We’re inching closer every day to our spring break Costa Rican adventure. Honestly, this is a trip that I probably wouldn’t have dared to do a year ago. When we first started to do international travel (it’s only been a year – we’re still newbies!), every logistical step in the process was something that we needed to examine. How long will we be waiting in customs? Is that layover long enough? How do the trains/busses/taxis work from the airport? Will we be understood if we don’t speak the local language well? Each trip that we take gives us a little more confidence in the process and our abilities to handle those logistical issues.

The biggest logistical hurdle this time is driving a rental car in a foreign country, especially Costa Rica. There are horror stories all over the internet about scams at the rental car counter. Also, driving habits apparently are a little different in Costa Rica and the roads sound like they will be questionable off the major highways.

It’s easier for us to mentally prepare ourselves for what could be stressful driving and perhaps a difficult time at the rental car facility when we don’t have to mentally prepare ourselves for the logistics of flying. I feel like there are parts of travel that we’ve started to understand pretty well and it opens up my mental energy for new experiences. This is really important when you don’t want the negatives of travel to overwhelm what I’m anticipating to be an amazing experience with waterfalls, beaches and volcanoes in Costa Rica.

Hold!!!

Jenn and I have been planning a trip for us with her parents and our good friends who live in Nashville. The biggest logistical issue for this trip was landing around the same time in Rome with us using 3 different flight itineraries. That part has been done, but we’ve only managed to book the flights to Italy, not the return flights.

However, every time I try to bring up the fact that maybe we should book the return trip, Jenn turns into Kirstin Bell from the Carvana commercial and just tells me “HOLD!” I think she’s waiting on the perfect flight home that costs something like 1,000 points in business class with a stopover in Madrid. I’m sure we’ll find something decent since it is off-peak from Europe, but she’s making me nervous. I guess there are worse things in life than getting stranded in Italy.

Anyway the flight we booked to Italy cost us 20,000 Chase Ultimate Reward points each transferred to Flying Blue plus about $90 in taxes and surcharges and $50 each to stopover in Amsterdam for a day. Stopovers are supposed to be free and I go into greater detail as to the $50 charge in this post about Flying Blue Stopovers. I would’ve paid the $50 charge anyway, but it would’ve been nice to know ahead of time.

The redemption turned out to be pretty good. The price of a comparable flight was $658 (with the $50 stopover fee included), so the 20,000 points we used reduced the cost of the flight by $518 each, meaning we got nearly 2.6 cents per point for the Chase Ultimate Reward points which are normally valued at 2 cents per point. You gotta love how great the deals have been on Flying Blue lately.

We also double booked some lodging in Costa Rica. We kept going over the logistics of landing at the Guanacaste Airport at a little past noon, going through passport control and customs, then renting a car and driving more than 3 hours to Grecia, outside of San Jose and trying to do this before dark. It gets dark in Costa Rica around 5:30 and it’s not recommended for people who aren’t familiar with the roads there to drive after dark, so we decided that maybe we should get a hotel closer to the airport and make the big drive the next day.

We ended up booking a local hotel in Playa Hermosa, which is less than 30 minutes from the airport. We booked it through Capital One travel for a little over 16,000 Capital One miles. These are redeemed at exactly 1 cent per point, which isn’t a fantastic redemption of Capital One miles, but it served it’s purpose and now we will get a little beach time while in Costa Rica, when we hadn’t planned to spend any time near the coast. We probably could have shortened our stay at the Airbnb by the day that we are in Playa Hermosa, but it feels wrong this late to change our reservation, and frankly it was only $75 per night at the Airbnb. This also ensures that we can check in at any time the next day.

A Shiny New Amex Gold Card

American Express Membership Rewards is a beloved program in the points and miles space. It has a ton of great transfer partners and has amazing opportunities to accumulate a massive amounts of Membership Rewards points very quickly with enormous signup bonuses, great bonus spend categories and other Amex offers. Up until now, I’ve avoided Amex because their cards tend to have high annual fees.

I applied for and was accepted for the American Express Gold Card. It has an annual fee of $250 and earns 4x on dining, 4x on groceries, and 3x on flights booked through Amex travel or directly through the airline. It also has $120 Uber Cash and $120 Dining Credit every month which is good at a handful of restaurants or Grubhub (so it’ll get used on Grubhub, if at all). Those credits are doled out monthly so it’s really $10 per month for Uber and $10 per month for Grubhub.

I applied with the bonus offer of 75,000 membership reward points and a 20% rebate on dining up to $250 back. The 75,000 membership reward points are awarded if I spend $6,000 in 6 months. There was also an offer for 90,000 membership rewards points without the 20% rebate, but I thought this was a way to get an Amex Gold card for essentially no annual fee, since spending $1,250 on dining for the $250 rebate is practically automatic for us and is equal to the $250 annual fee.

Anyway, On to the Point Check!

| Card Used | Spend | Points Earned | Point Value | Points Per $ | Return on Spend |

| Citibusiness AAdvantage | $1,139 | 1,139 | $17.65 | 1.0 | 1.5% |

| Capital One Venture | $706 | 1437 | $26.74 | 2.0 | 4.0% |

| Wyndham Business Earner Card | $581 | 3,069 | $33.76 | 5.3 | 5.8% |

| Citi Custom Cash | $540 | 2,539 | $45.70 | 4.7 | 8.7% |

| Ink Cash | $531 | 2,639 | $54.10 | 5.0 | 10.2% |

| Citi Premier | $491 | 935 | $16.83 | 1.9 | 3.4% |

| Marriott Bonvoy | $198 | 995 | $8.36 | 5.0 | 4.2% |

| Total | $4,184 | 12,753 | $202.99 | 3.0 | 4.9% |

We still haven’t managed to stop accidentally spending on our Citibusiness cards. They are practically useless for normal spend, and the problem is that when we are done with a bonus, we forget to remove them from all of the places where we’ve set up default payments. The most painful one here was when we ordered a dishwasher through Home Depot’s website and somehow managed to use that card instead of a card we are working on a bonus for. $700 worth of spending that could’ve gone toward a bonus, dammit.

Our spending was quite elevated this month because of the dishwasher and we also bought a new couch since the kids and the dog had managed to slowly kill the old one. Aside from the non-bonus spending in the chart above, Jenn spent a little less than $3,400 on her US Bank Altitude Business Connect card and earned a little more than $43 in cash back.

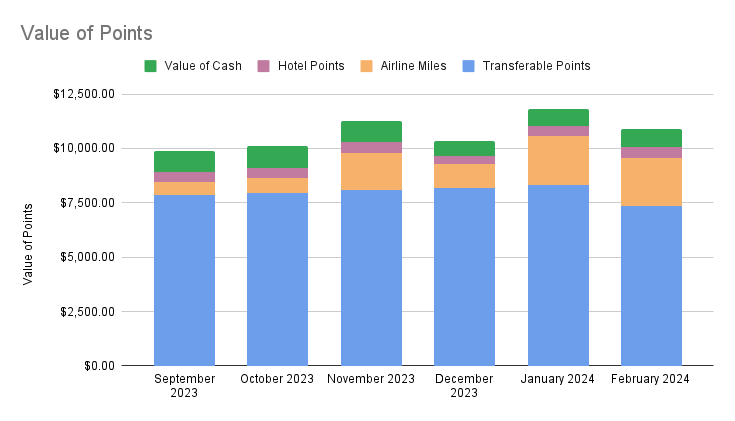

This left us with a grand total of 257,000 Chase Ultimate Reward points, 115,500 American Airlines miles, 75,100 Capital One Venture miles, 38,400 Citi Thank You points, 31,800 Marriott Bonvoy points, 24,900 United miles, 6,900 Hyatt points, 5,100 Delta miles, and $700 in cash back. According to the valuations determined by the Points Guy, these points are worth a grand total of a little less than $10,800.