2022 was the year that we got into travel hacking. It was out of a bit of desperation that we started looking into it as a way to reduce the expense of a trip I promised to take Emma on when she graduated from high school. The power of travel credit cards turned out to be much greater that I had anticipated when I started and now it’s become a way of life for us. We love to travel and if we spend less on each trip, then we can do it more often.

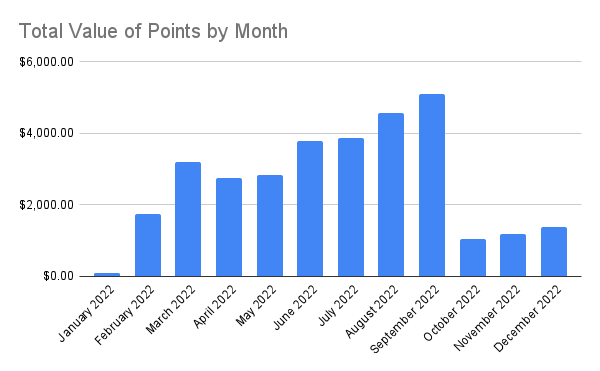

We didn’t take any trips using points and miles in 2022, it was mostly just a year of accumulating points and then booking the flights and hotels that we would be using in 2023. As you can see in the chart below, most of year was accumulating points and the dips were when we redeemed those points and miles for hotels or flights.

SignUp Bonuses – The Main Fuel of Travel Hacking

Nothing manages to pile up more points in this hobby than signup bonuses. It’s the fuel that makes travel hacking work. It’s also, essentially gambling with the credit card companies. The credit card companies are gambling that they can get you to sign up for their card, and you will begin to pay them interest and you are gambling that you won’t. It’s really a gamble on your self-control. They want you to pay them exorbitant interest rates and you want their points and miles. It’s very important that you have self-control because you need to win this gamble every time otherwise you won’t be saving any money with points and miles, you’ll be paying ridiculous amounts of fees and interest to the credit card companies.

Now this is going to sound ridiculous, but it’s really not – We signed up for 8 credit cards in 2022. Each of them had minimum spend requirements to reach the bonus. They were:

- Citi Premier Card (Me)- $4,000 spend in 3 months, 80,000 Citi Thank You Points

- United Explorer Card (Me) – $3,000 spend in 3 months, 60,000 United Miles

- United Explorer Card (Jenn) – $3,000 spend in 3 months, 60,000 United Miles

- United Explorer Business (Jenn’s Business) – $5,000 spend in 3 months, 75,000 United Miles

- Marriott Bonvoy Boundless (Jenn) – $5,000 spend in 3 months, 5 – 50,000 point free night certificates

- Marriott Bonvoy Boundless (Me) – $1,000 spend in 3 months, 3 – 35,000 point free night certificates

- World of Hyatt (Me) – $3,000 spend in 3 months, 30,000 World of Hyatt points

- Ink Unlimited (Jenn’s Business) – $7,500 spend in 3 months, 90,000 Chase Ultimate Reward Points (earned in 2023)

So we earned 7 signup bonuses in 2022, and that accounted for 660,000 of the 839,000 points and miles we earned for the year. There were also a total of 70,000 points and miles we earned from referral bonuses to each other. So 87% of the points and miles we earned in 2022 were because of signup bonuses in one way or another. That’s why they are important.

Complete Chart of Spending for the Year

| Credit Card | Annual Fees | Spending | Pts Earned | Value of Points Earned | Return on Spending |

| Citi Premier | $95 | $18,204 | 110,468 | $1,878 | 10.32 |

| United Explorer 1 | $0 ($95 waived) | $7,585 | 107,776 | $1,401 | 18.47 |

| United Explorer 2 | $0 ($95 waived) | $6,425 | 66,890 | $870 | 13.54 |

| United Business | $0 ($99 waived) | $6,768 | 82,954 | $1,078 | 15.93 |

| Marriott Bonvoy Boundless 1 | $95 | $7,906 | 309,620 | $2,477 | 31.33 |

| Marriott Bonvoy Boundless 2 | $95 | $1,569 | 108,341 | $867 | 55.26 |

| World of Hyatt | $95 | $6,305 | 42,378 | $720 | 11.42 |

| Ink Unlimited | $0 | $7,907 | 10,581 | $217 | 2.74% |

| Totals | $380 | $62,671 | 839,008 | $9,291 | 14.83% |

As you can see from the above chart, we spent over $62,000 in 2022 on credit cards, which just seems ridiculous, but we charge everything we can, which is pretty much anything besides house and car payments. Virtually everything is payable by credit card now including all utilities, streaming services, cell phone plans and insurance, in addition to the normal things like gas, groceries, dining and shopping. And when you total everything up and realize that you are getting almost a 15% return on all spending, it’s really hard not to want to process all payments through a credit card.

What did these points buy?

| Credit Card | Pts Earned | Pts Used | TPG Value of Used Pts | Act Value of Used Pts | Exp Pt Value (Act Pt Value) |

| Citi Thank You Points | 110,486 | 90,000 | $1,530 | $1,440 | 1.7 cpp (1.6 cpp) |

| United Miles | 257,620 | 221,600 | $2,881 | $5,110 | 1.3 cpp (2.3 cpp) |

| Marriott Bonvoy | 417,961 | 369,000 | $2,952 | $1,680 | .8 cpp (.45 cpp) |

| World of Hyatt | 42,378 | 41,000 | $697 | $763 | 1.7 cpp (1.9 cpp) |

| Totals | 839,008 | 721,600 | $8,060 | $8,993 | 1.1 cpp (1.2 cpp) |

So obviously, just collecting points does you no good. You have to spend those points wisely if you want to make the most of the spending that you have. In 2022, we had a very specific goal in mind and we burned our points as fast as we earned them. We were planning and booking a trip to Europe for the summer of 2023. It had been a promise that we made to Emma a few years back that we would let her pick a trip when she graduated and that bill was coming due. It’s primarily how I got into this hobby, because I was staring at a more that $10,000 upcoming bill I didn’t really want to pay. Jenn and I also celebrated our 25th Anniversary on a trip to Cabo San Lucas so all of that was booked using these points. Here’s what we redeemed points on:

- 2 Round Trip tickets from Chicago to San Jose del Cabo – 40,000 Citi points (transferred to Turkish to book United) – saved around $800

- 2 Nights at All-Inclusive Hyatt Ziva Los Cabos – 43,000 Hyatt Points (had to buy 2,000 points) – saved $763

- 4 One-way tickets to Zurich on United – 132,000 miles – saved around $2,300

- 4 One-way tickets from Rome to Stockholm – 50,000 Citi points (transferred to Avianca LifeMiles to book SAS) – saved around $630.

- 4 One-way tickets from Stockholm to Chicago – 89,600 United miles, saved around $2,800

- 2 Nights in Zurich Marriott, 2 – 50,000 point Marriott Certificates used, saved around $900

- 3 Nights, 2 Rooms in AC Stockholm Hotel near Stockholm, 3 – 50,000 point certificates and 3 – 35,000 point certificates used, $780 saved

All in all, the total saved on those two trips by using points was a little less than $9,000 which was a little better than the slightly more than $8,000 that those points were “worth”. Obviously the “savings” is debatable because there are so many ways to book, that it is nearly impossible to say that flight would have cost this or that hotel would have cost that. I’m doing my best to be honest with these numbers, but they aren’t exactly gospel.

Booking with Points Changes Travel Style

When you begin to book vacations with points instead of money, your travel style changes a little. Had we booked the trip to Europe with money I think our vacation would have been considerably different than what it ended up being.

One Way is OK

The thing that I think changes the most when you are traveling on points is that one way flights are perfectly fine when paying with points. I find it completely inexplicable that airlines charge almost the same amount for a one-way flight as they do for a round trip flight. It’s bonkers. I just looked at a February flight to Zurich on United and round trip they were charging a little less than $1,100 but one-way it was over $950.

Award flights, however, aren’t like that, they are priced individually. What this means is that there isn’t an incentive to fly back from the place you arrived, and that changes your travel itinerary. Our plan, before we got into points and miles, was that we would fly into Munich, stay for a little more than a week and fly home.

However, once we were into points and miles, there was no incentive to fly home from where we started, we simply looked for a place to arrive, a place to leave from and then connected the dots. What we ended up with was a trip that started in Zurich, then went to Munich, Venice, Rome and Stockholm before coming home. That is a much more interesting travel itinerary then just Munich and back.

Hotel Stays are a Little Different

For the most part, hotel stays for me are hotel stays. I’m not someone who needs a first class experience when I’m staying in a hotel, I just need a comfortable bed, a TV and a clean shower. I would like a decent coffee maker in the room, but that’s asking way too much of hotel chains. However, when you sign up for hotel co-branded credit cards, they like to give you free night certificates instead of points. This usually creates a situation where you try to maximize the redemption of the certificate by getting the highest priced hotel room that the certificate allows for instead of just getting the hotel room that works best for you.

We didn’t really like to play this game, and ended up using 6 certificates in Stockholm (2 rooms, 3 nights) at way less then their value simply because it was a nice hotel and they offered breakfast. We actually could have booked more expensive rooms closer to the city center because our certificates would have covered it, but Jenn loves a free breakfast. This hotel just worked better for us and on paper, it looks like a bad redemption, but it was what we wanted and what we needed.

Points just don’t feel Like Cash

When you are paying with cash, you have a tendency to horde it as much as possible. The reason is simple, the money you would spend on this vacation could be used on remodeling the house, getting a new dishwasher, buying clothes, etc. When you are paying with airline miles and hotel points, it’s pretty easy to go the extra mile knowing that’s what the points are for. It’s a lot easier to plan on a more expensive experience if you know that those miles and points can’t be used for something more practical.

5/24 and the Importance of Owning a Business

If you look at the list of 8 cards that we applied for in 2022, you will notice that 4 of them were mine, 2 were Jenn’s and 2 were for Jenn’s business. We are blessed to have a business that we can open up credit cards under, and that is because there are business credit cards and there are personal credit cards and if you don’t have a business, you don’t have access to business credit cards. Some of those cards are really good. The last card Jenn signed up for the year was Chase Ink Unlimited card which had a bonus of 90,000 ultimate reward points for $7,500 in spending in 3 months and it’s a $0 annual fee. That is a great deal, and if you don’t have a business, you are shut out.

As many people will tell you though, you can call just about any side hustle a business, even if you don’t make money. I now have a business and I have no revenue, although I plan to eventually, which makes me eligible for business cards. I just set up a checking account through my bank and picked a business name, and now I can get business credit cards. It doesn’t seem to matter that I probably won’t be earning any revenue for a while.

The other reason why business cards are important is that they don’t count against your personal 5/24 score (some do but most don’t). Chase has a rule that they don’t accept applications for new credit cards if you have opened at least 5 new personal credit card accounts in a 24 month period. This only really matters if you want Chase credit cards (and probably Capital One cards), so if you don’t care, then you are free to ignore this statistic. However, after one year, my 5/24 count is 4, and Jenn’s is 2 because she had 2 business cards and even though she had opened 4 accounts only 2 counted against her 5/24 number.

Looking Forward to 2023

2023, for us, is about finally being able to take advantage of all of these rewards that we accumulated in 2022. It’s when the fun stuff begins. Jenn and I have a trip to Mexico and we have our family trip to Europe coming in 2023. I am also looking forward to taking the knowledge that I gained in 2022 and really leveraging what I’ve learned into more points and miles and more great trips in the future. Travel hacking has really changed the way we do trips and I can’t wait to see what the future has in store.