Much of our time in October was spent preparing for our trip to Italy. Our trip included our good friends Bill and Theresa and Jenn’s Parents. None of them had been to Italy before and we wanted to make sure that they had a great time. I spent a decent amount of time researching places to visit, things to eat, train tickets, etc.

Meanwhile, Jenn spent a good deal of the month making ensuring that our kids had everything they needed to survive while we were gone. Emma and Alex are 19 and 15, respectively and they are definitely at the age where leaving them for another continent is questionable. I am, however, a firm believer that giving children challenges is a great way to turn them into functioning adults.

I can tell you that Emma passed this challenge with flying colors. She was not only responsible for taking care of Alex while she was gone, but she also was working, going to school and taking care of Jenn’s Parents’ dog. On top of that, she was coaching a youth basketball team. She took care of all of that and made sure that our house didn’t turn into a scene from Lord of the Flies. We couldn’t be prouder of her.

Citi Strata Premier Card

Right before we left for Italy, Jenn applied for, and her application was accepted for the Citi Strata Premier card. This is Citibank’s premier card and it’s a pretty good one. It has a $95 annual fee and has some pretty good bonus categories.

- 10x on Hotels, Rental Cars, and Attractions booked through the CitiTravel.com

- 3x on Groceries

- 3x on Restaurants

- 3x on Gas and EV Charging stations

- 3x on Flights and Other Hotel Purchases

- 1x on Everything Else

Getting 3x on groceries, restaurants and gas means means the cardholder can get 3x on a large portion of their spending without worrying about using one card for dining, and one card for gas, etc. It is a great credit card for people who don’t want to think too hard about points and miles.

This card currently has a 75,000 point welcome offer when the cardholder spends $4,000 within 3 months. Citi points are valued at 1.8 cents per point by The Points Guy, so that bonus is worth $1,350. In order to get that 1.8 cents per point value, you would need to use one of Citi’s transfer partners, including some of my favorites like Air France/KLM flying blue and Avianca Lifemiles.

It has a $100 credit on a hotel purchase of $500 or more using the Citi Travel site. It also has some trip protections and no foreign transaction fees. Overall, it’s a really solid travel credit card and especially good for people who don’t want to manage multiple cards.

Ok, On to the Point Check

This was not a great month for spending on non-bonus cards. We’ve gotten a little lazy about what card to use. For the vast majority of the month, Jenn didn’t have a card where she was working on a signup bonus. She is usually the one yelling at me that we need to sign up for a new card, because she can’t stand not working towards a signup bonus. Because she didn’t have a signup bonus to work towards, she just used her IHG Premier and her Amex Business Gold, neither of which were particularly great choices.

| Card Used | Spend | Points Earned | Point Value | Points Per $ | Return on Spend |

| Amex Business Gold | $1,143 | 1,310 | $26.20 | 1.1 | 2.3% |

| IHG Premier | $814 | 2,695 | $13.48 | 3.3 | 1.7% |

| Ink Cash | $561 | 2,783 | $57..05 | 5.0 | 10.2% |

| Venture | $372 | 745 | $13.78 | 2.0 | 3.7% |

| Wyndham Business | $284 | 1,588 | $17.47 | 5.6 | 6.2% |

| Total | $3,174 | 9,121 | $127.98 | 2.9 | 4.0% |

Because of that, the return on spend on cards where there wasn’t a signup bonus was 4%. I like to keep that number above 5% and lately we’ve been over 6%. Note to self – make sure Jenn has a signup bonus to work on.

Besides the spending on the above chart, I spent over $3,200 on my US Bank Triple Cash card, earning a little under $50 in cash back. That puts me more than halfway to the $6,000 in required spend to earn the $750 bonus on that card.

That meant that we finished the month with:

- 296,700 Amex Membership Reward Points

- 217,000 Chase Ultimate Reward Points

- 141,700 IHG Points

- 104,800 American Airlines Miles

- 85,400 Capital One Venture Miles

- 71,900 Marriott Bonvoy Points

- 30,400 Citi Thank You Points

- 11,300 Hyatt Points

- 5,000 Delta Miles

- 2,700 United Miles

- $220 Cash Back

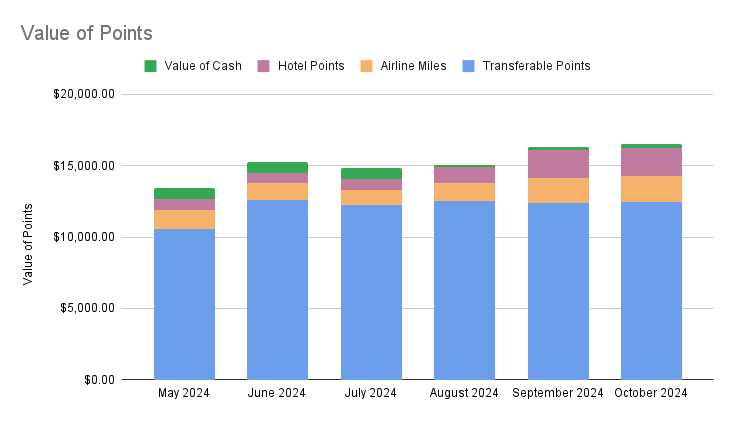

Using the Points Guy’s valuations, all of this totals to an all-time high for us of $15,800 in points, miles and cash back. We have some pretty big travel plans for 2025, so we’re going to need a big stash of points available. Hopefully I see some Black Friday deals so I can lock in some plane tickets!