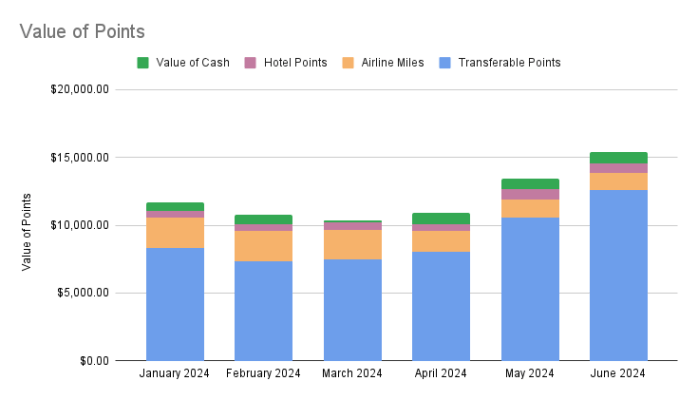

Wow, another big month of accumulating points as we continue to collect Membership Reward points from the three American Express cards that we signed up for this year. Last month Jenn earned her 130,000 point bonus on her Amex Business Gold card. This month, I earned my 75,000 point signup bonus on my Amex Gold Card. These bonuses in the last two months were the main reason why our total points valuations jumped from over $10,500 two months ago to over $15,000 now.

Hoarding Points

There is a a generally agreed upon philosophy in the points and miles community of “Churn and Burn”. It’s actually a very solid philosophy. The reason for that is because over time, points tend to lose their value. They don’t go bad like milk, but they do have a tendency to be worth less over time. For example, when we were planning our first trip to Europe, we accumulated a bunch of United miles with the hope that 240,000 points would be enough to fly round trip for four people.

This was actually the case for us on that trip, because at the time, 30,000 points one-way was actually pretty commonly available. However, if you try to use United miles to fly to Europe now, chances are that it will cost you over 40,000 points each way in economy. So if you were holding a bunch of United miles, you just saw the value of your points drop pretty significantly.

We are, against the advice of so many people, deliberately hoarding points. Why? Well, partly because of the fact that we have two kids and we are at the stage of our lives where we are unable to travel as much as we want. The other reason is that because of the kids we spend a lot of money on things like groceries, clothes, cell phones and especially car insurance that will be significantly reduced once they move out on their own.

This will eventually reverse and we will travel more, while spending and earning less. That is when we will definitely need to lean heavily on points and miles to allow us to maximize our travels. My rough goal is to save about $5,000 worth of points and miles annually until I’m eligible for retirement. It seems aggressive, however in two and a half years in the points and miles hobby, we’ve managed to accumulate $15,000 in points and miles, while still taking some pretty great trips.

A minor Redemption

We have a trip to Italy planned in November, where we were able to leave a 25 hour stopover on our flight from Chicago to Rome. The stopover is in Amsterdam, and I am very much looking forward to it. When we planned for that, I knew we would need to book a hotel. I was hoping to use our category 1-4 Hyatt certificate for the stayover. The problem was that the hotel that I really wanted to stay at was a category 5, and the only other Hyatt that made sense was a category 2.

I’m not going to burn a free night certificate on a category 2 hotel, so we went ahead and used 8,000 Hyatt points to book a room at the Hyatt Place near the Amsterdam airport. We’re going to have to take the train into the the center of Amsterdam to enjoy it, but at least we’ll be close to the airport when it’s time to catch our flight.

Capital One Spark Card Select

Jenn applied for and was accepted for the Capital One Spark Card Select. The Spark Card Select is a business card that earns an unlimited 1.5% on all purchases. It doesn’t have an annual fee and it comes with a $750 signup bonus when you spend $6,000 in the first 3 months.

One interesting wrinkle in this is that you can transfer any cash rewards to a Venture card, if you have one, at a ratio of 1 cent to 1 point. This means that if you have a Venture card, which Jenn does have, you can transfer the $750 signup bonus to the Venture card as 75,000 venture miles. The nice thing about Venture miles is that they can be transferred to any of Capital One’s many transfer partners.

This is probably not going to be a card we spend on once we hit the signup bonus. We already have a couple of 2% anywhere cards that work as a good base for any spending in non-bonus categories, so 1.5% just isn’t going to excite me much after earning the signup bonus. That being said, it doesn’t have an annual fee, so there isn’t a huge incentive to run out and cancel it either.

On to the Points Check!

| Card Used | Spend | Points Earned | Point Value | Points Per $ | Return on Spend |

| Venture | $1,292 | 2,584 | $47.80 | 2.0 | 3.7% |

| Ink Cash | $534 | 2,651 | $54.35 | 5.0 | 10.2% |

| Wyndham Business Earner | $450 | 2,734 | $30.07 | 6.1 | 6.8% |

| Citi Custom Cash | $94 | 318 | $5.72 | 3.4 | 6.3% |

| Total | $2,370 | 8,287 | $137.95 | 3.5 | 5.8% |

Aside from the spending in the above chart, I spent under $300 on my Amex Gold card, and under $700 on my Amex Blue Business Plus card. That spending, as well as earning the signup bonus on my Amex Gold, increased my Membership Reward points by a little less than 80,000 points. Jenn spent a little over $2,700 on her Amex Business Gold card. Some of that spending was at 14x on dining, which was part of the referral bonus to get me to sign up for the Blue Business Plus. That $2,700 in spending earned over 15,000 points, so I would imagine a decent chunk of that was part of that bonus.

After all of that, we finished the month with 279,400 Membership Reward points, 233,000 Chase Ultimate Reward points, 81,200 Venture miles, 71,400 American Airlines miles, 39,300 Citi Thank You points, 34,900 Marriott Bonvoy points, 33,000 Wyndham points, 5,000 Delta miles, 2,300 Hyatt points, 1,800 United miles, and around $800 in cash back. Using the Points Guy’s valuations, these points are worth around $15,300 – not too shabby.