March was a pretty exciting month. We took a spring break trip to Costa Rica and had the opportunity to see just how beautiful that country is. We stayed in an Airbnb in the Central Valley near Grecia, which meant we were staying amongst the locals. That really gave us a more authentic taste of Costa Rica and was definitely not the normal touristy vacation.

We had to drive quite a bit to get to the locations that we wanted to visit, but in a week we managed to do hikes in a mountain pine forest and another by gorgeous waterfalls. We visited the only coffee farm owned by Starbucks. We also visited Poas Volcano as well as Playa Hermosa. Hey, any week you manage to visit the mountains, the beach and waterfalls in the same week is pretty good.

Costa Rica is a beautiful country and I would recommend it to anyone who is willing to go a little off the beaten path.

American Express Business Gold

Jenn applied for and was accepted for the American Express Business Gold. This is a card that we normally would ignore because of the higher annual fee and the higher required spend to earn the bonus on the card.

I have some mixed feelings about this card. The first issue for me is the $375 annual fee. We have, for the most part, gotten used to annual fees when they hand you a nice welcome bonus, but normally they have been less than $100 for us. That being said, this was an enormous 130,000 Membership Reward point bonus which The Points Guy values at 2 cents per point, so the bonus itself is worth $2,600. That definitely takes the sting out of the annual fee, especially if you plan to cancel before it renews.

The other negative here is that in order to receive this massive bonus, you must spend $10,000 in the first 3 months. That’s not easy for us, but with tax time coming and a pretty large tax bill, this shouldn’t be too hard. Making the most out of paying our taxes is becoming a annual tradition for us, last year we managed to profit $1,350 from paying our taxes.

The Amex Business Gold card earns 4x on some pretty good categories such as dining, gas and transit. It also offers 4x in some business categories such as advertising, electronics retailers, cloud system providers and cell phone service providers. In addition, it earns 3x on purchases through amextravel.com and 1x on all other purchases.

They have some monthly and annual credits, such as $155 refund for Walmart Plus membership and $20 per month for purchases at office supply stores, Grubhub, or FedEx. While I don’t think we’ll be signing up for Walmart Plus, Jenn has figured out that she can use that $20 per month by ordering takeout through Grubhub for some of our favorite restaurants so we will definitely be using those $20 Grubhub credits.

Ok, on the Points Check

| Card Used | Spend | Points Earned | Point Value | Points Per $ | Return on Spend |

| Ink Cash | $534 | 2,651 | $54.35 | 5.0 | 10.2% |

| Capital One Venture | $519 | 1,038 | $19.20 | 2.0 | 3.6% |

| Marriott Bonvoy | $421 | 2,105 | $17.68 | 5.0 | 4.2% |

| Citibusiness AAdvantage | $347 | 347 | $5.38 | 1.0 | 1.6% |

| Wyndham Business Earner | $124 | 814 | $8.95 | 6.6 | 7.2% |

| Custom Cash | $49 | 244 | $4.39 | 5 | 9.2% |

| Total | $1,994 | 7,199 | $109.96 | 3.6 | 5.5% |

We actually have 3 open cards where we are working on signup bonuses, which is a little crazy so the spend on cards without signup bonuses is pretty low this month. Most of the stuff in the chart above are set up as autopay for things like insurance, cell phones, utilities, etc. The Marriott Bonvoy charges are because we were earning 5x on groceries as a promo, and once again, somehow, we accidentally spent on the Citibusiness card at 1x which is a little frustrating. All in all, though, getting 5.5% back on non-bonus spend is fine by me.

In addition to the non-bonus spend, I spent $735 on my American Express Gold card and earned a little over 1,900 Membership Reward points. Jenn spent about $2,250 on her US Bank Business Connect card and earned $46 in cash back.

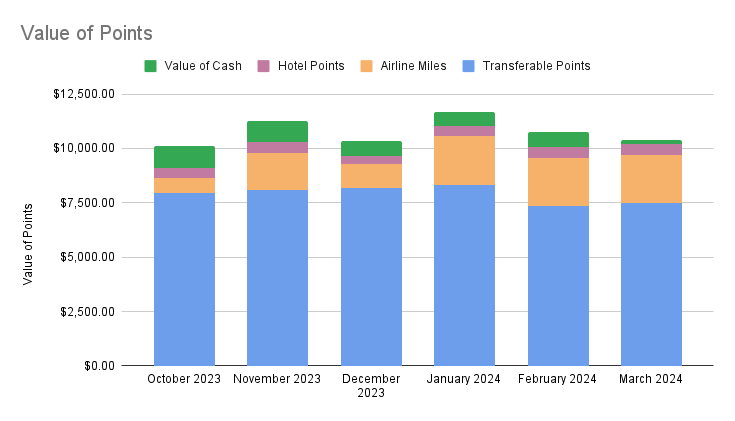

We didn’t earn any bonuses this month but I would imagine that those should start to hit over the next few months and they are some pretty big ones, with a $500 cash back bonus, a 75,000 Membership Reward bonus on my Amex Gold card, and the 130,000 Membership Reward bonus on Jenn’s Amex Business Gold card. I’m looking forward to seeing our point valuations balloon as these start to hit.

The only real redemption this month was that I used the cash back that I had earned last year to pay for the rental car and some of the gas while we were in Costa Rica.

Because we used some of our cash back, and we didn’t have any bonuses hit, we ended the month with a lower total value than the previous month. We ended the month with 260,300 Chase Ultimate Reward points, 115,200 American Airlines miles, 76,300 Capital One Venture miles, 38,800 Citi Thank You points, 34,000 Marriott Bonvoy points, 25,000 United miles, 10,000 Wyndham points, 6,900 Hyatt points, 5,000 Delta Miles, 1,900 Amex Membership Reward points and $183 in cash back. All of that, according to the valuations from The Points Guy, is worth around $10,300.