For years, Wells Fargo has been a boring bank for travel hackers. However, in the last year or so, Wells Fargo has been put the travel rewards industry on notice that they intend to compete for business in the points and miles space.

The difference is that they have added some transfer partners for their credit cards. This allows for users to redeem their rewards for value that is better than the normal cash back rate. They are also adding new credit cards to their lineup.

Why Choose the Signify Business Cash Card

There are 3 good reasons to choose the Signify Business Cash card:

- $0 Annual Fee

- 2% Cash Back

- $500 Signup offer

These are all pretty boring reasons, but they are important if you are planning to maximize return on your spending. 2% cash back seems pretty boring in the points and miles world, but it’s important because it allows you to get at least 2% in categories where there are no bonus categories. This is especially true if you have a business that has to purchase supplies or parts.

Having a 2% base is especially nice if you can use a different card for purchases in other bonus categories. For example, if you also had the Wells Fargo Autograph card, you could earn 3% on gas, groceries, transit, streaming services, and phone plans. Simply pairing these two cards, could allow you to get 3% on a lot of your expenses while earning 2% on everything else.

Also, having no annual fee allows you to not use it when you want and not worry about getting the most out of the card. If you decide you want to put it aside while you work on a new credit card signup bonus, you’re not going to worry that you’re getting your money’s worth on an annual fee. In that way, a 2% card with no annual fee becomes a solid, dependable card that you can use when you want and shove it to the back of your wallet when you don’t need it.

$500 Signup Bonus

The Signify Business Cash card is currently offering a $500 signup bonus when you spend $5,000 in the first 3 months. That’s a very strong signup bonus for a card with no annual fee. The best comparison to this card, in my opinion is the American Express Blue Business Cash card that earns 2% cash back, has no annual fee and is offering a $250 statement credit on $3,000 in spending in 3 months.

It’s Not Just a Cash Back Card – There are Transfer Partners!

This is where things get a little in the weeds. By itself, the Signify Business Cash card is strictly a 2% cash back card. However, as Frequent Miler points out in their review of the Signify card, if you have either the Wells Fargo Autograph card or the Wells Fargo Autograph Journey card along with the Signify card, you can convert the cash back to Wells Fargo Reward points at 1 cent per point.

This allows you to access Wells Fargo Transfer partners, including:

- Aer Lingus Avios

- British Airways Avios

- Iberia Avios

- Qatar Privilege Avios

- Air France Flying Blue

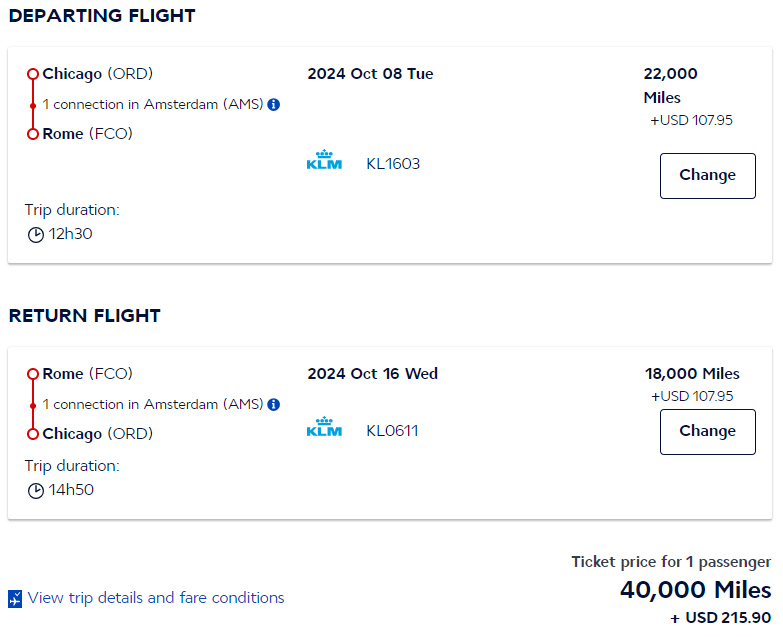

- KLM Flying Blue

- Avianca Lifemiles

- Choice Privileges

Having these transfer partners means that you can take advantage of some of the great deals these programs have. For example, if you wanted to fly round trip from Chicago to Madrid in March 2025, the cost of that flight, in economy, using Avios, is 34,000 Avios and $228.70 (that’s not a flash sale – it’s normal off-peak pricing using Iberia Avios). In terms of the Signify card, that is essentially $340 in cash back transferred to Wells Fargo Rewards points then to Iberia Avios and $228.70. So essentially for $568.70 in cash back, you can fly to Madrid and back. That’s a really good deal, especially if you factor in the $500 signup bonus.

These transfer partners make the Wells Fargo Signify card much stronger than just a 2% cash back card. The Points Guy values Wells Fargo Reward points at 1.6 cents per point, meaning if you use the cash back from the Signify card as points, you are really earning 3.2% back as travel rewards. That’s pretty good.

Wells Fargo Active Cash is the Personal Version of Signify Cash

The Wells Fargo Active Cash card is essentially the same thing as the Signify Cash card, except that it’s a personal card. It is a 2% cash back everywhere card with no annual fee. Like the Signify card you can pool your rewards together with an Autograph or Autograph Journey Card and accumulate all of the rewards as Wells Fargo Reward points and transfer those points to their transfer partners.

The main differences here is that the Active Cash is a personal card and that the signup bonus is much lower ($200 for spending $500 in 3 months)

I expect this to Get Even Better Over Time

The transfer partners that Wells Fargo have chosen to work with initially are really good choices, but it’s a pretty limited list. Flying Blue, Avios, and Avianca Lifemiles are all really good programs that cover a lot of needs for travelers on points and miles. However, that’s a pretty short list and I imagine that Wells Fargo is trying to add more transfer partners.

As I pointed out in a previous post when Wells Fargo announced they would have transfer partners, but before they announced who the partners would be, Wells Fargo is associated with the Bilt Card, and Bilt has probably the best list of transfer partners in the points and miles space. It took a while for Bilt to build out their impressive list of transfer partners, and if Wells Fargo follows suit, this could become a very valuable transferrable points currency.

There are a few, like Air Canada Aeroplan and Emirates Skyward, that I think would be pretty easy for them to add. Some others, such as Alaska Air or American Airlines, would be amazing but I wouldn’t count on it. I would also love to see them add Hyatt, but I don’t think they will, although I would expect them to add at least one more hotel chain.

Wells Fargo Rewards Keeps Getting Better

Anything that Wells Fargo can add to their transfer partner list at this point will make Wells Fargo Reward points more valuable, and by extension, Wells Fargo credit cards. The Wells Fargo Autograph and the Wells Fargo Autograph Journey are already cards that do a great job of earning points with some really strong bonus categories.

Wells Fargo seems intent on making some cards that really appeal to the points and miles community. It looks like they definitely want to start aggressively taking some business away from Chase, American Express, Capital One and Citibank. With that in mind, and the fact that they’ve been offering transfer partners for less than a year, I expect that Wells Fargo will add new credit card offerings, and new transfer partners over time. This is absolutely a bank to keep your eyes on.