So it’s about that time. The flights, trains, buses, hotels and Airbnbs are all booked. Our passports are in our hands. In some respects, this is crazy. I’ve always wanted to go to Europe, it’s been something that I’ve dreamed about since I was a kid. It was just always unreachable or impractical. I’m sure we could’ve made it work at different times, but it probably would’ve been crippling to us financially. I could never justify it. Now that we’ve figured out how to make this work, it seems unreal that it’s actually happening. All we have to do now is wait and of course, pack.

A Change in Flight

We changed our flight from a two-leg flight from Chicago to Zurich with a 12 hour layover in Brussels to a direct flight from Chicago to Zurich. That cost us 28,000 United miles, of which 22,000 came from Jenn’s United accounts and 6,000 came from transferred Ultimate Reward points. There was a whole ordeal where Jenn had merged her business and personal United accounts and because of that the plane tickets she booked for Alex and I somehow became completely unreachable for customer service. It was some kind of insane glitch that ended up taking about 4 hours on United’s customer service to unravel when Jenn was trying to change our flights. Customer service felt so bad about the mix up that they upgraded us to economy plus, which at the time they were charging over $200 per ticket for an upgrade, so 4 hours on hold for $800 worth of upgrades, sure I’ll take it (especially when it wasn’t me on hold). Ironically, Jenn was considering upgrading her and Emma to business class which would have cost an additional 80,000 points, but because we had been moved to economy plus, the upgrade didn’t make as much sense to her. It’s one thing to spend 40,000 points per ticket to move from basic economy to business class, it’s another to spend 40,000 points per ticket to move from economy plus to business class.

The bad thing about this flight change is that we aren’t going to see Brussels, but the good news is that if we’re exhausted from the flight, we will now be able to take a nap once we’ve checked into the hotel. Also, this ends up giving us an extra day in Zurich, which I felt like we weren’t going to be in long enough. Also, since it’s now a direct flight, that means much less time spent in airports. This is going to make the trip simpler and I’m sure, better.

Jenn’s New Card is the Same as My New Card

Jenn applied for the US Bank Leverage Card and her application was accepted. This is the same card that I am still working on a sign up bonus for. The US Bank Business Leverage Card is a cash back card that gives 2x on your top 2 spending categories each month and 1x on everything else. It has a $750 bonus after $7,500 in spending in the first 4 months. It also has a $95 annual fee which is waived for the first year. It’s not a very exciting card, but with our points stacking up nicely, it seems more important right now to accumulate some cash for those expenses that points can’t cover. $750 is a pretty nice sign up bonus, even if there’s a fairly hefty spend requirement to get it. Essentially this works out to 11 to 12 percent cash back on everything we spend up to $7,500. I’ll take that.

On to the Point Check!

I spent over $3,200 on my US Bank Business Leverage and earned around $51 in cash back. Jenn spent over $200 on her Wyndham Business Earner card and earned 1900 points. She also spent over $300 on her Chase Ink Unlimited Card and earned 500 Ultimate Reward Points and $1000 on her Chase Ink Cash card and earned 2,900 Ultimate Reward Points.

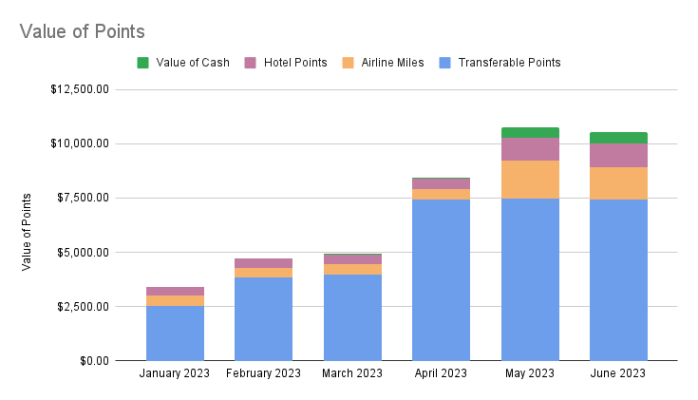

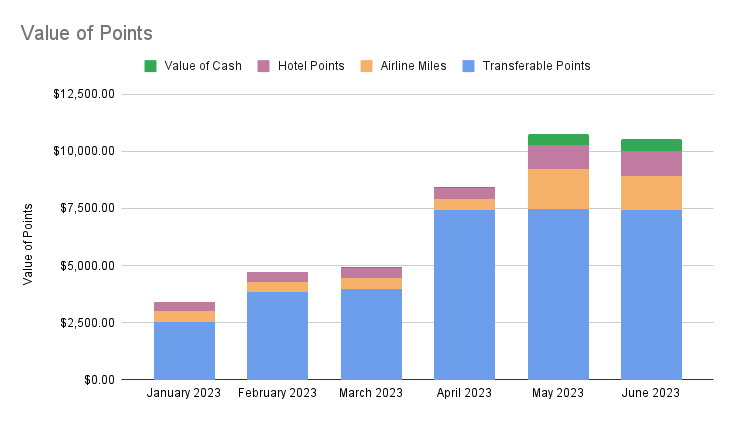

With the redemptions and the earnings, we finished the month with 25,400 Citi points, 23,700 United miles, 80,200 Delta miles, 5,200 American Airlines miles, 58,300 Marriott Bonvoy points, 1,600 Hyatt points, 272,300 Chase Ultimate Reward points and $525 in cash back. Using the monthly valuations published at The Points Guy this brings our total to over $10,400 which is down a couple hundred dollars from last month because of the extra points and miles used to change our flight.

A Moment of Gratitude

We’re about to embark on a trip which Jenn and I have been planning for the better part of a year and a half. It’s not lost on me just how amazing it is to live in a time that I can just hop on a plane and overnight be transported to another continent. I feel incredibly lucky and privileged to be able to make this journey and be able to do it while my kids are at an age that they should be able to appreciate what they are experiencing. It also is not lost on me how much information we are able to digest in order to make this trip possible. I learned how to use points and miles by reading blog posts and listening to podcasts. I’m learning how to speak different languages by using an app on my phone. We have even gotten all kinds of travel and packing advice from watching YouTube videos. All of the information is readily at my fingertips which makes this trip possible and will hopefully enhance our experience. This is an incredible age that we live in and I’m very grateful to be able to take advantage of this opportunity.