Because I had been denied for the Chase Sapphire Preferred card, Jenn decided to apply for it. I told her that I had been denied twice and that she shouldn’t get her hopes up. She filled out the application, hit enter, waited about 30 seconds and then began to taunt me because not only was she approved instantly, but they gave her a pretty big credit limit. Chase Sapphire Preferred, why do you hate me?! She still needles me about it, waving that card in front of me. I should probably divorce her.

Anyway, the Chase Sapphire Preferred has a $95 annual fee. It offers 5x points on travel purchased through the Ultimate Rewards program, as well as a $50 hotel credit when booked through the Ultimate Rewards program. The card also earns 3x points on dining, streaming services and online groceries, 1x on everything else. She also will receive a 60,000 point bonus when she spends $4,000 within 3 months. What makes this card valuable, though, is the fact that it can be used to transfer points to 3 hotel programs and 11 airline miles programs. Also, it makes some other Chase cards in your wallet more useful, because, for example, if you had a Chase Freedom Flex, you can take advantage of the 5x points on certain categories and then transfer those points through the Sapphire and into those other programs.

I moved on to cash back cards, I know, boring. I applied for the Bank of America Customized Cash Rewards card. It earns 3x on a category of your choice, 2x on grocery stores and warehouse stores and 1x on everything else. It offers a $200 bonus after spending $1,000 in 3 months. I don’t think I will use this card too much after earning the bonus, but it doesn’t have an annual fee, so there’s no reason to get rid of it.

Anyway, on to the point check!

I spent a little over $1,000 on my Citi Premier card and earned almost 2,900 Citi points. I also spent almost $600 on my United Explorer card and earned around 1,200 points. We spent almost $200 on Jenn’s Marriott Bonvoy on a hotel/park & ride near O’hare Airport with what I assume was a concrete mattress. That stay earned us almost 1,000 Marriott Bonvoy points and a massive backache. Jenn spent $2,600 on her Chase Sapphire card and earned almost 4,600 Ultimate Reward points. She also finished off the necessary spending on her Ink Unlimited card with $1,300 and earned 2,000 points plus the 90,000 point bonus.

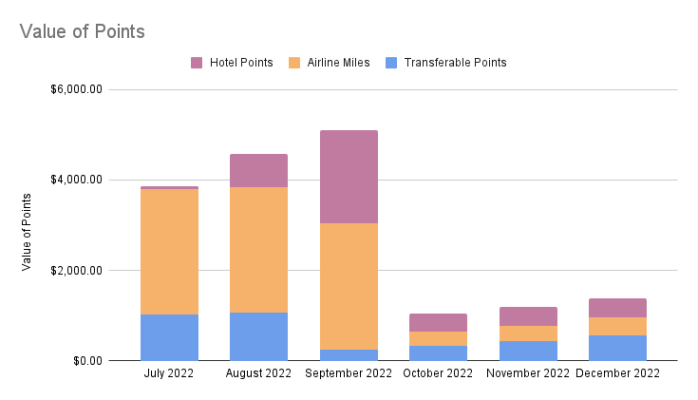

That left us with 23,300 Citi points, 40,400 United miles, 50,000 Marriott Bonvoy points, 1,400 Chase points, and 107,100 Ultimate Reward points.

According to valuations assigned to those points by The Points Guy, found at https://thepointsguy.com/guide/monthly-valuations/, these points and miles are worth around $3,400. At this point, we’ve developed a solid strategy and have stacked up quite a bonuses that should be hitting in the next few months. I expect this valuation to balloon over the next few months.