I am a travel hacker, and the amount of travel I do is unusual. We traveled three times last year, including a week in Canada, a week in Costa Rica, and a week and a half in Italy. I also had a extended weekend trip to Montana with my old high school friends. I do realize that this isn’t normal and it’s also a lot more than we did even a few years ago. We also did that without spending a lot of money, because of points and miles.

Most Americans, if they travel at all, probably plan just a single vacation a year. If you only travel once a year, though, you really want to make the most of it. This is where doing a little bit of travel hacking would allow you to stretch your budget and allow you to travel with a little more panache.

The average American who wants to take one trip per year, should maximize that trip as much as is possible by using a one credit card per year strategy. This gives the average traveler the ability to reduce the cost of their vacation or increase the luxury of the vacation without having to become a crazy travel hacker.

Why New Accounts are Important

Let’s say that you already have a Chase Sapphire Preferred card. It’s a great card with good earning categories and great benefits. Why would you need anything else? Well, the truth is that signup bonuses are really important to building point balances. In the case of the Chase Sapphire Preferred card, if you spent $3,000 per month on that card, you would probably earn around 4,000-4,500 points, depending on what categories most of the spending was in. That means that at the end of the year, you would have earned somewhere around 50,000 points on $36,000 in credit card spend.

The signup bonus for the Chase Sapphire right now is 60,000 points. That means that if you signed up for the card and did the above spend, you would end up with 110,000 Ultimate Reward points. For 50,000 points, you can probably eek out enough points for 2 to fly to Cancun, if you’re flexible on when you fly. For 110,000, you can fly to Cancun and stay in an All-Inclusive hotel for 2 or 3 nights. For 110,000 points you could also pretty easily fly 2 people to Europe and back, if you transferred those points to KLM/Air France Flying Blue, or Iberia/Air Lingus/British Airways/Finnair Avios. If you were only paying for one flight, you could probably get to New Zealand and back for that, but that’s a long flight in economy.

Signup Bonus Frequency

The problem is that you can’t sign up for the Chase Sapphire Card each year. Chase only allows for you to get a signup bonus on the Sapphire Card once every four years. The same is also true of the Capital One Venture Card and the Citi Strata Premier Card. The American Express Gold Card is technically for a lifetime, but apparently people do get a second bonus on that card, usually after around 7 years.

I mention these cards because they have transferable points, meaning that you can earn them as Citi Thank You points, Chase Ultimate Reward points, Capital One Venture miles or Amex Membership Reward points and you can transfer them to any of their hotel and airline partners to take advantage of their best deals.

It’s also fortunate that there are four of these cards and with the exception of the Amex Gold card, you can get an additional bonus once every four years. This means that you can signup for one of these cards, earn as many points as you want during the year, transfer the points out and either downgrade or cancel that card and move on to the next card in this group. With the exception of the Amex Gold card on the 4th year, you could rotate though those cards every year.

Work With a Friend

While solo travel can be fun, traveling with a spouse, significant other, or a friend can make trips extra special. Working together to earn points also makes for a great strategy. In the travel hacking community, they affectionately call this ‘two player mode’.

Let’s say that you’re married and your spouse will be traveling with you. Two player mode essentially works like this: You sign up for the Citi Strata Premier card. You do the required spending and earn your signup bonus, but you DO NOT add your spouse as an authorized user. Then your spouse signs up for the same card and earns the same bonus. After both of you have earned your bonuses you continue to use those cards for all of your credit card spend for the rest of the year.

In two player mode, assuming the $3,000 per month spend listed above, in addition to the 50,000 or so points you would earn on your normal spend, you would also earn two 75,000 point sign up bonuses. That would mean a total of 200,000 Citi Thank You points that can be used to vacation in a variety of places.

Citibank’s Transfer Partners

If you just used Citi Thank You points to pay for items on your card, you would get .8 cents per point for a total of $1,600 for those 200,000 points. Don’t do that. The best way to use those points to transfer to airline partners and purchase flights. Citi has quite a few transfer partners. They are:

| Partner | Citi Points Used | Points Received |

| Aeromexico Rewards | 1,000 | 1,000 |

| Accor Live Limitless | 1,000 | 500 |

| Avianca Livemiles | 1,000 | 1,000 |

| Cathay Pacific | 1,000 | 1,000 |

| Choice Privileges | 1,000 | 2,000 |

| Emirates Skywards | 1,000 | 1,000 |

| Etihad Guest | 1,000 | 1,000 |

| EVA Air | 1,000 | 1,000 |

| Air France/KLM Flying Blue | 1,000 | 1,000 |

| Jetblue Trueblue | 1,000 | 1,000 |

| Leaders Club | 1,000 | 200 |

| Preferred Hotel and Resorts | 1,000 | 4,000 |

| Qantas Frequent Flyer | 1,000 | 1,000 |

| Qatar Privilege Club | 1,000 | 1,000 |

| Singapore Airlines | 1,000 | 1,000 |

| Thai Royal Orchid Plus | 1,000 | 1,000 |

| Turkish Airlines Miles and Smiles | 1,000 | 1,000 |

| Virgin Atlantic Flying Club | 1,000 | 1,000 |

| Wyndham Rewards | 1,000 | 1,000 |

This list can be a bit overwhelming, but if you spend a little effort you can use these transfer partners for some great value. There are too many great uses of these points to discuss all of them but I’ll give you some surprising examples:

Using Turkish Airlines Miles to Fly To Hawaii on United Airlines

This is one of those bizarre combinations that works pretty well if you are flexible about when you go to Hawaii. You do this by finding saver awards to Hawaii on the United Airlines website. Once you find this then you search on the Turkish Airlines Miles and Smiles website for Star Alliance award space for the same day. Usually if saver awards are available on the United website, you will find it on Turkish Airlines for 10,000 points each way. If you used United miles, it’s probably going to be 25,000 miles.

This is because Turkish Airlines uses a zone based award chart and any flights within the United States are 10,000 miles each way, even those going to Hawaii. If you are lucky enough to find business class awards, it would be 15,000 miles each way. This used to also be the case for flights to Mexico, Canada and the Caribbean but that changed in a recent devaluation for Turkish Airlines that I was very disappointed in.

Air France/KLM Flying Blue Flights to Europe

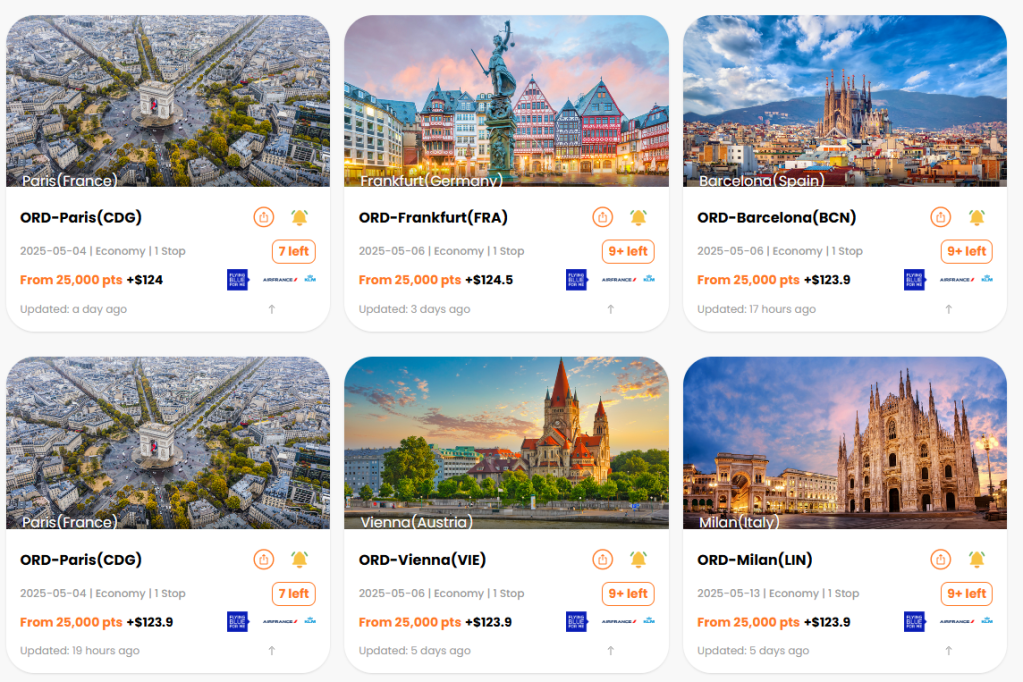

Flying Blue used to offer a lot of flights to Europe for an extremely low 20,000 points. A recent devaluation happened that has raised that price to 25,000 points. There are some great things about this program. One is that it covers both Air France, which uses Paris as its hub, and KLM, which uses Amsterdam as it’s hub, making a single platform that covers both airlines’ reward programs. The second thing is that it covers a whole lot of award flights to Europe from the United States. Using the Daydream Explorer feature in PointsYeah, I came up with a ton of 25,000 point flights to Europe in May.

However, one of my favorite things about Flying Blue is that it allows for stopovers in Paris and Amsterdam. In other words, if I’m flying from Chicago to Munich on KLM, there is going to be a stop at it’s hub in Amsterdam. I can choose to do a stopover for up to a year in Amsterdam before moving on to Munich. This allows me to book one flight to Munich, pay one fare, and stay in Amsterdam for a few days, a week, whatever I feel like doing. The bad news is that there isn’t a way to do it on the website, you’ll have to call. The worse news is that if you book with an agent on the phone, it costs 50 Euros per ticket. That being said, I’ll gladly pay 50 Euros for a stopover in Amsterdam.

East Coast to London on Virgin Atlantic

I honestly can’t believe this hasn’t dried up yet, but for some reason Virgin Atlantic offers flights from mostly JFK airport in New York to London for 6,000 points and around $70 in taxes. They also have the same prices for some flights from Washington Dulles and Boston Logan, but most are from New York to London. It seems to be too good to be true, so get it while you can, I guess.

Qatar Privilege Club for Transferring to Avios

I really like the Avios program. It is a points platform that is used by Qatar Airlines, British Airways, Iberia Airlines, Aer Lingus and Finnair. In the case of Citi, it only transfers to Qatar, but once you transfer points to Qatar you can transfer to these other programs, although it can get a little complicated, One Mile at a Time has a good explanation of how to do it.

Once you convert your Citi Thank You points to Avios, you can use them for such things as 13,000 point off peak flights from most of the eastern portion of the US to Dublin, 17,000 points from Chicago to Madrid off peak on Iberia Airlines, and 30,000 points to Helsinki from the US. These are obviously not always the prices, but they are fairly typical, and available if you are flexible.

Other Examples

There are some other transfer partners that can be very useful as well. If I were booking anything to Central America, South America, Mexico, or the Caribbean, I would start my search with Avianca Lifemiles. They consistently have competitive prices to those areas. I recently saw an example of 14,000 points and around $65 to San Jose del Cabo from Chicago.

Keep your eyes on JetBlue as well. There is a new partnership with TAP Portugal where you can get to Portugal from the United States for as low as 19,000 miles and $5.60 using JetBlue Trueblue miles. The Points Guy went into depth on this new sweet spot, and I think I’m going to have to look into that one a little more, it sounds very promising.

Citi’s Hotel Partners

While I love the choices for transferring to Airline partners, Citi’s hotel partners aren’t as exciting. You can get some value by transferring to Choice hotels at 2 Choice points per 1 Citi Thank You point. You could also transfer to Wyndham and take advantage of their partnership with Vacasa that has been a little watered down, but it’s still pretty good.

For the most part, though, the best use of Citi points will be to book flights, so I would hesitate to transfer to hotel partners in less you found a great use for those points. Of course you should never feel bad if you choose to use your points in a suboptimal way, since they’re your points and you should use them the way you want, but making the most out of your points will help stretch your vacation budget.

How Much Can This Save You?

If you are only going to take advantage of one signup bonus per year, it becomes imperative that you do everything you can to maximize the use of those points. This is where you should spend your mental energy. The good news is that there are a ton of resources on how to take advantage of these transfer partners to get the most of those points.

I suggest using PointsYeah as a good place to start. You can search a number of airline programs simultaneously so that you can choose where to transfer your points an book your flights. Also, sometimes just spending a few minutes googling for the best use of points for flights to the destination you want to go to will yield you a blog article that will be very beneficial.

So how much can you actually save doing this? Let’s look at the example of a couple in two player mode that earned 200,000 Citi Thank You points. From the examples above, probably the easiest, and most available redemption opportunities would be to book two sets of one way flights to Europe using Flying Blue. If they had a family of 4, they could book one set of flights on KLM with a stopover in Amsterdam and then head on to Munich. On the way back, they could book a flight with Air France and stop for a few nights in Paris. In this example, the family of four would spend 50,000 points and around $300 in taxes and surcharges each. Those flights probably would normally cost over a $1000 each. I would imagine that this would save the couple around $3,000 on this trip.

In the Turkish Miles and Smiles example above, booking from the US mainland to Hawaii for 10,000 points each way would mean that for 200,000 points that couple could book 10 round trip tickets. Those tickets typically cost between $600 and $1,000. So in this example it could save the couple between $6,000 and $10,000.

The amount that you save is definitely going to vary by location and airline, but it can definitely stretch that vacation budget out to save money on the flights.

A Simpler Way to Travel Hack

By using a one card per year strategy, you can reduce the cost of your vacations without putting too much of an effort into it. Juggling multiple credit cards to maximize point accumulation in bonus categories and having multiple signup bonuses per year takes work and mental energy. Most people would prefer to not have to think so hard about which credit card to swipe on every single purchase.

By signing up for one card per year, you can take advantage of the signup bonus and continue to use that card throughout the year. The key is to be smart when redeeming those points with transfer partners and Citi Thank You points have some really great transfer partners. Doing this one thing, can save you thousands of dollars per year on your travel plans. It can also be the key to unlocking vacations that you wouldn’t have considered before. Doing just a little travel hacking absolutely has the potential to open the entire world to you.