September was a fun month. We took a trip with our friends Bill and Theresa to Nice, France, to compete in the UTMB Nice Côte d’Azur ultramarathons. Obviously, that wasn’t the only reason we went there. We also took a day trip to Monaco and spent quite a lot of time walking the beautiful streets of the old town of Nice.

The Nice area is stunning with deep blue Mediterranean waters and marinas filled with massive yachts. This area is where the Alps meet the Mediterranean, creating amazing coastline views from hundreds of feet above the water. It’s simply beautiful.

We stayed in the old town of Nice, which is a tightly packed group of old buildings with restaurants and shops along narrow streets. It’s pretty touristy, but it’s also a very nice place to walk around. The old town is actually a fairly large area, which makes its winding, narrow streets easy to get lost in.

We also spent a couple of days in Dublin on the way home. During our time in Dublin, we visited some classic Irish pubs and walked through Grafton Street and the Temple Bar district. We just happened to be there right after the Pittsburgh Steelers played the Minnesota Vikings in Dublin, so there were a ton of NFL fans and bars decorated to draw in those fans. It felt a little too much like being in the US.

My favorite stop in Dublin was the Jameson Distillery. I thought they did a fantastic job explaining the history of the distillery as well as the process of making their whiskey. They also, of course, had samples of their products to try along the tour.

No Real News

This may be hard to believe, but I’ve lost some of my desire to aggressively accumulate points through signup bonuses. Every new account adds complexity to what I need to keep track of, and I’m probably going to close a few accounts soon that have annual fees that we don’t use. Those were cards where the intention was to get the signup bonus and cancel them anyway.

The other reason why I haven’t been as aggressive is that we don’t have a ton of travel planned. We have a half-booked Spring Break trip to the Canary Islands, but we already have the points to book the rest of it. We thought we might take it a little easier next year, because our youngest child is going to be a Senior in high school and we don’t want to miss anything. We were hoping to do some camping next summer, but that doesn’t require any points and miles.

What that really means is that we’ll probably take advantage of great offers when they pop up so we can accumulate some points for later, but it will most likely be at a slower pace. Once Alex goes off to college, though, Jenn and I can finally take vacations whenever we want without worrying about missing anything. That sounds amazing!

On to the Point Check!

Most of our spending that isn’t devoted to a signup bonus looks pretty solid; the one exception to that is the spend on the Sapphire Preferred. However, I can explain. Those were charges that were done overseas, where bonus categories are not really a thing. The Sapphire Preferred is a pretty good card for foreign transactions, because it’s accepted just about anywhere (I’ve had issues using Amex in Europe) and it doesn’t have foreign transaction fees. Overall, it’s a good overseas choice, even if the points earned there aren’t great. Overall, we managed a return of 6.6% on that spending, and I’m happy with anything that is above 5%.

| Card Used | Spend | Points Earned | Point Value | Points Per $ | Return on Spend |

| Amex Gold | $991 | 3,164 | $63.28 | 3.2 | 6.4% |

| Ink Cash | $716 | 3583 | $73.45 | 5.0 | 10.3% |

| Sapphire Preferred | $522 | 522 | $10.70 | 1.0 | 2.0% |

| Wyndham Business Earner | $513 | 3,063 | $33.69 | 6.0 | 6.6% |

| Total | $2,742 | 10,332 | $181.13 | 3.8 | 6.6% |

The only card that we had where we were working toward a signup bonus was Jenn’s Citi AAdvantage Platinum card. Jenn spent just under $1,100 on that card, earning her a little over 1,700 American Airlines AAdvantage miles. She still has around $2,000 left to finish her spend to earn the 80,000 point signup bonus.

At the end of the months, we were left with:

- 264,400 IHG Points

- 239,600 Chase Ultimate Reward Points

- 135,700 Amex Membership Rewards Points

- 90,600 Wyndham Points

- 79,100 Alaska Miles

- 37,700 American Airlines Miles

- 33,400 Marriott Bonvoy Points

- 33,300 Citi Thank You Points

- 16,700 United Miles

- 9,300 Hyatt Points

- 1,500 Delta Miles

- $133 Cash Back

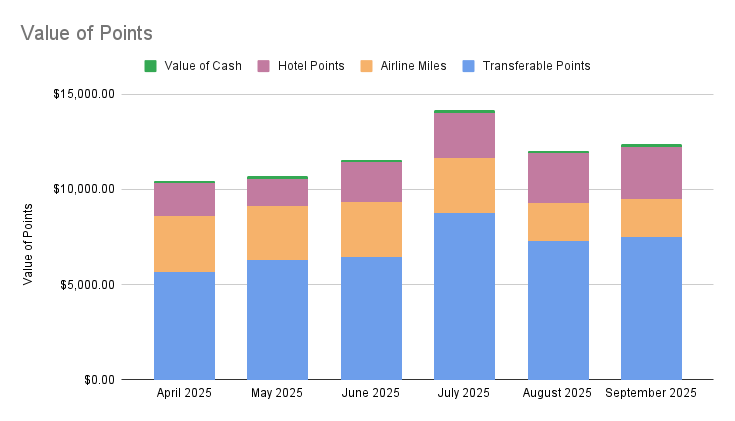

According to The Points Guy’s Valuations, the total of those points, miles, and cash back is worth around $12,400. That is up from last month’s total of $12,000. We need to book flights back from Tenerife and some hotel stays, but after that, we don’t have much to plan for, so I expect our point totals will grow a lot in the next 12 months or so.