Ah, the start of a new year. Last year was a busy travel year for us, and we’re hoping to take it a little easier this year, but we’ll see. We have a trip to London, Tenerife, and Madrid scheduled for spring break, but nothing else so far. We’re hoping to do a little camping this summer and maybe take a short trip to Mexico in the fall. That would be a busy year for most, but last year we went to Europe three times, so it just feels a little light.

The winter in Iowa, as always, has been dreadful, with a couple of weeks in January being so bitterly cold that all anyone really did was go to work and bundle up at home. This is why spring break is always so important – it gives us something to look forward to when living in this icy hell is at its worst. Jenn has been planning our two days in London, while I’ve been planning the five days in Tenerife. The plan for Madrid is fairly simple: get off the plane from Tenerife, walk around and eat tapas, sleep at the hotel, go back to the airport, and fly home.

Iberia Plus Visa Signature

I applied for the Iberia Plus Visa Signature card and was accepted. This card has a $95 annual fee and earns 3X on purchases with Iberia, British Airways, and Aer Lingus, 2X on hotels, and 1X everywhere else. It provides a 10% discount on flights booked with Iberia, as well as a $1,000 discount voucher toward Iberia flights, issued when the cardholder spends $30,000 on the card in a year.

This card really isn’t that interesting, but it does come with a bonus of 75,000 Avios after spending $5,000 on the card in 3 months. I was looking for a way to pick up a few Avios without having to transfer points from our Amex Membership Rewards or Chase Ultimate Rewards stashes. Our son Alex wants to go to Finland and Iceland for his post-graduation trip in a year and a half, and Finnair uses Avios, so I’m planning ahead.

This is actually one of three Chase credit cards that earn Avios, with the others being the Aer Lingus Visa Signature and the British Airways Visa Signature cards. With any of these cards, you can earn the bonus every two years. If you cycle through these cards, you could potentially earn 225,000 to 300,000 bonus Avios every two years (the typical bonuses range between 75,000 and 100,000 Avios). We might decide to pick up a couple more of these cards over the next year or so in order to accumulate some points for Alex’s trip.

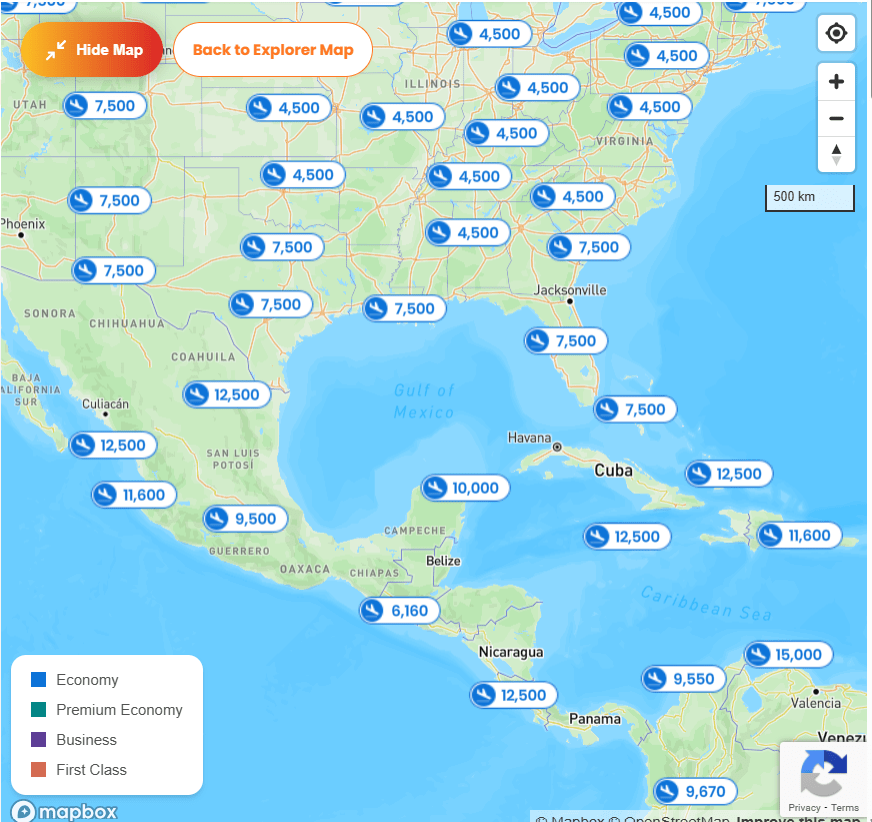

Finnair has a direct flight from Chicago to Helsinki that can often be booked for as few as 30,000 Avios. If we choose to be a little more creative, we could also fly to Madrid, London, or Dublin using Iberia, British Airways, or Aer Lingus, and then continue on to Helsinki. Either way, it’s nice to know that there are four European cities that have hubs used by airlines that use Avios. For us, that makes Avios a valuable airline currency that we are willing to accumulate, even if we don’t have an immediate need.

Bilt Palladium Card

Jenn applied for and was approved for the Bilt Palladium Card. Her enthusiasm for this card isn’t terribly high, and that’s because every time I try to explain what Bilt is and why I think it’s great, she just looks at me and says it’s too complicated. Frankly, she has a point, and that has been the biggest complaint about the Bilt 2.0 rollout. It’s just a lot to wrap your head around.

I’ve written a few blog posts over the past few weeks about the refreshed Bilt program and the three credit cards that they’ve issued with the new rollout. It’s a complex program, but it does allow you to earn 1X points on your mortgage or rent (through ACH, not with your credit card) as long as you charge essentially 75% of the total amount of your mortgage or rent on a Bilt Card. In the end, it’s really a gimmicky ploy to get you to use the card every month, but that’s fine with me. In addition to the 1X on the mortgage or rent, the Palladium card earns 2X on all other purchases.

The Bilt Palladium Card has a $495 annual fee and comes with a variety of travel protections, as well as two $200 hotel credits, one for the first half of the calendar year, one for the second half. It comes with a Priority Pass Select membership, which provides unlimited visits to Priority Pass lounges for the cardholder and up to two guests per visit. It also gives you $200 in Bilt Cash annually. Currently, it offers a 50,000 Bilt Point signup bonus, plus $300 in Bilt Cash and Bilt Gold Elite status for the remainder of 2026 and 2027 if you spend $4,000 in the first 3 months.

In addition to the 2X Bilt Points it earns on all spend, it also earns 4X in Bilt Cash, which is used to unlock points earned on rent or mortgage. Any Bilt Cash that is earned and not used to unlock points on rent or mortgage can be used for a variety of coupon-like benefits, as well as a point accelerator where you can exchange $200 in Bilt Cash for the ability to earn an additional 1X for the next $5,000 in spend on the card.

Between the Bilt Points, Bilt Cash, the benefits, and the status, this is a difficult program to understand, but not a difficult program to get good value from your spend. This card specifically is great for all uses, and we plan to use this for just about everything, unless we are working on a signup bonus.

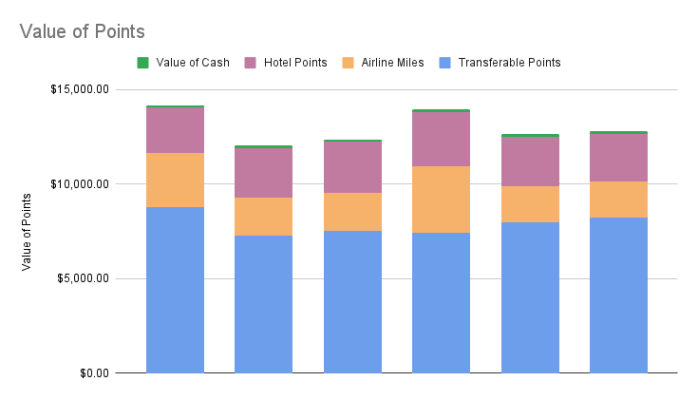

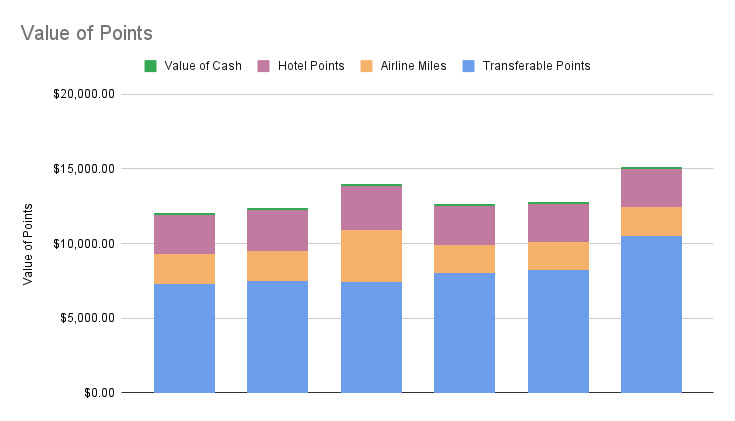

On To the Point Check!

Before the two cards that we signed up for in January, we really hadn’t signed up for much recently. The fact of the matter is that there just haven’t been many offers with good signup bonuses that we were eligible for. Jenn hasn’t had anything to work on for a while, and when she’s not working on a bonus, she just uses whichever card is the saved payment method on Amazon or whatever is at the top of her wallet. This really means that we’re not optimizing our spending for points earning, and that shows up in the chart below.

This is actually one of the reasons that I’m excited to get the Bilt Palladium Card. It’s such a great card to use on virtually anything, I can just tell her to use it on everything when she’s not working on a signup bonus. Honestly, I’m really considering purging a ton of credit cards because they’re not necessary. We’ll see how that evolves over the next few months.

| Card Used | Spend | Points Earned | Point Value | Points Per $ | Return on Spend |

| Amex Gold | $1,770 | 4,147 | $82.94 | 2.3 | 4.7% |

| Ink Cash | $441 | 2205 | $45.20 | 5.0 | 10.3% |

| IHG Premier Business | $420 | 1,261 | $6.31 | 3.0 | 1.5% |

| Wyndham Business Earner | $398 | 1,990 | $21.98 | 5.0 | 5.5% |

| Sapphire Preferred | $376 | 376 | $7.71 | 1.0 | 2.1% |

| Blue Business Plus | $66 | 132 | $2.64 | 2.0 | 4.0% |

| Total | $3,862 | 10,501 | $174.09 | 2.7 | 4.5% |

In addition to the spending listed above, I spent a little under $1,800 on my Ink Unlimited card and received a little under 2,700 Chase Ultimate reward points on that spend. That was the last required spending needed for me to earn my 90,000-point signup bonus on that card.

Jenn also received a 10,000 Membership Rewards point bonus for adding our daughter as an authorized user on her Amex Gold card and having her complete $2,000 in spend over 6 months.

That leaves us with:

- 323,600 Chase Ultimate Reward Points

- 266,700 IHG Points

- 172,400 Amex Membership Rewards Points

- 100,700 Wyndham Points

- 79,400 Alaska Miles

- 33,900 American Airlines Miles

- 19,300 Citi Thank You Points

- 16,700 United Miles

- 15,900 Marriott Bonvoy Points

- 1,500 Delta Miles

- 300 Hyatt Points

- $133 Cash Back

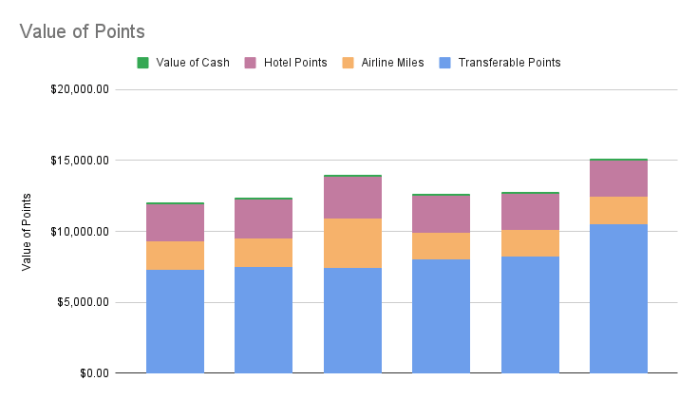

When totaled together, these points and miles, according to valuations published by The Points Guy, are worth over $15,100. That is the highest total we’ve had since November of 2024. We have some ideas about what we want to do in 2027, and they seem like they could be expensive. However, it looks like we’re well on our way to banking enough points for those plans to be feasible. I always enjoy planning and booking those trips, so I can’t wait to figure out how I can spend those points.