I’m a travel hacker. When I explain how I got a cheap trip somewhere, it sounds like a crazy conspiracy theorist explaining how the lizard people are controlling the world banks. For example, the first flight I booked on points was made with Citi Thank You Points transferred to the Turkish Airlines Miles & Smiles program to book a United Airlines flight. It was complicated, it took some research and it’s probably something that someone with limited time doesn’t want to spend their mental energy on.

Travel Hacking is Complicated, but it Doesn’t Have to Be

If you want to maximize every dollar of personal spending to earn the most points and then maximize the value of those points when you redeem them, it takes effort, lots and lots of effort. When I explain what I’m doing, sometimes I get confused looks, because travel hacking can get really complex. I do it because it interests me, its a hobby, but for many people it sounds like a lot of work.

There is a much simpler way to save significant amounts of money without putting in a ton of effort. What I’m talking about is a one new credit card per year strategy that gives you simplicity but still allows you to take advantage of points and miles.

Why One Card Per Year?

One of the things that has become annoying for us is that because we have opened so many credit cards (to earn signup bonuses) that it means that whenever Jenn reconciles our budget, she has to log into a bunch of accounts to see our spending. I believe we had some spending on 8 different cards last month. That’s a lot to keep track of, especially when you consider different usernames and passwords for each website.

If you can keep it to one card per year, it’s literally just one account, one username and one password. You’ll only get the one signup bonus, but you’ll only have to deal with one account.

Working Backwards

If you are going to use just one card per year, it’s important that you pick the right card and that starts with knowing what you want. This usually means starting with where you are planning to go. The examples that I will be talking about in this post are from the US to Europe, specifically Spain, England and Ireland.

Why those three specific countries? Well, those are the home counties of Aer Lingus, British Airways and Iberia Airlines, three of the airlines that use Avios as their award currency. Concentrating on earning miles from an airline that has a hub where you want to visit is extremely helpful. Also, checking flightconnections.com to see direct routes is a great way to get a sense of airlines that might be useful for you to concentrate on.

In this case, Aer Lingus, British Airways and Iberia Airlines have co-branded cards that are issued by Chase. Each one of those are currently offering elevated bonuses of 125,000 Avios with a fairly large spend of $20,000 in a year. That may seem like a lot, but if it’s just a one card strategy, then it’s not really a lot to spend.

Assumptions for this Example

I’m going to assume for these following examples that we have a family of four that spends $3,500 per month on a credit card. You might be thinking that’s a of credit card spend for a family, but you can charge a lot on credit cards these days. We charge our phone bill, all our utility bills, insurance, groceries, shopping, dining, hell we even charged out taxes last year. If you think credit card first, it’s really not that hard to charge a big amount each month while staying within your existing budget.

Saving Over $4,500 on Flights to Ireland

Let’s assume that your family of four wants to go to Ireland during summer vacation (in 2025 – they need to earn the points before they can spend them).

They start January 1st by getting a shiny new Aer Lingus credit card from Chase with the 125,000 Avios sign up bonus. With this card, they will earn 75,000 bonus Avios after they spend $5,000 in the first 3 months and an additional 50,000 bonus Avios when they spend a total of $20,000 in a year. In addition, they will earn a companion pass when they reach $30,000 in spending on that card in a year. The card has a $95 annual fee.

This card earns 3 points per dollar on flights with Aer Lingus, Iberia Airlines and British Airways. It earns 2 points per dollar on hotels and 1 point per dollar spent on everything else. For this example, we will assume all spending is at 1 point per dollar.

In this case, the example family will spend $42,000 in the year, all on this credit card. They will earn all 125,000 bonus Avios after the $20,000 in spending, the companion certificate when they spend $30,000 and they will also earn 42,000 Avios through normal spending in a full year. That means they will earn a total of a companion certificate and 167,000 Avios.

The family wants to fly to Dublin from Chicago in June and according to the Aer Lingus award chart, that is “in peak.” That means 20,000 Avios each way per ticket and around $285 per round trip ticket for taxes and fuel service charges. The family uses 120,000 Avios, a companion ticket (no taxes or fuel surcharges on the companion certificate) and pays $854.40 for taxes and fees.

How much does that save, though? Well, the exact same flights from Chicago to Dublin in June cost $5,492.24, in economy – not business class, economy class.

If you account for the $95 annual fee, that is a savings of $4,542.84 on a trip for four to Ireland! The only thing that this family did was put all of their spending on the Aer Lingus card and then use their points and companion certificate to book those flights instead of cash. That’s a huge return for a very small amount of effort.

Saving Over $3,000 on Flights to London

The British Airways Visa Signature Card is very similar to the Aer Lingus card. It earns 75,000 bonus Avios earned after $5,000 in spending in the first 3 months, with an additional 50,000 bonus Avios after a total of $20,000 in 12 months. When the cardholder hits $30,000 in spending in 12 months, they will receive a 50% off travel together certificate for two people. I assume that means that two people will get an award flight for the number of Avios for one flight, but will have to pay the taxes and fees on both flights. It has a $95 annual fee.

British Airways also will cover up to $600 in taxes and fees per year, but what that really means is up to to 3 times per year they will pay $100 of the fees on economy flights and $200 of the fees in a business class taxes and fees. In the example we are using, I assume that means that the family of four may deduct $100 off of their taxes and fees for their flights.

With the same earning structure as the Aer Lingus card we can say that the hypothetical family of four will earn the travel together certificate, the 125,000 bonus Avios and 42,000 Avios in normal spending for a total of 167,000 Avios.

When they go to redeem those Avios for flights, a Sunday to Sunday spring break round trip flight for 4 comes up to 200,000 and $1,359 in taxes and fuel surcharges, however because of the travel together certificate, they can take 50% off two of the flights and because of the fee credits from the British Airways credit card, they would actually pay 150,000 Avios and $1,259.00.

The cash price for the same exact flights were $4,755.20. The amount that would be saved is $3,496.20. If you take into account the $95 annual fee for the card, you end up saving a grand total of $3,401.20 for a family of four to visit Big Ben over spring break – not too shabby.

Saving Over $3,500 on a Trip to Madrid

The Chase Iberia Visa Signature card offers the same 75,000 bonus Avios after $5,000 of spending in 3 months and an additional 50,000 bonus Avios after reaching a total of $20,000 in spending in 12 months. There is an additional benefit of a $1,000 discount voucher on two tickets booked on the same flight when you spend a total of $30,000 in a calendar year. This card also comes with a $95 annual fee.

As with the other two cards, it earns 3x on flights on Aer Lingus, British Airways, and Iberia as well as 2x on hotels. All other spending would be 1x and for this example I will assume all spending will be at the 1x level.

With this card, the spending would end up identical as the previous examples with the theoretical family of 4 spending $3,500 per month or a grand total of $42,000 over the course of the year. They would earn the 75,000 bonus Avios, the additional 50,000 bonus Avios and the $1,000 discount voucher. After a year, the cardholder would have 167,000 Avios and a $1,000 discount voucher which is only good for one year after issue.

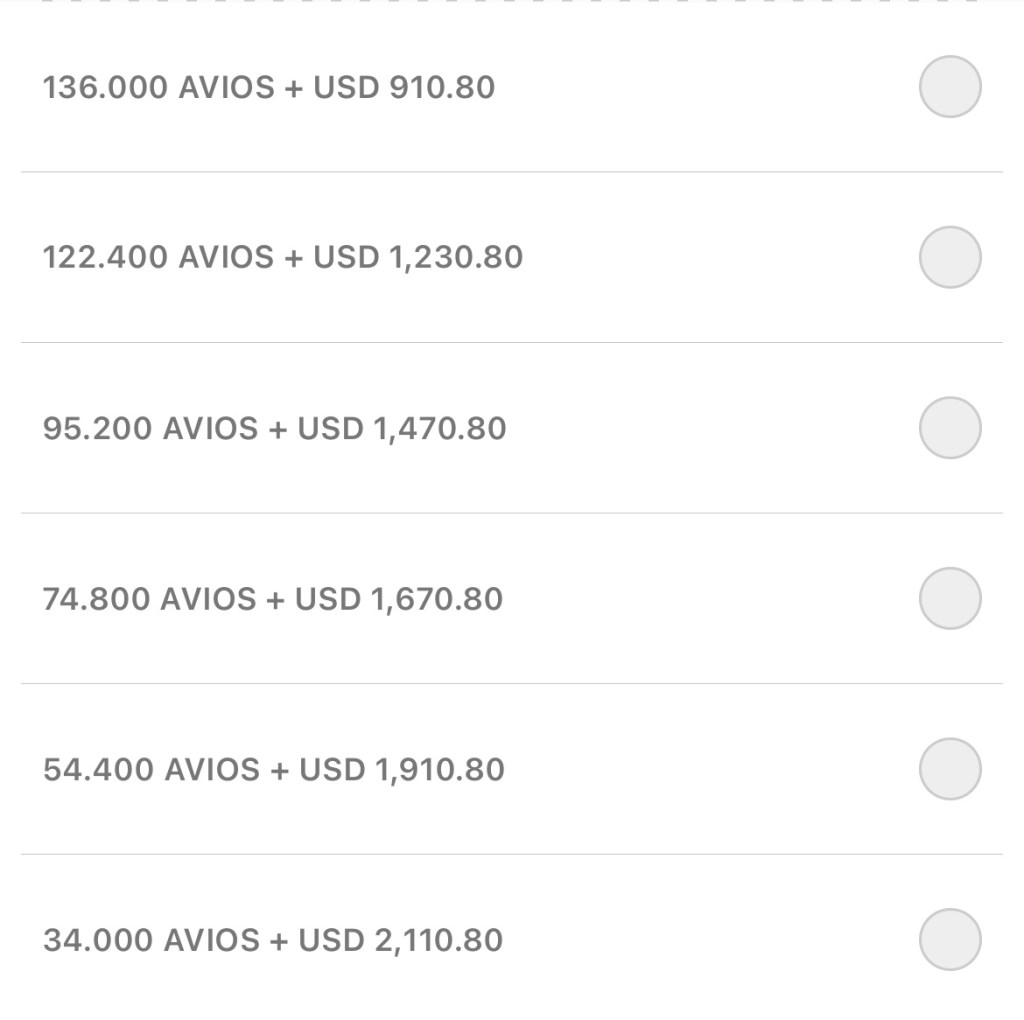

The example I’m using is for a spring break trip to Madrid, it ended up being Saturday to Monday (because of availability, sorry the kids are going to have to miss an extra day of school). Iberia gives you a variety of ways to pay combinations of points and cash but since we have the 167,000 Avios I would go with the 136,000 Avios and $910.80.

The cash price for the exact same flights was $4,594. If you take into account the $95 annual fee and the $910.80 in taxes and fees you end up with a savings of $3,588.20.

Everyone Likes Leftovers!

In all of the examples above, the example family is left with Avios and/or certificates that they weren’t able to use. In the Aer Lingus example, the family used 120,000 of the 167,000 Avios they had and used their companion certificate. This left them with 47,000 leftover Avios. In the British Airways example, the family used 150,000 of their 167,000 Avios and the companion certificate leaving them with 17,000 leftover Avios. In the Iberia example, they kept the $1,000 discount voucher and used 136,000 of the 167,000 Avios they earned. That left them with a $1,000 discount voucher and 31,000 Avios.

Doing a Second Year?

None of these cards are really compelling to keep more than 1 year, and that’s because they all are basically 1x cards, which in the points and miles world is basically as bad as you can get.

Assuming that you want to continue traveling on points, the thing to do is to cancel this card (before the annual fee is charged) and open a new credit card with a new signup bonus.

If you get any of the other credit cards that earn Avios (you can’t get another signup bonus on the card you already had due the rule that Chase will not give you another bonus within 24 months of earning a bonus on that card), you will be able to earn a new bonus and you can transfer the leftover Avios to your new account (certificates and vouchers are not transferable).

Intermediate Strategies for More Points

The easiest strategy is the one outlined above, however there are a few basic things you could do to amp the point earnings up without overcomplicating things.

Player 1/Player 2

Since we are talking about a family of four, I’m assuming two are adults, although that’s not always the case, since there are lots of single parents out there. If there are two adults then there can be what is referred to as “Player 1/Player 2” in the points and miles world. This is basically where the two adults both have separate credit card accounts but work together to earn miles (this, by the way doesn’t have to be romantic in nature, it could just be someone you like to travel with, maybe a parent, sibling or best friend).

Two Players Open Accounts Near the Same Time

Let’s take the Aer Lingus card example here. Player 1 opens an account and starts the clock on the $5,000 minimum spending in 3 months. Once the account is set up, Player 1 refers Player 2 to the same Aer Lingus card.

In this example, not only does Player 1 get the opportunity to earn the 125,000 bonus Avios but also gets a 10,000 Avios referral bonus for referring Player 2. Player 2 then also has the opportunity to earn up to 125,000 bonus Avios as well, but they will have to decide how they want to split their $42,000 annual spending (from the example at the beginning of the post) on these cards.

Method 1 – split evenly

In this case, both players would barely earn the 125,000 bonus Avios since $20,000 spend is required and each would have around $21,000 in spend. This means they would have to be very careful to make sure they got the bonuses by the end of the year.

However, being diligent would pay off and they would each earn 125,000 bonus Avios for a total of 250,000 Avios as well as Player 1 earning a 10,000 Avios referral bonus. On top of that would be the 42,000 Avios for normal spending. That would equal a grand total of 302,000 Avios and since round trip from Chicago to Dublin during the summer is 40,000 Avios and $285, that’s 7 round trip transatlantic flights for $285 each. Not too shabby.

Method 2 – Go for the Companion Pass

In this example, Player 1 would do at least $30,000 of the $42,000 total spend and Player 2 would do at least $5,000 of the total spend (in the first 3 months to earn the 75,000 Avios bonus).

Player 1 would earn the 125,000 Avios for $20,000 spend, plus the companion ticket as well as a 10,000 Avios referral bonus. Player 2 would only earn a 75,000 Avios bonus. Together, they would also earn 42,000 Avios from normal spending for a grand total of 252,000 Avios and a companion certificate.

Method 3 – Only 1 player, Churn and Burn

Let’s say in this example, you are a single parent or your significant other has less than ideal credit and can’t get approved for cards.

In this case, I would probably sign up for the Aer Lingus card, spend until I got the companion certificate (at $30,000, which at a $3,500 per month spending rate should take about 9 months). Then sign up for the British Airways card and spend the $30,000 on it in 9 months and sign up for the Iberia card.

Each nine months period in this example would earn the cardholder 155,000 Avios and the big bonus that each card offers at $30,000 in spending. Interestingly, the basic rules that Chase has is that you cannot earn a bonus on the same card more than once in a 24 month period, meaning that after you get the last bonus, you should be able to cycle back to the beginning and get the Aer Lingus bonus for a second time.

The Fine Print

This all sounds great, I mean who doesn’t want to save a huge amount of money on a trip to Europe? But there are a few things to keep in mind.

The 125,000 Avios Offer is Probably Temporary

If you are counting on this offer to be around indefinitely, it’s probably not. There almost always are offers on the three Avios cards, but the typical amount is 75,000 Avios when you spend $5,000 in the first 3 months. There have also been extended periods where the offer was a 100,000 Avios bonus after spending $5,000 in 3 months. Keep these previous offers in mind when you time out your applications for Avios cards. The big spend bonuses (ie. the companion certificates are features of the cards, not bonuses, so those should always be available after $30,000 spend in a year).

Those Avios Prices for Flights are not Guaranteed

The examples I included in this post are typical, but not guaranteed. At any time, the airlines can change the cost of those flights, including points needed, without warning. It is fairly common in the points and miles world to have your points devalued and its frustrating if you were counting on them for an important trip, so keep that in mind. Also, there is no guarantee about availability and often you might find yourself flying on less than ideal days, such as a Tuesday instead of a Saturday. If you are going to fly on points you will need to be little flexible.

You Will Need a Decent Credit Score to Get Travel Credit Cards

Travel reward credit cards, especially the ones with big bonuses, typically require higher credit scores to get than other credit cards. From what I’ve read, people seem to think that a 700 credit score is the floor for travel hacking in general, but you can definitely get some co-branded cards with a lower score than that and other cards such the Chase Sapphire Preferred card probably require higher scores than that. If you want to do any travel hacking, you’re probably going to want to keep a good handle on your credit score, and I would recommend Credit Karma for that.

Do Not Carry a Balance on these Cards!

Most cards that give travel rewards have ridiculous interest rates. Typically when I look at mine, they are always between 20%-30%. I honestly don’t care what the interest rate is because I always autopay for the full amount and I never pay that interest rate. If you carry any balance on a travel reward card, you will regret it, because it’s incredibly high.

Do Not Make Player 2 an Authorized User

We made this mistake on the first travel rewards card we applied for. By signing up your player 2 as an authorized user, it shows up as a new credit card account for the authorized user and counts on their Chase 5/24 status. This could, potentially, keep you from getting a new credit card later. That being said, if you are going to always follow a one new card per year strategy, this isn’t really an issue.

Beware of the 5/24 Rule

This is a rule that Chase has implemented to prevent travel hackers from getting too many bonuses from them. The rule is essentially this – Chase will not consider your application for a new credit card if you have opened 5 new credit card accounts in the last 24 months. One of the nice things about the strategy that I wrote about in this post, is that it should comfortably keep you under that 5/24 number.

It matters how you Apply

Depending on what links you click on, the signup bonus amounts may vary. Yes, I realize that sounds stupid, and it is, but depending on what website you start from can make a huge difference between how big your bonus actually is. That being said, Frequent Miler always has the current best offers on their website. You should always start there to check if you’re getting the best deal.

Saving with Simplicity

Having a simpler strategy for earning points and miles will not earn you the greatest possible points, but it will allow you to save significant amounts of money with a lot less effort. It’s not just about saving money, though. A lot of families, mine included, would not take a trip to Europe if the airfare was between $4,000 to $6,000. It’s just too much to spend. By saving thousands of dollars on airfare, it opens up vacations that we wouldn’t have considered before.

Keep in mind, if you could afford to drive to Florida, rent an Airbnb, and eat in restaurants while you’re there, those things are probably about the same price as they would be in Europe. The difference between the cost on those two vacations, primarily is the difference between gas and airfare. By dramatically reducing the cost of those flights, it equalizes those two destinations. This is unless, of course, you were planning to go to Disneyworld while in Florida, because then Europe is way cheaper.