Travel hackers have for years directed their efforts around four main banks – Citibank, Chase, Capital One, and American Express. You might throw Barclays in there as an honorable mention. Also in 2021, the Bilt Mastercard was launched which allowed renters to earn points by paying their rent with Mastercard. Aside from that, there are “travel cards” that are offered by US Bank, Bank of America, and Wells Fargo.

The Sweet Spot for Travel Hackers

Credit cards that offer signup bonuses as well as transfer partners are the sweet spot in travel hacking. The Bilt Mastercard has great transfer partners but they don’t really offer much in the way of signup bonuses. The travel cards from US Bank, Bank of America, and Wells Fargo offer signup bonuses, but they essentially are cash back cards that you can redeem using their travel portals. But Citibank, Capital One, Chase and American Express were the only banks to offer signup bonuses as well as the option to transfer those points to a variety of hotel and airline programs. Until now? Maybe?

Rumors About Wells Fargo

Wells Fargo launched the Autograph Card in June of 2022, which came with a 30,000 point ($300) bonus and offered a nice variety of 3x categories. It was a strong offering by Wells Fargo for a no annual fee card, but it was essentially a cash back card because they didn’t offer any transfer partners. However, as 2024 approaches, Wells Fargo is teasing a couple of things. They are teasing that transfer partners will be available soon and that a new card called Autograph Journey is coming.

Why are Transfer Partners Important?

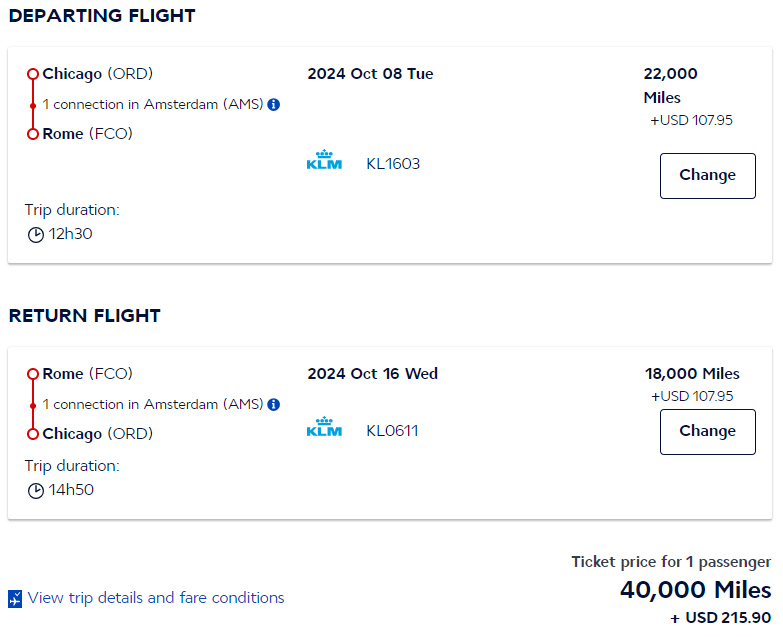

Transfer partners are important because they often offer a significant discount over the price you can get through a travel portal. Here’s an example from a flight I’m currently researching for my own travel plans. Using the Chase Travel Portal, a flight from Chicago to Rome runs 95,608 Chase Ultimate Reward points.

However, the same flight costs 40,000 miles and $215.90 if you transfer those same Chase Ultimate Reward points to Flying Blue and book there.

Even if you chose to pay for the $215.90 fees with Ultimate Reward points by cashing out at 1 cent per point that would only cost 61,590 points instead of 95,608. That’s a significant savings simply by transferring the points and purchasing there. The other benefit is that I would always rather book a hotel or an airline ticket using that program’s own currency and website. It will most likely be easier to deal with a cancellation or a problem if you are dealing directly with the hotel or airline instead of trying to get a travel portal to resolve it with the hotel or airline.

What could the Wells Fargo Transferable currency look like?

As Summer Hull and Nick Ewen from the Points Guy confirmed, Wells Fargo intends to give points transfer options for their Autograph card as well as a new product called Autograph Journey. This could end up being anything from pathetic to amazing, but it really all hinges on who they land as transfer partners and how good the transfer rates are.

The Pathetic Option

If Wells Fargo only lands a few transfer partners or they land fairly weak transfer partners like Choice Hotels, EVA Air or Royal Orchid it’s only going to make the points mildly interesting. Also, if those points transfer at rates lower than they would from Citi, Chase, Amex, or Capital One, then Wells Fargo points won’t be as valuable as points from those other banks. This won’t move the needle for most consumers, and probably won’t create any real buzz for their products.

The Middle of the Road Option

If they put together a set of transfer partners like Capital One or Citibank along with decent transfer ratios, then you will essentially have a pretty good list of transfer partners that provide good value for their customers. This would put Wells Fargo’s consumer cards immediately on par with consumer cards from Capital One and Citibank.

The Amazing Option

The best set of transfer partners, in my opinion, is the one put together by Bilt. One huge reason is that they have Hyatt as a 1:1 transfer partner which is by far the most valuable hotel currency from a major hotel chain. The second reason is that they are the only transfer partner for American Airlines. Prior to Bilt landing that partnership, there were no transfer partners for AAdvantage miles. Considering how big American Airlines is, that makes Bilt points very interesting to people who live near places that American flies.

I mention Bilt for one reason – you can apply for the Bilt Mastercard on Wells Fargo’s website. I don’t know how tight the relationship is with Bilt, but if they are able to use the exact same transfer partner roster that Bilt has, then this will be an absolute home run. I can’t imagine many people who know a lot about points and miles who wouldn’t sign up for a Wells Fargo travel card immediately after it launched.

What This Could Mean For US Bank and Bank of America

If Wells Fargo is able to make a big enough splash with this release, that is going to put a lot of pressure on US Bank and Bank of America. Nobody likes losing market share and I can’t imagine that they wouldn’t notice if their customers begin to choose Wells Fargo over them. I would expect those banks to counter with their own transfer partners.

Both US Bank and Bank of America are well positioned to be able to take that next step. US Bank offers the Altitude Connect card and the Altitude Reserve card. Both currently offer 50,000 point bonuses and have some strong bonus categories. Bank of America has both a travel rewards and a premium rewards card with 25,000 and 60,000 point offers respectively. Bank of America also offers cobranded airline cards with Alaska, Allegiant, Spirit and Air France/KLM Flying Blue.

Both of these banks offer good travel cards and could fairly easily insert themselves into a travel rewards arms race. The only thing that is stopping either of these banks is making the necessary agreements with these airline and hotel programs and adding the necessary changes to their software and website. I would imagine those changes could take at least a year to implement.

Benefits for the Consumer

Anytime competition creeps into a space like this, then the customer will benefit. If suddenly there are 7 banks that offer signup bonuses and points that are transferable instead of 4, these banks will be competing for business. I would imagine that elevated signup bonuses could be the end result of this and that would be a nice benefit for travel hackers.

The other nice result would be the ability to choose between which package of transfer partners that you like. For example, if you live near an airport that is serviced by Delta, you might want to pick an American Express card because Amex Membership Rewards points transfer to Delta. If you have a favorite hotel chain, you might pick your travel rewards card by who transfers to that hotel’s points program. Maybe you can find one card that transfers to both your favorite airline and favorite hotel program. Having 7 menus of transfer partners would be very good for the consumer.

I’ll be keeping my eye on what Wells Fargo does here. If they release Autograph Journey with a signup bonus of at least 60,000 points and a similar menu of transfer partners to Bilt and if they have an annual fee under $100, then I’ll definitely be applying for a card. If they offer it with similar 3x categories that the Autograph card has, then it might quickly become my favorite credit card.

Wells Fargo may have just started the new points arms race, and I’m here for it.