After we finished all of the travel plans and bookings for Europe, we no longer had a clear goal to work toward. We did, however, learn that because we had points in very specific programs, it made it difficult to get the best value for our points. Points and miles are really just weird currency. Their value can vary wildly from day to day and points are generally only good for one thing. Some points have transfer partners, others have alliances where you can book a flight on a partner airline with another airline’s miles. The best kind of points though are transferable points. There are a few, but the big transferable points are Chase Ultimate Reward points, Citi Thank You points, Capital One miles, and American Express Membership Reward points. Each one of these have their own set of hotels and airlines with which to transfer points and miles.

My belief is that these points should be used to round up other programs when redeeming. For example, if I had 25,000 United miles and needed another 5,000 miles to book a flight, I could transfer 5,000 Ultimate Rewards points to United to book the flight. There are a ton of different combinations and transfer rates between programs, and occasionally there are even transfer bonuses. The subject of how best to acquire and use transferable points could fill a book. However, the general theme is that transferable points are good and you should have some.

Let’s get some transferable points!

We decided that Jenn should pick up the Chase Business Unlimited Ink card. It was offering $750 cash back when you spent $7,500 in 3 months. It’s a pretty a pretty basic card, unlimited 1.5x on everything, no annual fee.

I thought you said you wanted transferable currency? What’s with the cash back card?

The Ink Unlimited is strictly a cash back card, but they give you the cash in Ultimate Reward points. If you only have this card then you can only redeem it for cash, but if you pair it with a Chase Sapphire or a Ink Business Preferred card then you can move your points to one of those other accounts and transfer them to hotel and airline partners. We didn’t have one of those cards yet, but I knew we would soon.

Anyway, on to the point check!

I spent around $500 on my Citi Premier card and received around 600 points. My United Explorer card offered me 10x points from October to December at gas stations, so that suddenly started to get more use. I spent $1,000 on my United card and received 3,200 points. Jenn spent $2,900 on her Chase Unlimited Ink and received 4,300 Chase Ultimate Reward points. She also spent around $300 on her Marriott Bonvoy Boundless card and received about 800 Marriott Bonvoy points.

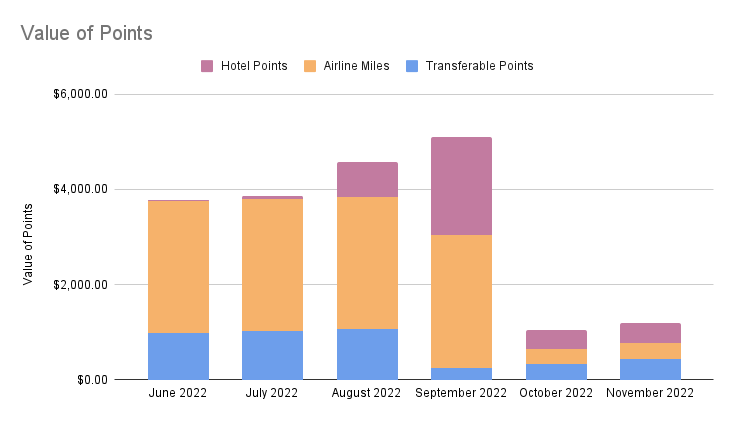

We finished the month with 20,200 Citi points, 31,000 United miles, 48,800 Marriott Bonvoy points, 1,000 Hyatt points, and 4,300 Chase Ultimate Reward points.