When I booked our flight and Airbnb for Cabo San Lucas, I left 2 days off the calendar. We had 6 days between flights and the last 4 days were locked in at the Airbnb, but I hadn’t booked anything for the first 2 nights. My plan was to get a credit card to pay for 2 days in an all-inclusive resort. I looked around and there wasn’t much you could book on points in Cabo at the time. The only hotel I could find that had pretty consistent award availability was the Hyatt Ziva Los Cabos. That meant that I needed a Hyatt card.

I applied for the Chase World of Hyatt personal card, it was offering a 30,000 point bonus after 3,000 in spend and a total of 2x on everything until you spent $15,000 on the card for the first 6 months. The card has a $95 annual fee and earns 2x points on Gym memberships, dining out, transit and flights. It also earns 9x on Hyatt stays. You also receive a one night certificate each year for a category 1-4 hotel on your anniversary date. In other words, each year you pay $95 for a one-night certificate. That being said, I just did a random search for a Saturday night in October in Chicago and found out that a Hyatt Place that would be $460 on that night would qualify for the certificate. Not too bad, if you plan to use those certificates.

The Hyatt Ziva was typically 20,000 points per night for 2 people and so I figured I needed to spend around $5,000 on the card to get the necessary 40,000 points to book the hotel for 2 nights.

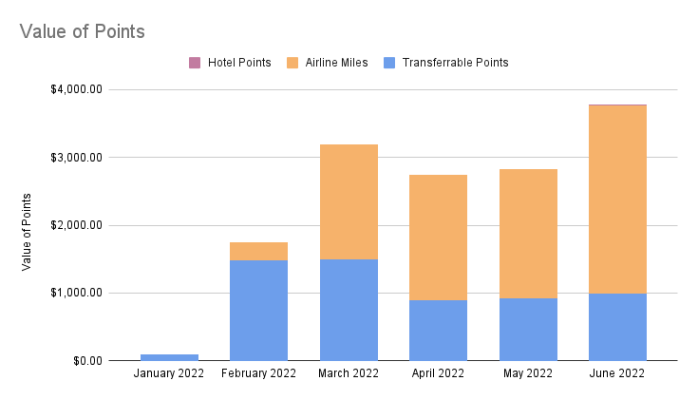

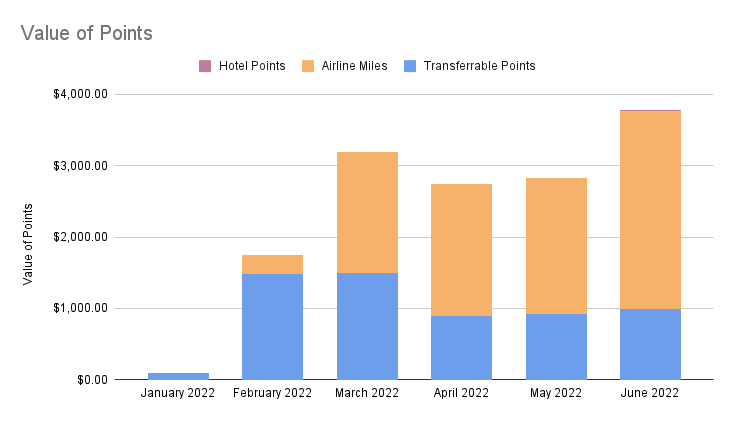

On to the point check!

I spent about $500 on the Hyatt card and earned around 1000 Hyatt points. Jenn spent around $1,600 on her United Business card and earned 1700 points, and she hit her 75,000 point bonus! I also spent $2,700 on my Citi card and earned 3500 points

That left us with around 245,300 United miles, 58,000 Citi points and 1,000 Hyatt points. I thought that the 245,300 United miles was enough to fly to and from Europe, and it is, sort of, but in our case, not so much. I’ll explain this in a later post, but I found out when I tried to book flights that you really can’t transfer points between family members, so that threw a wrench in my plans.