April was about the only breather we could take for a while. March consisted of a trip to Spain and Portugal to do a week on the Camino de Santiago. In July, Jenn is taking our daughter Emma, as well as her sister and niece, to Munich and Dublin. Meanwhile, I will be taking our Son Alex to Berlin and Dresden as well as doing a little hiking in Bohemian Switzerland National Park. In September, we will be going to Nice, France, to participate in the UTMB Nice Côte d’Azur. It’s almost a little too much traveling in too short a time, but I’m willing to take this challenge head-on.

A Decent Deal on a Delta Flight?

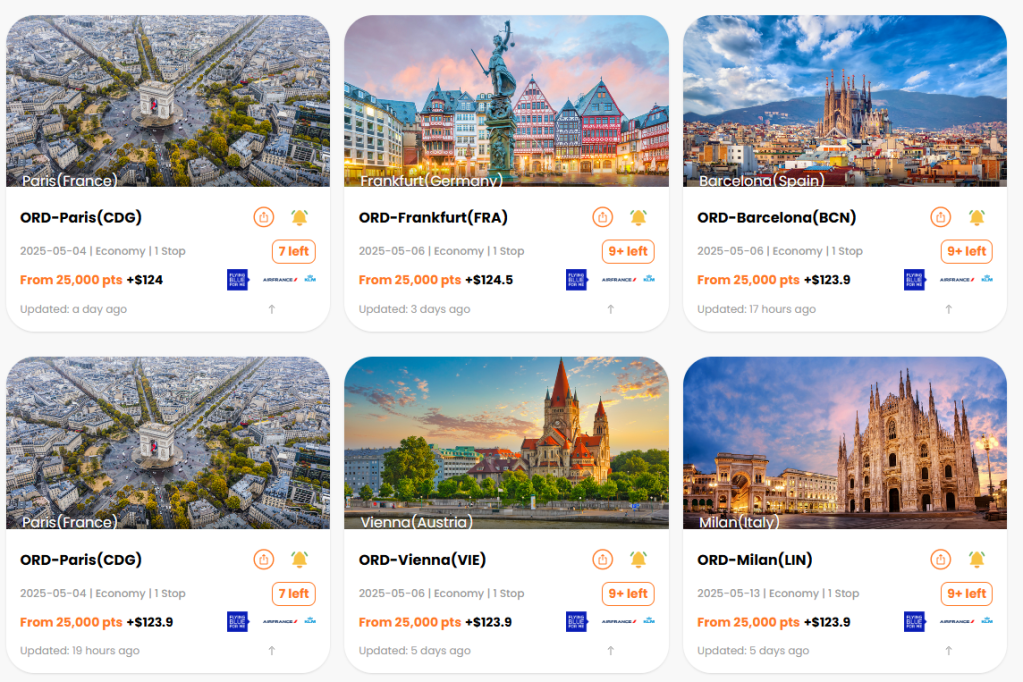

I had been looking for months for a decent price on a flight for Alex and me to go to Europe, preferably Germany. For a while, I was getting frustrated because I could get flights to Europe for a decent number of points, but the prices for getting home were more than I wanted to spend. I was patient, and finally, Delta came through with round-trip flights for 40,800 Delta miles and $132 each. The price was 48,000, but Jenn has a Delta Gold Card, so the redemption was 15% off.

That meant Alex and I were set to go to Berlin in July for 81,600 Delta Miles and $264. That’s a pretty good price, but the downside was that it was the price for Basic Economy. In other words, we don’t get to choose our seats, so Alex and I may not be sitting together. I’m sure he’ll survive; he is 16 after all.

Those points came from a small amount of Delta miles that Jenn had, but she also had to transfer 76,000 American Express Membership Rewards points to Delta to cover the rest. Those flights would have cost around $1,000 each, so the redemption came to around 2.1 cents per point, which isn’t bad.

This was the last of the redemptions that we have planned for flights this year. It’s honestly difficult for me to believe it, but we booked 12 flights to Europe this year on points as well as a flight to San Antonio. Those flights weren’t “free” because they always come with taxes and sometimes come with fuel surcharges, but they have always been at severely discounted prices.

There is no way I would have paid cash for all of those flights, so I’m glad that we were able to use points to get to these amazing destinations. This year alone, I will have visited Portugal, Spain, France, Monaco, Ireland, Germany, and the Czech Republic. That’s pretty amazing, and I’m very thankful that I’m able to take these trips.

Sign Up Bonuses

In January, I signed up for the Alaska Airlines Visa Signature Card, which had a signup bonus of 75,000 Alaska miles and a companion fare after $3,000 spend in 3 months. In April, I finally completed my spending and received the bonus. The companion fare is essentially a $122 fare that you can use on any Alaskan flight if you purchase a second flight. It’s only good for a year, and I don’t think I’ll get an opportunity to use it. The Alaska Air miles, though, will definitely come in handy, especially when there are a lot of chances to use 4,500 Alaska miles to fly American Airlines on short flights. For us, they are especially useful for flying from our home airport in Moline to Chicago O’Hare.

Jenn got her 75,000 Membership Reward Points bonus for spending $6,000 in 6 months on her American Express Gold Card. That came just in time to replenish the points I used to book the Berlin flights for Alex and me. Membership Reward points are very valuable, and it’s always nice to have a little stash of those.

100K on Chase Sapphire Preferred

It doesn’t happen very often, but Chase occasionally offers a 100,000 point bonus on the Chase Sapphire Preferred card. When it does happen, every points and miles enthusiast checks to see if they’re eligible to receive the bonus. The basic requirements are that you have signed up for less than five personal credit cards in the last 24 months, you haven’t received the bonus in the last 48 months, and you currently don’t have a Sapphire Card.

Chase Ultimate Rewards points are the most coveted points in travel rewards outside of Bilt points. Getting 100,000 Ultimate Rewards points with one signup bonus is phenomenal, but the card itself is an excellent travel credit card. This card earns 5x on travel through the Chase Travel portal and 2x on all other travel purchases. It also earns 3x on dining, online groceries, and streaming services, and 1x on everything else. There is also a $50 hotel credit per year that you can receive if you book a hotel through the Chase Travel Portal.

What makes the points valuable, however, is their transfer partners. They have some great Airline transfer partners such as United, Southwest, Air France/KLM Flying Blue, Aer Lingus/Iberia/British Airways Avios, Air Canada, and Virgin Atlantic. A lot of people, however, love their Chase Ultimate Rewards points because they transfer to Hyatt at a 1:1 ratio. Hyatt has the most valuable hotel points, with most people valuing their points at around twice the value of Marriott points and about triple the value of Hilton points.

Jenn referred me to the Chase Sapphire Preferred card, so she will receive 10,000 points, and I will receive 100,000 points. I need to spend $5,000 in three months to receive the bonus. She also referred another friend, so she will be getting an additional 10,000 for that signup. I think I know five people who jumped on this deal, because it was so good.

On to the Point Check!

Most of our spending in April was on cards for which we were working on signup bonuses, so the spending below is almost entirely recurring charges. That being said, a 7.1 percent return on those charges is phenomenal, so I feel good about how I have our recurring charges set up.

| Card Used | Spend | Points Earned | Point Value | Points Per $ | Return on Spend |

| Amex Gold | $552 | 2,130 | $42.60 | 3.9 | 7.7% |

| Ink Cash | $445 | 2,224 | $45.59 | 5.0 | 10.2% |

| Wyndham Business Earner | $347 | 1,736 | $19.10 | 5.0 | 5.5% |

| Venture | $345 | 690 | $12.77 | 2.0 | 3.7% |

| Total | $1,689 | 6,780 | $120.05 | 4.0 | 7.1% |

On top of the spending listed above, I spent a little over $1,000 on my Alaska Airlines Card, earning over 1,500 Alaska miles as well as the 75,000 Alaska mile bonus. Jenn spent a whopping $8,500, a good portion of which was our annual taxes, nailing down her 75,000 point bonus as well as an additional 12,000 Membership Reward points. After all of that, we ended the month with:

- 126,900 Chase Ultimate Rewards Points

- 122,600 Amex Membership Rewards Points

- 93,000 American Airlines Miles

- 85,000 IHG points

- 79,100 Alaska Miles

- 60,000 Marriott Bonvoy Points

- 58,900 Wyndham Points

- 32,100 Citi Thank You Points

- 15,900 United Miles

- 6,500 Hyatt Points

- 1,100 Delta Miles

- $109 in Cash Back

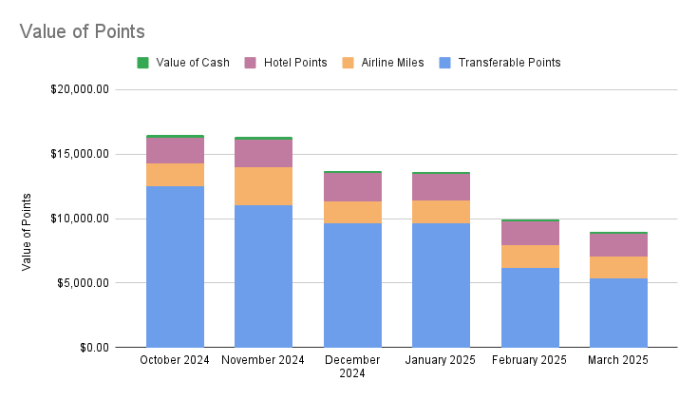

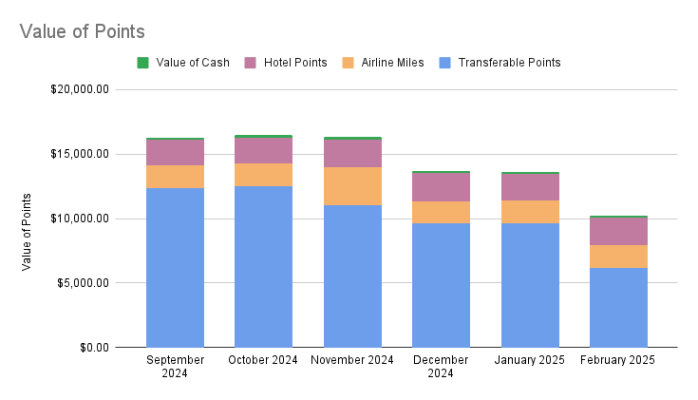

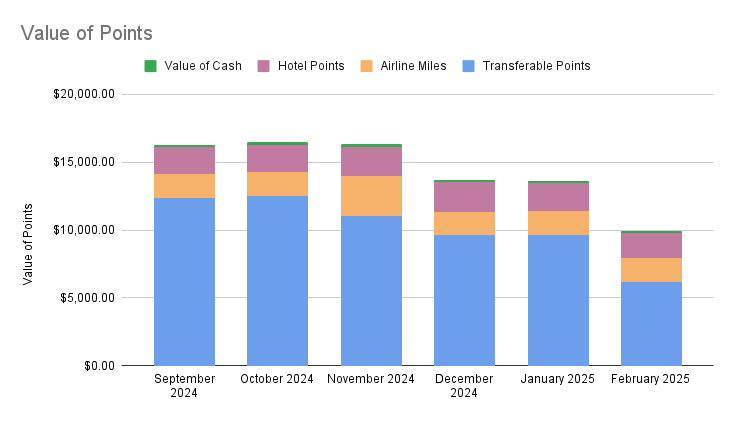

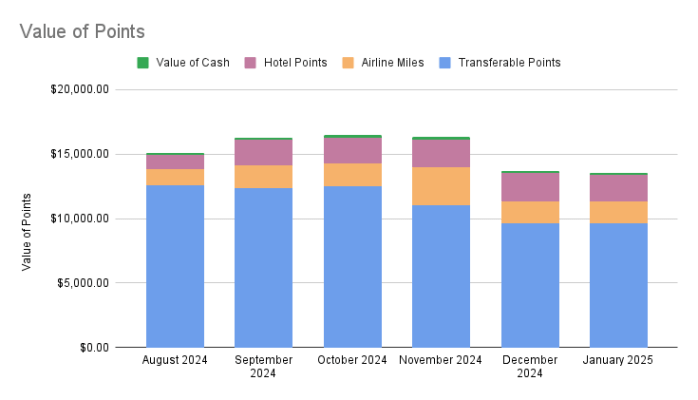

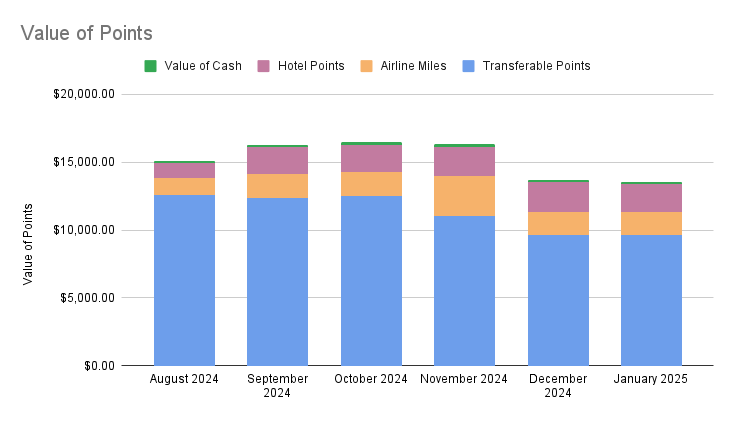

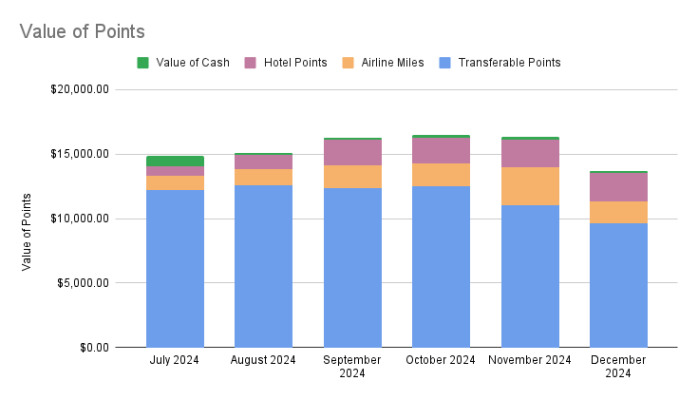

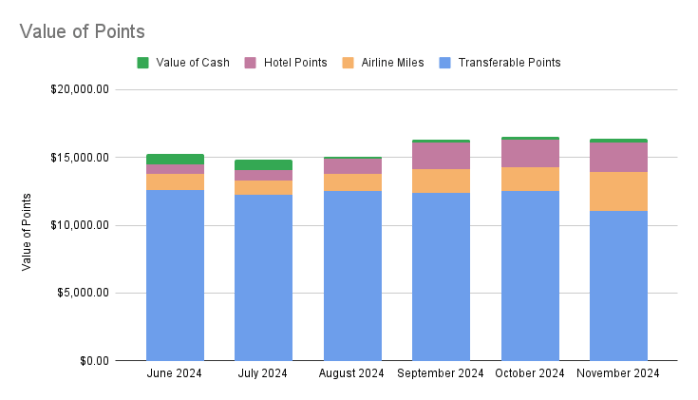

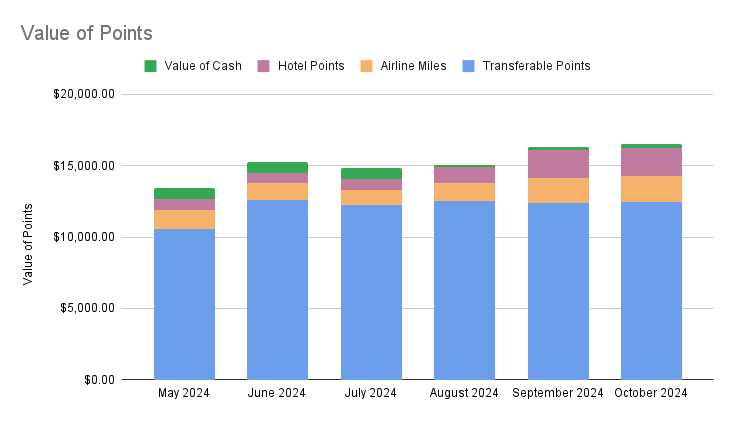

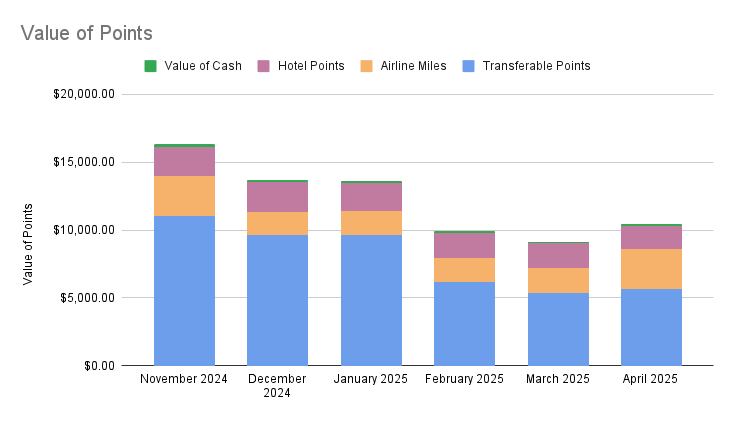

When you add everything up, the total value of points and miles, using the valuations from The Points Guy, comes to over $10,400. That is a $1,300 increase over last month. I don’t anticipate us booking very much for a while, since our trips for the year are pretty much planned. That means our point totals should be growing for the rest of the year and hopefully leave us with enough points to make some fun decisions for trips in 2026.