines, might make sense.

We also added over 80k points by meeting the the minimum spend on a Capital One Venture card. That’s intriguing because Capital One miles transfers to the Turkish Airlines Miles & Smiles program where booking round trip United Airlines saver flights to Mexico and the Caribbean often costs only 20k points .

Jenn also jumped on a 75k point bonus offer on the Delta Business Gold Card. When she did it, I scoffed a little because a lot of people joke about Delta Skymiles as being “Sky Pesos”. It’s a bit of a joke because Delta is notoriously expensive to fly to Europe or in business class on points. That being said, I think people might find that Skymiles could be particularly valuable for domestic and North American international economy award tickets and Jenn found that out.

In this case, Jenn received an email from Delta about a flash sale, and went on to Delta’s website, where she was surprised to find a round trip flight out of Moline Airport to Cancun in January for 26k Skymiles each. Because of the 15% award discount afforded to Delta Gold Card holders, she was able to book it for 22k Skymiles and $116 in taxes each for a total of 66K and $348. Those flights were priced at that time at $631 each, which means that this redemption was more than 2.3 cents per point which is a really good value for airline miles and definitely not worthy of being derided as “Sky Pesos”. This is particularly great, because good award rates out of the Moline Airport are usually hard to find, and typically we fly out of Chicago because of it, which usually means booking a hotel and paying for pretty expensive parking.

Because of the fact that we had significant amounts of Chase Ultimate Rewards points, Capital One Venture miles and Delta Skymiles, we were able to keep our eyes open for special rates with Delta, United, and Southwest Airlines, as well as being able to book Sky Alliance flights through Turkish Miles and Smiles or Avianca Lifemiles. I’m sure that we could get more creative than that, but honestly, it wasn’t needed in this case. Having flexibility in multiple programs allowed Jenn to be patient and wait for a great deal, and then jump on it when she had the opportunity.

Flexibility on Booking Lodging

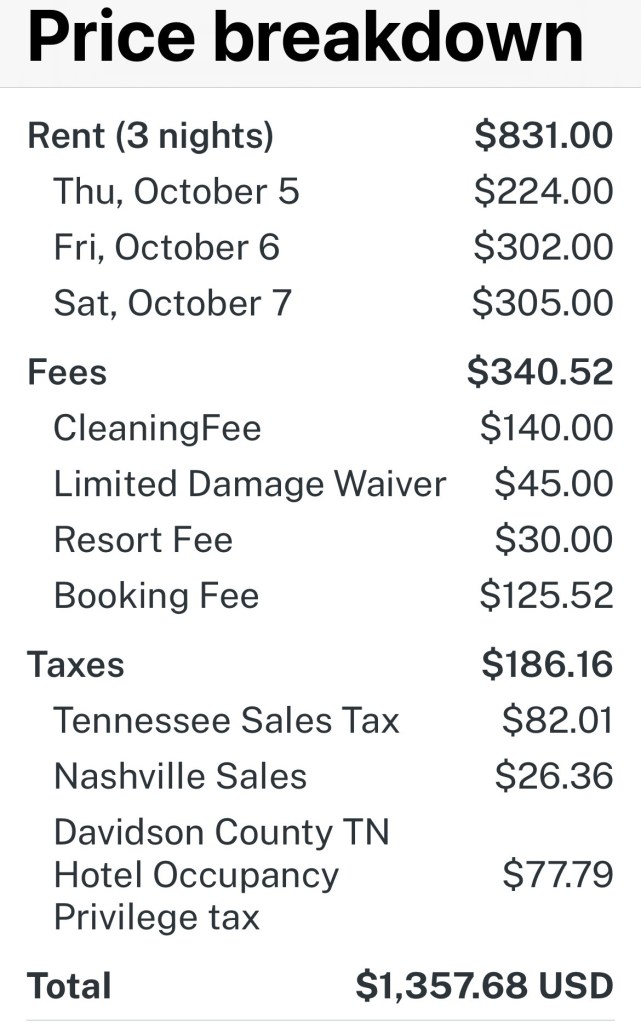

We had some flexibility built into our points for lodging as well. We had accumulated a decent amount of Wyndham points, and a respectable but not huge amount of Marriott Bonvoy points. However, with Jenn having a nice stockpile of Chase Ultimate Reward points, which transfers 1:1 to World of Hyatt points, that also made Hyatt a good possibility as well. Because of a status match made possible by Jenn’s Wyndham Business Earner card to Ceasars Rewards (visit Upgraded Points for more details), we also had a 4 night “free” stay available at Atlantis in Nassau in the Bahamas. The Atlantis stay would have had a bunch of extra resort fees that would have added up to over $200 a night and was quickly eliminated. Chase and Marriott were definitely possibilities, but the Wyndham-Vacasa partnership is just too good to pass up. We booked a Vacasa with Wyndham points before and got great value for that redemption.

Jenn decided to book a 1 bedroom Vacasa in Playa Del Carmen for 54,000 Wyndham points total for a 4 night stay. That particular Vacasa typically would rent for $1,325 for a 4 night stay in January meaning that those points were redeemed at 2.4 cents per point. This is another ridiculous value considering Wyndham points are generally valued at 1.1 cents per point. Booking a Vacasa rental with Wyndham points is a little weird because you have to call a special line to do it, but the rules are simple. Vacasa rentals cost $15k points per night per bedroom and is bookable with points as long as the cash price is under $500 per night per bedroom. For example, a one bedroom is bookable for 15K points per night as long as it costs under $500 and a 2 bedroom is bookable for 30k points per night as long as the cash rate is under $1000. Having a Wyndham Business Earner card gives you a 10% point discount on those rates. (Update – the program has recently changed and now the ceiling on cash price is $350 per bedroom per night, this changed in October 2023)

Obviously we’ll have to wait until they get there to find out if the Vacasa rental is as nice as the photos, but it looks gorgeous. It looks like Jenn did a great job booking this trip and I really hope they all have a great time (I’m sure she’ll feel sorry for me shoveling mounds of snow out of our driveway while she’s sipping a Bohemia Oscura cerveza on the beach). In the end, this was made possible because Jenn had the ability to be flexible with dates, locations and points programs. It allowed them to book what looks like a great vacation for not a lot of points and cash.

I may Have Created a Monster

When we got started with points and miles, it was pretty much me doing all of the research, listening to podcasts, reading blogs, and doing as much internet research as I could. As we started to have some success, with booking trips to Cabo San Lucas as well as our trip to Europe this summer, Jenn really started to not only get interested in points and miles, but she actually really gets it now. I expected to have to guide her on planning this trip, but for the most part, other than a couple of suggestions, she did this on her own and it was undoubtedly the best trip in terms of redemption value that we’ve made. Going forward, I think with both of us having a solid understanding of points and miles, we should have some great trips ahead, as long as she decides to come back from Mexico, of course.