The Bilt Obsidian Card is a card that could be interesting for families or anyone who has a significant amount of dining or grocery spend, especially for a family with a large rent or mortgage payment. Prior to February 7th, 2026, Bilt allowed people to earn points on rent payments, but after that date, it will allow people to earn Bilt Points when you pay your mortgage.

The payments aren’t charged to the card, but rather you use the Bilt platform to make the payment with your Venmo or bank account and routing number. You earn 1 point per dollar on the transaction, as long as you make the necessary non-housing transactions on the credit card. But finding out how much will require some math.

What is the Bilt Obsidian Card?

The Bilt Obsidian Card is the middle-tier card of the three new cards created for the Bilt program. It has a $95 annual fee and earns 3X on your choice of grocery or dining, 2x on travel and 1X on all other purchases, including 1X on mortgage or rent payments paid through the Bilt platform.

The card also comes with two $50 hotel credits, one in the first half of the year and the second in the second half of the year. These credits are for two-night stays booked through the Bilt Travel Portal. Honestly, this feels almost useless, unless you prefer to use the Bilt Travel Portal, then it’s a nice $50 coupon. Most likely, I wouldn’t even use this credit.

The Bilt Obsidian Card also comes with some travel protections, including MasterRental Coverage, trip delay, and cancellation coverage. It also comes with no foreign transaction fees, purchase assurance, and extended warranties.

The Bilt Obsidian Card currently comes with a signup bonus of $200 in Bilt Cash.

Unlocking Points on Rent or Mortgage

The biggest selling point of Bilt is that they allow you to earn points when you pay for your rent or mortgage through the Bilt platform. However, it’s not as simple as that. Because the points have a cost to Bilt, they have set up a system to ensure that they can recoup the cost of those points.

As with all credit cards, they make money through interchange fees. Therefore, Bilt requires that you spend on the card to help recoup the cost of those points. With the old Bilt Credit Card, you only had to make 5 purchases throughout the month. Now, the rules are, well, a bit more complicated.

Option 1 vs Option 2

As if the new Bilt system isn’t complicated enough, they have introduced two options to unlock the points that are earned on rent or mortgage. Option 1 sets your earning rate on those housing charges based on a “simplified” chart. It looks like this:

| Non-Housing Spend as Percent of Housing Spend | Earning rate on rent or mortgage |

| 0% to 25% | no points earned on rent or mortgage |

| 25% to 50% | .5 points per dollar on rent or mortgage |

| 50% to 75% | .75 points per dollar on rent or mortgage |

| 75% to 100% | 1 point per dollar on rent or mortgage |

| Over 100% | 1.25 point per dollar on rent or mortgage |

The more you spend on non-housing expenses, the more points you earn per dollar on your housing expenses, maxing out at 1.25 points per dollar. In order to choose Option 1, you need to forgo Bilt Cash, which is a feature of Option 2.

In Option 2, you earn 4X per dollar spent on non-housing expenses in a second currency called Bilt Cash. You can use the Bilt Cash at a rate of 3% of the housing expenses to unlock the Bilt Points earned by housing expenses. For example, a $1,000 rent payment would earn 1,000 Bilt points unlocked and paid for with $30 in Bilt Cash. At 4X per dollar, that amount of Bilt Cash is earned with $750 in non-housing expenses.

With Option 2, any spend above what is necessary to unlock Bilt Points can be banked as Bilt Cash, which can be used for a variety of things. These potential uses are mostly coupon-like credits for some of Bilt’s corporate partners. They include things like Lyft rides, Bilt Dining experiences, hotel credits, fitness classes, and even Blade helicopter airport transfers.

The best use of Bilt Cash is the points accelerator, which allows you to turn $200 in Bilt Cash into an extra 1X on all spend for the next $5,000. This means that instead of 3X on grocery or dining, 2X on travel, and 1X on everything else, this card would earn 4X on dining or grocery, 3X on travel, and 2X on everything else for the remainder of the accelerator period. Essentially, it’s a way for the cardholder to turn $200 in Bilt Cash into 5,000 Bilt Points.

The Confusing and Rewarding World of Bilt Cash

When the new Bilt credit cards launched on January 14th, 2026, there was a lot of confusion about Bilt Cash. A week later, Bilt explained what it is used for. Most of the uses are not that interesting, but the point accelerator seems to be the clear best use of Bilt Cash.

Average Family of 4 Using Option 2

According to Google AI (take it with a grain of salt) the average family spends around $2,300 per month on mortgage plus taxes and insurance. For the sake of easy math, let’s just say $3,000 all together with taxes and insurance included. The average family of 4 also spends around $1,400 per month on groceries (also according to Google AI).

In order to unlock the 3,000 points earned from the mortgage payment, they would also have to spend a total of $2,250 on non-housing expenses on the card. If they put the entire $1,400 of groceries on it then they would need to spend an additional $850 on other expenses on the card.

That means that they would earn 3,000 Bilt points on the mortgage, 4,200 points on the groceries (3X on groceries), and 850 points on the other spend. That is a grand total of 8,050 Bilt Points earned on what is $2,250 in credit card spend. That is almost 3.6X, which is fantastic. It’s actually more than the 6,450 Amex Membership Reward points that you would earn on that spend on an Amex Gold where there is 4X on grocery spend.

Bilt Points are the Best Points

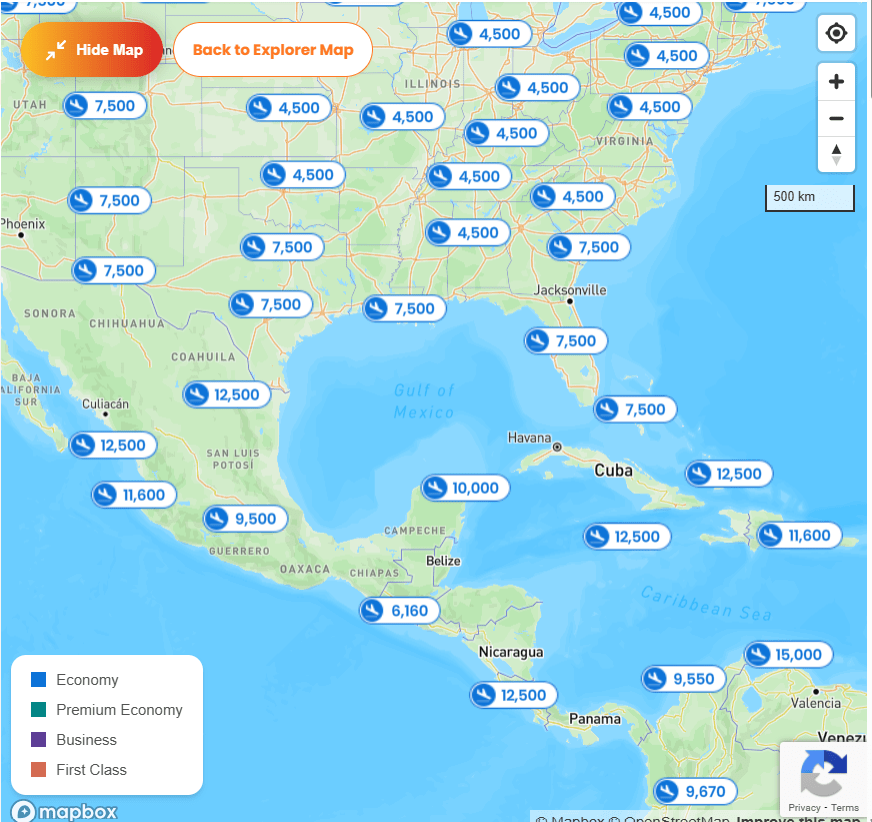

Bilt points are generally viewed as being the most valuable points of the major programs. That is primarily because they have a great list of transfer partners, with some highly coveted partners such as Atmos Rewards and World of Hyatt. The full list of partners are:

- Aer Lingus (1:1)

- Air Canada (1:1)

- Atmos Rewards (Hawaiian Airlines and Alaska Airlines) (1:1)

- Avianca Lifemiles (1:1)

- British Airways (1:1)

- Cathay Pacific (1:1)

- Emirates (1:1)

- Etihad Guest (1:1)

- Flying Blue (KLM and Air France) (1:1)

- Iberia (1:1)

- Japan Airlines (1:1)

- Southwest Airlines (1:1)

- Spirit Airlines (1:1)

- Tap Portugal (1:1)

- Turkish Airlines (1:1)

- Qatar Airways (1:1)

- United Airlines (1:1)

- Virgin Red

- All Accor Limitless (3:2)

- Hilton (1:1)

- Hyatt (1:1)

- IHG (1:1)

- Marriott Bonvoy (1:1)

Rent Day Specials

Bilt Rewards has a tradition of having special deals only available on rent day. They have offered things like free fitness classes in the past, but the thing to really look out for are massive transfer bonuses.

In December 2025, for example, British Airways offered a transfer bonus of up to 100% based on your Bilt Status. The bonus was 100% for platinum members, 75% for gold members, 60% for silver members, and 50% for blue members. Your membership tier is based on how much you spend within the Bilt program. For a Silver member, this transfer bonus would mean that if you transferred 10,000 Bilt Points to British Airways, you would end up with 16,000 British Airways Avios. That’s a great way to get extra value for your Bilt points.

There is an indication that you can use Bilt Cash to unlock higher transfer bonuses; however, we have no idea how much Bilt Cash will be required to do so. But there is a chance you could make good use of your Bilt Cash to take advantage of status for these rent-day transfer bonuses.

Who is the Bilt Obsidian Card For?

I think, if there is one thing common to the three new Bilt Cards, it is that they are great for people who would like to earn points for travel but don’t want to sign up for a bunch of credit cards. There is no doubt that signup bonuses are the best way to accumulate a ton of points and miles, but there are many reasons why people might not want to sign up for a new credit card every few months. Bilt Cards appear to be designed to be more rewarding the more you use them, making them perfect for people who only want to deal with one credit card.

With the ability to earn points on rent or mortgage, as well as 3X on your choice of groceries or dining, 2X on travel, and 1X on everything else, depending on what you use your credit card for, it could be a pretty good overall earner. If you are able to accumulate enough Bilt Cash to activate the point accelerator and add 1X to all spend, it could get really lucrative.

The $95 annual fee isn’t too much of a barrier for most people, and besides the two $50 hotel credits there isn’t any coupon-like things to worry about, so it is fairly simple.

Overall, I think it’s a great card for someone who has a decent amount of grocery or dining spend each month, to take advantage of the 3X category (or 4X with the point accelerator). To me, it makes a lot of sense for a family, because of how much a family spends on groceries.

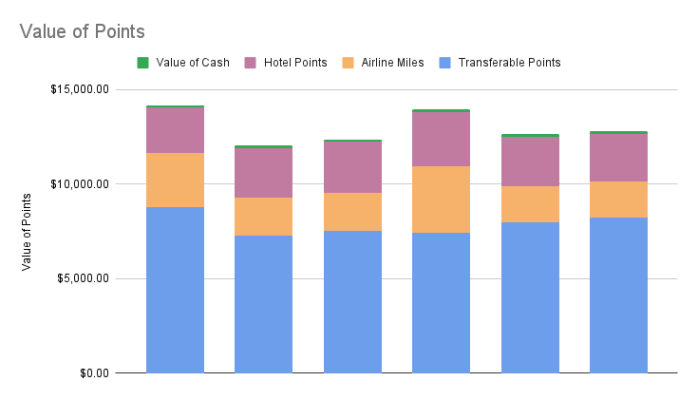

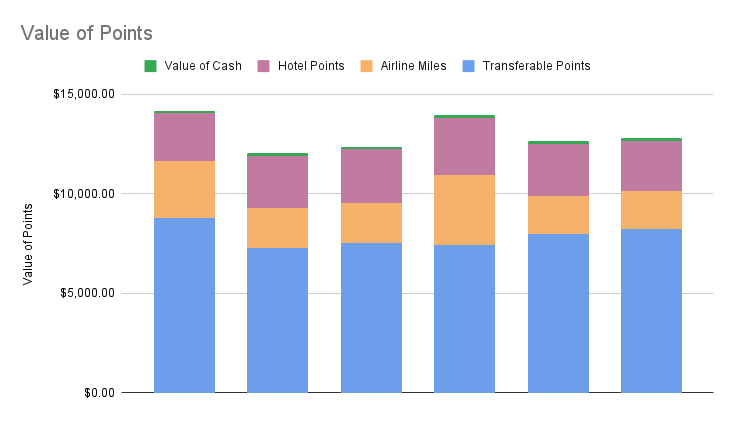

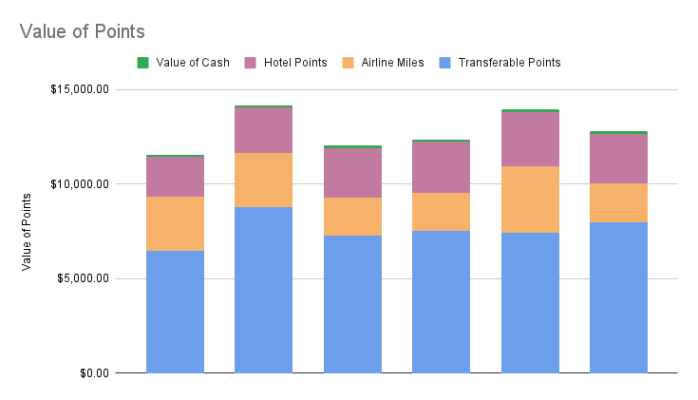

Let’s go back to the earlier example, but in addition to the $3,000 mortgage, $1,400 in grocery spend, they have an additional $2,600 in spend on the card (at 1X). In this example, they earn Bilt Cash along with their points and use the vast majority of Bilt Cash earned toward the point accelerator.

Over the course of one year, they would earn 36,000 Bilt Points on Mortgage, 50,400 Bilt points on grocery spend, 31,200 Bilt Points on other spend, and 25,000 Bilt Points on the point accelerator. That totals 142,600 Bilt points for the year. The Points Guy values Bilt points at 2.2 cents per point, meaning that amount of Bilt Points is worth a little over $3,000. That’s not bad for simply using one credit card for everything.

Conclusion

While not being as lucrative as signing up for multiple credit cards, the Bilt Obsidian Card is a great credit card for anyone who wants to earn a decent number of Bilt Points but doesn’t want to spend all of their time thinking about points and miles. Cardholders can simply put all of their spend on one card and earn the most valuable transferable currency in points and miles.

While the Bilt program itself is complicated, having to just concentrate on the one program will make it much easier for people to learn the nuances of the program and take advantage of transfer bonuses and Bilt Cash. It’s a great card for people who want to do a little travel hacking, but don’t want to spend too much time on it.