On January 14th, 2026, Bilt released the details on the three credit cards that were replacing the original Bilt credit card. The original Bilt card was issued by Wells Fargo and it was widely reported that it was a significant money loser for them. These three new cards are issued by Cardless, and are intended to be a profitable way for the Bilt Program to issue credit cards.

The Five Banana Problem

The original Bilt credit card allowed users to earn one point per dollar when putting their rent on the credit card as long as they used their card five other times per month. The intention was that Bilt would recoup the money lost from interchange fees (which landlords don’t pay but retailers do) by generating it back through interchange fees from other purchases. The problem was that many savvy users swiped the card for five small purchases each month (such as a single banana), which didn’t generate much revenue for Bilt. Therefore, the joke was that Bilt had a five-banana problem.

With the new credit cards, Bilt believes they have solved the five-banana problem by creating a second currency called Bilt Cash that is earned each time the user swipes the card on non-rent or mortgage purchases. That Bilt Cash can be used to unlock the points earned from rent or mortgage payments. It’s strangely complicated, but the short answer is that if you spend 75% of your mortgage payment on other things, you earn enough Bilt Cash to unlock your points. In other words, to get the 1,000 points earned from a $1,000 mortgage payment, you would need to use it for $750 worth of other spending. Five banana purchases won’t work anymore.

What is the Bilt Blue Card?

The Bilt Blue Card is a no-annual-fee credit card that earns 1X on all spend and 4X Bilt Cash on all purchases (mortgage and rent payments are not made on the card itself). It also earns 1X on all rent or mortgage payments, but requires 3% of the total transaction in Bilt Cash to unlock those points. In other words, you need $30 in Bilt Cash to unlock the points from a $1,000 mortgage or rent payment, and at the 4x rate to earn those points, you would earn $30 in Bilt Cash after $750 in purchases.

Technically, the 1X earned on housing spend is not on the credit card, since that is not allowed. The housing payments must be done by ACH or Venmo using the Bilt website. The old card allowed you to charge the rent to the card itself, and this change appears to be an effort to reduce costs and make the Bilt card profitable.

Yes – I get it – this is complicated, but the point is that you can earn valuable Bilt Points on your rent or mortgage as long as you are actively using that credit card for a significant amount of your monthly spend. This is unique because you cannot do this to earn Chase Ultimate Reward Points, Citi Thank You Points, Amex Membership Reward Points, or Capital One Venture Miles.

Transfer Partners

What is also unique about the Bilt Blue Card is that it is a no-annual fee that allows you to earn points that can be transferred to airline and hotel programs. Transfer programs are what really make Bilt Points valuable, and while Citi, Chase, Amex, and Capital One have transfer partners as well, most require a credit card with an annual fee to unlock the ability to transfer.

In addition, Bilt points are the most valuable of any of the major transferable currencies. That is because they have a ton of transfer partners, and some of the most coveted. On the airline side, Atmos rewards is a highly valued currency for its ability to book partner awards for not a lot of points. On the hotel side, you can transfer to Hyatt, whose points are extremely valuable. The complete list of transfer partners, as of January 2026 are:

- Aer Lingus (1:1)

- Air Canada (1:1)

- Atmos Rewards (Hawaiian Airlines and Alaska Airlines) (1:1)

- Avianca Lifemiles (1:1)

- British Airways (1:1)

- Cathay Pacific (1:1)

- Emirates (1:1)

- Etihad Guest (1:1)

- Flying Blue (KLM and Air France) (1:1)

- Iberia (1:1)

- Japan Airlines (1:1)

- Southwest Airlines (1:1)

- Spirit Airlines (1:1)

- Tap Portugal (1:1)

- Turkish Airlines (1:1)

- Qatar Airways (1:1)

- United Airlines (1:1)

- Virgin Red

- All Accor Limitless (3:2)

- Hilton (1:1)

- Hyatt (1:1)

- IHG (1:1)

- Marriott Bonvoy (1:1)

Why are People Disappointed?

The old Bilt Card was a fantastic card, especially for young renters. For example, let’s say that you are a 25-year-old who is out of college and lives in a major city, but you’re not earning a big salary yet. In this example, let’s say that you are spending $2,500 per month on a small apartment and it’s a large chunk of your salary. With the old card, you would earn 2,500 Bilt points for simply putting your rent on the card and then swiping it 5 times throughout the month.

Now, to unlock the 2,500 Bilt points, you would need to spend $1,875 in other spending on the card. Even if you are putting your car insurance, cell phone, all utilities, your groceries, and all of your shopping and entertainment on the card, you might not reach that amount. So, for the person who spends a large portion of their income on rent, they’re not going to earn all of the points that they would have with the old card. In addition, the old card earned 3X on dining and 2X on travel, while the Blue Card is 1X on everything.

There is also the pesky problem with how Bilt changed the way that it allows you to pay rent. With the old card, you could actually use the card to pay your rent. This meant that you could essentially float your rent for 30 to 45 days by waiting until the credit card bill is due. With the new program, that is gone, and you have to pay by ACH, which saves Bilt money in interchange fees. In practice, this means that there are a whole bunch of people who are going to have to pay two rent payments in March as the last rent payment on the Bilt Card comes due, and they have to pay their rent with ACH simultaneously.

These changes are painful for people who had the old Bilt Card. I would argue, however, that if you forget about the old card for a second, the Bilt Blue Card is probably still the best option for this person.

Comparison to Venture Card

I think one of the best travel cards for someone in this situation is the Capital One Venture Card. That is because it earns 2x on all purchases and has only a $95 annual fee. It also has great transfer partners, although not as great as Bilt Points transfer partners. Let’s talk about the same person in the above example.

Let’s say that their personal spending can’t quite reach the $1,875 that they would need to unlock all of the points from rent. Instead, they average $1,500 per month other spending on their credit card. Since no points are earned on rent with Capital One, they would earn 2x on the $1,500 spent. That would total 3,000 Venture Miles.

On the Bilt Card, the $1,500 in spend would unlock (and I’ll spare you the math on this) 2,000 (out of the total of 2,500 points possible), plus 1,500 points from the spend. That is 3,500 Bilt Points earned. If you ignore the housing spend for this comparison (since Bilt is the only card that allows it), until you unlock all of the Bilt Points from the housing spend, you earn 2.33X on all spend.

That’s 500 more points, and I would prefer Bilt Points over Venture Miles, because the transfer partners are better. In addition, the Bilt Blue card is a no-annual-fee card, while the Venture Card costs $95 per year. In the end, it’s actually better than the Venture Card, even though it’s 1X vs 2X if you don’t spend past the threshold where you’ve unlocked all of the points from rent.

What about Bilt Cash?

Bilt Cash was created to force people who wanted to earn points on rent or mortgage to spend on the Bilt credit cards. It solves the five bananas problem mentioned earlier. However, because each card earns 4x Bilt Cash on every purchase, there is a real possibility that there will be excess Bilt Cash accumulated by any Bilt cardholder who uses their card for most or all of their everyday spend.

For the most part, Bilt Cash can be used to essentially purchase coupons on various things like Lyft rides, Bilt Dining experiences, hotel credits, fitness classes, and even Blade helicopter airport transfers. The best use of Bilt Cash appears to be the points accelerator, which is unfortunately unavailable on the Bilt Blue card.

The Confusing and Rewarding World of Bilt Cash

When the new Bilt credit cards launched on January 14th, 2026, there was a lot of confusion about Bilt Cash. A week later, Bilt explained what it is used for. Most of the uses are not that interesting, but the point accelerator seems to be the clear best use of Bilt Cash.

Option 1 vs Option 2

If all of this sounds confusing to you, you’re not alone. So many people complained about this that after 2 days, Bilt offered an alternative. Option 1, is to completely forgo the Bilt Cash system and instead earn points on your rent or mortgage based on this chart:

| Non-Housing Spend as Percent of Housing Spend | |

| 0% to 25% | no points earned on rent or mortgage |

| 25% to 50% | .5 points per dollar on rent or mortgage |

| 50% to 75% | .75 points per dollar on rent or mortgage |

| 75% to 100% | 1 point per dollar on rent or mortgage |

| Over 100% | 1.25 point per dollar on rent or mortgage |

Option 2 is using Bilt Cash to unlock points on housing. Based on what we know about Bilt Cash and the fact that the point accelerator isn’t available for the Bilt Blue Card, you would have to look through the list of uses for Bilt Cash and decide whether or not anything is interesting to you. I would guess that many people will choose option 1, because it’s just simpler.

Who is the Bilt Blue Card For?

Because it is a 1X on all spending credit card, it’s not going to be great for earning points unless you are using it for rent or mortgage. I think the ideal candidate for this card is someone with a fairly large rent or mortgage payment and just enough everyday spend to earn all of the points on that housing spend. Frankly, I see the ideal candidate as a young professional with oversized rent or mortgage payments.

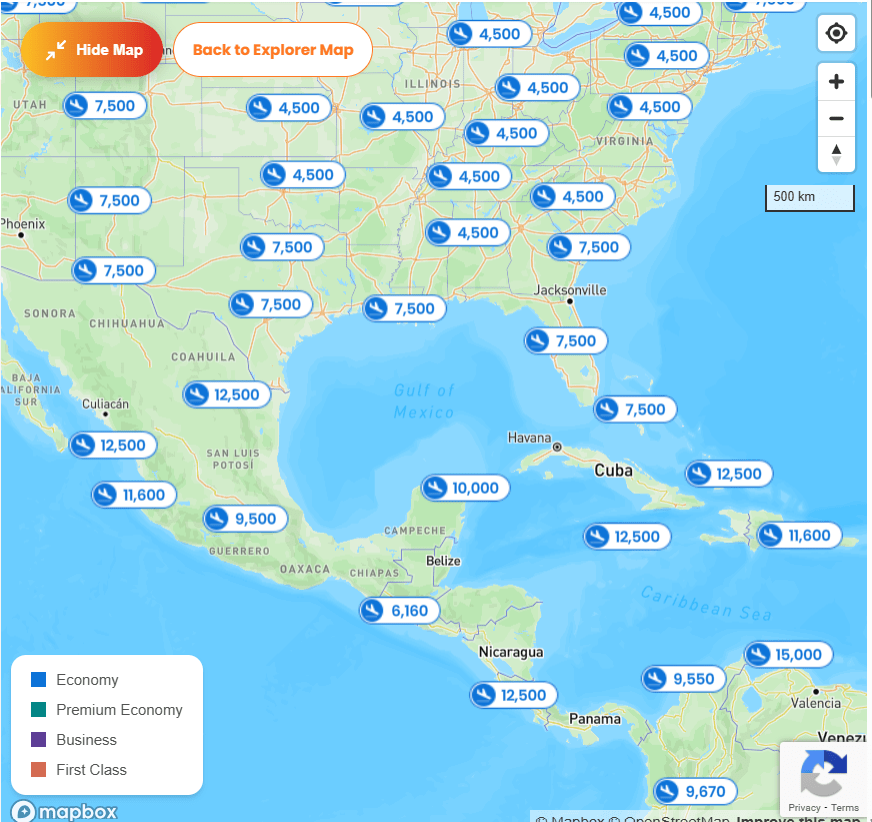

In the example above, the individual with a $2,500 mortgage and $1,500 in other spend per month would earn 42,000 Bilt Points in one year. I put that into Daydream Explorer on PointsYeah.com for the entire month of February (filtered for Bilt Points), and this is what I got for one-way fares from Chicago:

Obviously for a round-trip ticket you would need a ticket home as well, but there are plenty of places in Florida that you can fly for 7,500 points, Cancun for 10,000 points, or Punta Cana for 11,600. A category 1 Hyatt during standard time can be had for 5,000 points or a category 2 for 8,000 points. It might not be the most luxurious vacation ever, but when I was that age I just wanted to go somewhere warm and hang out at the beach. While 42,000 points isn’t a ton, a vacation can be assembled for that, especially if traveling with friends.

The card is currently being offered with a $100 Bilt Cash signup bonus, which would make it easier to unlock the points earned from rent or mortgage.

Conclusion

I think the Bilt Blue Card, while a disappointment to people who loved the old Bilt Card, is a good card for a fairly specific segment of the population. For other people, the Bilt Obsidian Card or Bilt Palladium Card might be a better fit. But for a young professional who doesn’t want an annual fee and wants to be able to take a no-frills trip every once in a while, I think this works better than any other option I can think of.