After really pushing every angle we could for the last 17 months, we now have accumulated 25,000 Citi Thank You points, 45,700 United miles, 80,000 Delta miles, 5,300 American Airlines miles, 58,300 Marriott Bonvoy points, 1,600 Hyatt Points, 274,900 Ultimate Reward points, 49,500 Wyndham points, 83,300 Capital One Venture Miles and $470 in Cash Back. By using the Points Guy valuations located at https://thepointsguy.com/guide/monthly-valuations/ that comes to a total value of $10,650. That sounds like a lot, but what exactly does that mean? It’s a bunch of points, but it’s spread over a ton of different programs. How useable are they, really? It turns out, that they are really useful because the real power are the transferable points that total up to around $7,500 worth of value between the Citi Thank You points, Capital One Venture miles, and the 274,900 Ultimate Reward points. Those points can either bulk up the points that you have in airline or hotel programs, or they can be transferred to a program you don’t even have points in, if there’s a great deal available. Let’s examine what these points could actually do.

United Airlines

Because Chase Ultimate Reward points are transferable to United Airlines (as long as you have a Chase Sapphire Preferred Card, Chase Sapphire Reserve Card, or a Chase Ink Business Preferred Card) the 274,900 points can be transferred to United. That means that while we have a total of 45,700 United miles, it actually means we have the potential to have 320,600 United miles. With United Airlines saver rates to Europe running at 40K right now, that means the possibility of 4 round trip tickets to Europe.

American Airlines & Delta Airlines

American Airlines doesn’t have typical transfer partners. There was a brief moment when Citi Thank You points were transferable in late 2021, but there aren’t any current transfer partners. So the 5,300 miles are basically useless unless I get an AA credit card with a sign up bonus. However, Marriott Bonvoy will transfer to AA at 3:1, so 57,000 Bonvoy points could turn into 19,000 AA miles for a total of 24,300 AA miles, with which you could probably pretty easily get a domestic round trip ticket. With Delta we have 80,000 points, so that’s a usable amount, but we don’t have any points with Delta’s only major transfer partner, American Express. There is a 3:1 transfer opportunity from Marriott, so we could transfer 57,000 Marriott Bonvoy points to Delta for 19,000 Delta miles to make 99,000 Delta miles when added to the 80,000 we already have. Neither one of the Marriott transfers would be an ideal use of Bonvoy points, but it is available. That could pretty easily get us a few domestic round-trip tickets as 16K round-trip in Basic Economy is not too hard to find.

Marriott Bonvoy Points

Transferring to Marriott can be done at a 1:1 rate from Chase Ultimate Rewards to Marriott Bonvoy. This means that there is a potential of more than 330,000 Bonvoy points by combining our Ultimate Reward Points and Bonvoy points. Since I’ve been eyeballing a trip to the Canary Islands, I found this listing which is a 3 bedroom villa with a heated pool in the Canary Islands for 43K points per night. That’s 7 nights in this villa.

Hyatt

Hyatt is known for having the most valuable hotel reward points. Because of that, Hyatt has been a favorite way for people to use Ultimate Reward points for years, since they transfer at 1:1 to Hyatt. While I only have 1,600 Hyatt points, we are able to leverage as much as 276,500 Hyatt points by transferring our Ultimate Reward Points. Hyatt points are extremely valuable. For example, if you just need a clean and comfortable room, Hyatt has some pretty nice category 1 Hyatt Places that you can routinely book for 5,000 per night. If you were to use those points that way it’s a total of 55 nights at 5,000 per night. If you want to book all-inclusive resorts, they are classed from A-F. The standard night bookings for A is 15k points per night, B is 20k, C is 25K, D is 30K, E is 40K, and F is 50K. So we would be able to book 18 nights at a class A, 13 nights at a class B, 11 nights at a class C, 9 nights at a class D, 6 nights at a class E or 5 nights at a super-swanky class F. We stayed at the Hyatt Ziva Los Cabos (which recently jumped from a class B to a class D) and we thought it was fantastic. If we were to go back we could stay for 9 nights, although my liver probably couldn’t handle it.

Wyndham Rewards

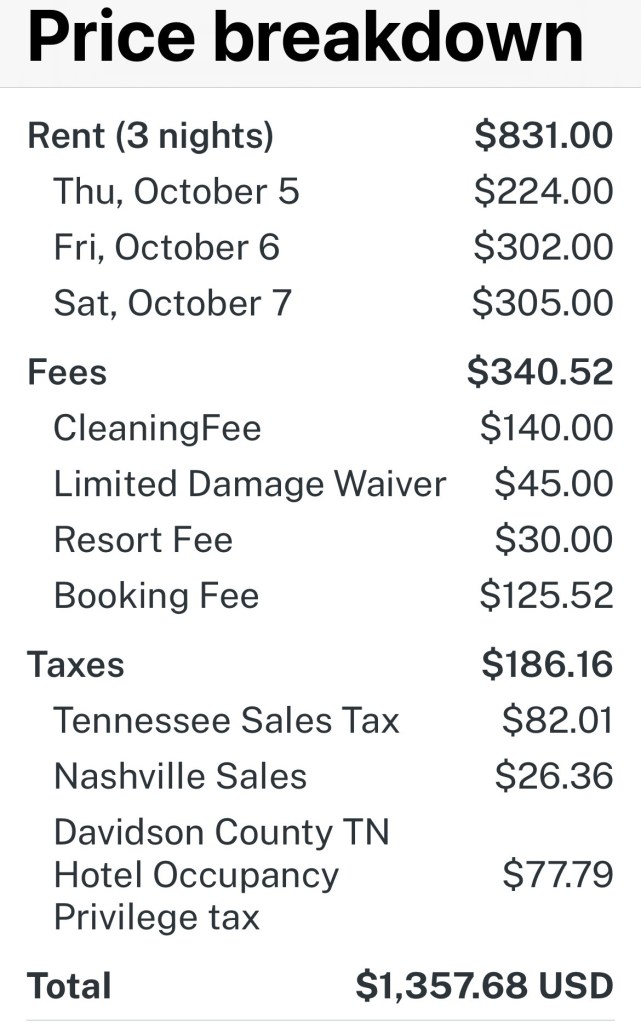

Both Capital One Venture miles and Citi Thank You points transfer to Wyndham at a 1:1 ratio, so if you total all of those points up, I have the possibility of 157,800 Wyndham points. The only interesting use of Wyndham points, for me, is to use them for Vacasa rentals. The generally accepted rule on Vacasa is that the you can basically book any available Vacasa for 15,000 points per bedroom per night as long as the normal price of the rental isn’t more than $500 per bedroom per night. In other words, these points would be worth 10 nights at a one-bedroom Vacasa rental worth up to $500 per night, or 5 days at a two-bedroom Vacasa worth up to $1,000 per night or even 3 nights at a Vacasa rental worth $1,500 per night. It’s such a good deal that we recently purchased points for a rental in Nashville and it saved us around $1000 over three nights.

Flying Blue

Ok, I have exactly 0 Flying Blue miles. Flying Blue is the rewards currency of Air France, KLM, and 4 smaller airlines. Just because I don’t have Flying Blue miles doesn’t mean that I can’t redeem them for flights, though. Flying Blue is great because they have great transfer partners and occasionally have ridiculous deals. They are 1:1 transfer partners with Chase, Capital One, American Express, Citi and Bilt. They are also 3:1 partners with Marriott Bonvoy. So if I do the math on the Capital One, Citi, Chase and Marriott Bonvoy Points, I have access to over 375,000 Flying Blue miles. On top of that, sometimes they have some awesome transatlantic flight rates. Here is an example I put together from Chicago to Paris. It’s round trip in Economy, 30K miles and less than $200 in taxes and fees. I could literally book this 12 times with the available points.

Virgin

Ok, this one, honestly, I don’t even believe this exists. Bear with me on this, again I have precisely 0 Virgin miles. Virgin has a ton of great transfer partners, similar to Flying Blue. They have Chase Ultimate Rewards, Citi Thank You points, Capital One and Amex all at 1:1 as well as Marriott Bonvoy at 3:1. In this case, it would be similar to Flying Blue with us able to covert our points to 375,000 Virgin miles, however, they also right now are offering a 30% transfer bonus from Chase, as described in this post from One Mile at a Time. With the transfer bonus, we would have access to 464,500 Virgin miles if we did complete transfers from Citi, Chase, Capital One and Marriott. Here is the deal from Virgin that would be the most intriguing to me – Virgin cruises occasionally runs sales on cruises where you can get a one week cruise for 2 people for 80,000 points. The latest special, as described by Upgraded Points, has 4 different 7 day itineraries for Mediterranean cruises to choose from. With the available points, we could cruise for 5 weeks and have points to spare. That’s just silly.

The importance of Flexibility

Obviously, a lot of these examples are ridiculous. We’re not going to stay 55 nights in a Hyatt Place, fly to Paris 12 times or cruise for 5 weeks, but they are meant to illustrate a point. If you stay on top of deals and know who you can transfer points to, you can really stretch out your points. If you can also be flexible with dates and locations, you can stretch it out even more. Keep in mind though, a typical, non-saver one way fare across the Atlantic Ocean is 70K United miles, not 40K, and business class typically runs 155K so these miles can disappear quickly if you’re not shopping around. If you try pricing out a Saturday to Saturday trip to Cancun during spring break on points to stay at an all-inclusive resort, that will probably be an ungodly amount of points, if you can even book on points at all. However, flying to Europe during spring break is off-peak and can be extremely cheap by comparison. Just like with cash, your points can go a lot farther if you are a diligent shopper.

Cash

I hope this never happens, but there is always the possibility that at some point I won’t want to travel, or can’t travel for some reason. In which case, these points are useless, correct? Well, not exactly. The credit card points do have a cash value, not the airline and hotel points, but the credit card points. The Chase Ultimate Reward points are worth 1 cent each, the Citi Thank You points are worth 1 cent each and the Capital One miles we have are worth half a cent each, when redeemed for cash. That would mean all of those transferable points have a current cash value of over $3,400. Which is nice, but probably not how I want to use the points.

What do we do now?

It’s almost strange to think about, but I just consider this to be a good base of points. We finally have enough points to utilize multiple programs (this post doesn’t even scratch the surface of great transfer partners, I didn’t even mention one of my favorites, Turkish Airlines). Our strategy moving forward will probably include a decent amount of cash back cards to fill in those gaps that points can’t, like Airbnb and taxes and fees on flights. It will also probably mean getting cards that are running elevated sign up bonuses. Either way, the next vacation we book should be easier for us to get a really good deal because of the flexibility we have built with this cache of points and miles.