In a widely expected move, American Airlines is now a transfer partner from Citi Thank You Points. Rumors have been circulating since it was announced that American Airlines was phasing out its Barclay’s credit cards and signing an exclusive deal with Citibank. Finally, Citibank has added American Airlines to its Thank You Points transfer page, making those points much more valuable.

How This Transfer Partnership Works

People who hold a Citi Strata Premier, Citi Prestige, or Citi Strata Elite credit card can now transfer Citi Thank You Points to American Airlines AAdvantage Miles at a 1:1 ratio. Adding a coveted transfer partner makes any Citi Thank You Points much more valuable, especially since Citi is the only bank that transfers its points to American Airlines.

In addition, this also means that as long as you hold one of those cards, any points earned with a Citi credit card that earns Thank You Points, such as the Double Cash or Custom Cash, can also become AAdvantage Miles. This is because you can combine your Thank You Points and then transfer them to any of 15 airline partners or 5 hotel partners.

The reason why transferring points is so important is that in many cases, you can book hotels and flights with fewer points when you transfer them to a hotel or airline loyalty program. Even better, if what you’re looking for is actually a better deal to book with points through a travel portal, you have that option as well.

Domestic Airlines are (Mostly) Monogamous

Many international airline programs, like Air France/KLM Flying Blue, Avianca Lifemiles, and Air Canada Aeroplan, are polyamorous, allowing transfer partners from multiple bank points programs. For example, Flying Blue allows transfers from Chase, Citibank, American Express, Capital One, Bilt, and Wells Fargo. This is extremely common for international programs. Even Virgin Atlantic, despite its name, is a bit of a swinger.

Airlines based in the United States aren’t the swinging type; by comparison, they’re mostly monogamous. Delta Airlines only allows transfers from American Express Membership Rewards, American Airlines only allows transfers from Citi, and Alaska Airlines allows transfers from Bilt Rewards.

There are three airlines that, however, that aren’t exclusive. Southwest Airlines and United Airlines allow transfers from both Chase and Bilt, while JetBlue allows transfers from Citi, Chase, and American Express.

Your Airline Preferences Matter

Because of several factors, such as route networks, hub locations, award pricing, or just which airline you prefer, you should earn points that transfer to the airline that works best for you. For example, I know people who absolutely love Southwest Airlines. They fly a ton of flights out of Midway Airport in Chicago, which is an airport that isn’t far from where we live. Unfortunately, we do a lot of our flying to Europe, and Southwest Airlines doesn’t fly to Europe. We’re just not going to use it.

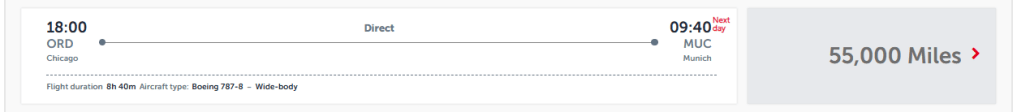

United Airlines flies to Europe and has a great network there, but generally, I find that it takes a lot of United miles to book a flight to Europe. Also, even though they fly out of my small home airport in Moline, the point prices for United flights out of Moline are extremely high.

Delta Skymiles is probably the most popular airline award currency in the world, but I struggle to find good value with Delta. They overcharge for one-way flights, and usually it’s difficult to find competitive pricing for round-trip tickets as well. That being said, I do occasionally find a great deal, and did recently book round-trip tickets in the summer for a little over 40,000 points each to Berlin. Unfortunately, those deals are not the easiest to find, and I don’t consistently find good value with Delta.

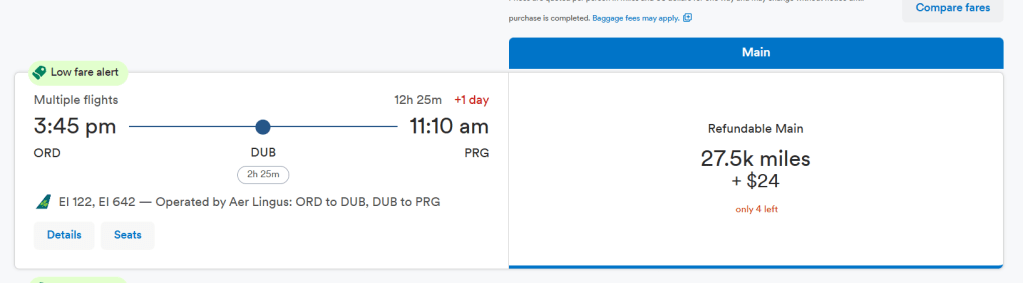

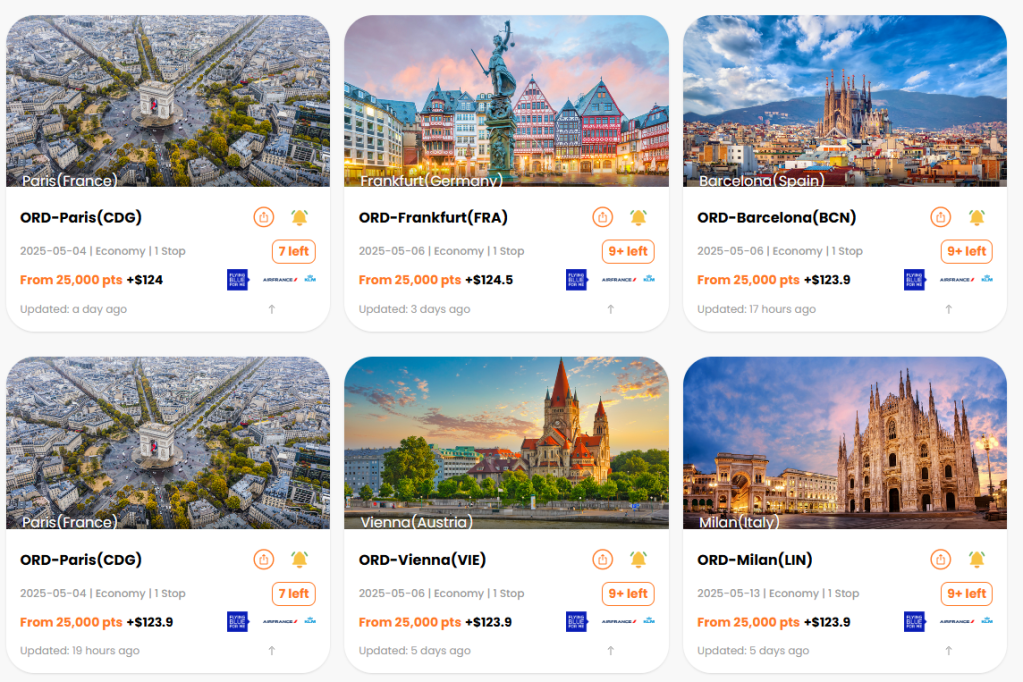

American Airlines, however, has a lot of great flights out of our local airport to Europe and some for extremely low prices, in points. In September, we are flying to Nice, France, from our local airport for only 19,000 AAdvantage miles each, and we were able to find a flight home from Dublin for only 19,000 miles as well. I have also seen several flights to Italy, Spain, and England for only 19,000 miles. Overall, it’s just a program that works well for us.

Those airline miles aren’t created equal either. The Points Guy does valuations each month, which look at the price of flights in miles and compare it to the price in cash for the same flights. In July 2025, the values of those domestic airline miles are:

- Delta Skymiles- 1.15 cents per point

- United Mileage Plus- 1.3 cents per point

- Southwest Rapid Rewards- 1.4 cents per point

- JetBlue TrueBlue – 1.45 cents per point

- Alaska Airlines Mileage Plan- 1.5 cents per point

- American Airlines AAdvantage – 1.55 cents per point

As you can see, according to the Points Guy, AAdvantage miles are the most valuable of the domestic airline currencies, so having an additional way to earn those miles is a very good thing.

This Will Shift My Focus to Citi

Lately, I’ve been concentrating on earning American Express Membership Reward Points and Chase Ultimate Rewards. That’s because they have excellent ways of earning points, and they have great transfer partners. Both have great ways of accumulating points through sign up bonuses and cards with great earning rates.

For example, we put all our internet and cell phone charges on our Chase Ink Cash card because it earns 5x in those categories. Also, as much as possible, we use our Amex Gold Card for restaurants and grocery stores because they earn 4x in those categories. Those are both great ways to accumulate a lot of points without sign up bonuses.

However, with Citi, I have a Custom Cash card which earns 5x on all spending in your top category, up to $500 in a billing cycle. This means that if you pick a category that you can come close to spending $500 on each month and only use it in that category, you can accumulate 2,500 Citi Thank You points each month without a lot of spending. I haven’t been doing that, however, because I just wasn’t that excited about accumulating Citi Thank You Points.

The partnership with American Airlines changes that. Because AAdvantage miles are very valuable to me, I will be going out of my way to earn Citi Thank You Points so I have points available to transfer to American Airlines.

Current Citi Strata Travel Credit Cards

Now that Citibank has revamped its travel cards, they are currently offering three different credit cards that all earn Citi Thank You Points: one is an entry-level card, one is a travel card, and one is a premium travel card.

Citi Strata Card

This is the entry-level travel card, and it is a pretty good starter card. It has no annual fee and is currently offering a 30,000-point welcome offer if you spend $1,000 in 3 months. For being a no annual fee card, it has tremendous bonus categories including 5x on travel through the Citi Travel Portal, 3x at supermarkets, 3x on gas and EV stations, 3x on a self-selected category, 2x on dining, and 1x everywhere else.

The downside is that it has a limited number of transfer partners (Does not allow transfers to AAdvantage), and those points transfer at a worse ratio. You could however, hold onto those points until you get a Citi credit card with a better transfer ratio, or perhaps transfer those points to a family member who holds a Citi credit card with better transfer options and have them book flights or hotels for you.

Citi Strata Premier

The Citi Strata Premier is a great travel credit card. It has a $95 annual fee and is currently offering a 60,000-point bonus if you spend $4,000 in the first 3 months. It offers 10x on hotels, attractions, and car rentals booked through the Citi Travel Portal, 3x on other air and hotel purchases, 3x on supermarkets, 3x on restaurants, 3x on gas and EV Charging stations, and 1x on everything else.

Unlike the Citi Strata Card, the Citi Strata Premier transfers to all of Citi’s partners at the best transfer rate that Citi offers. This also includes the 1:1 ratio to American Airlines. In addition, the Citi Strata Premier also offers a variety of benefits, including trip delay coverage, trip cancellation, and protection insurance, lost and damaged luggage coverage, and some car rental coverage.

Citi Strata Elite

The Citi Strata Elite is a brand-new premium credit card offering from Citibank with a $595 annual fee. It is currently offering an 80,000 point bonus when you spend $4,000 on the card in the first 3 months. It earns 12x on hotels, car rentals, and attractions booked through the Citi Travel Portal, 6x on air travel through the Citi Travel Portal, 6x on dining on Friday and Saturday nights, 3x on dining other nights, as well as 1.5x on all other purchases.

To compensate for the high annual fee, it offers $300 per year in hotel credits, $200 on an annual splurge credit, $200 Blacklane credit, a Priority Pass Select Membership, 4 American Airlines Admirals Club Lounge passes, as well as a $120 Global Entry or TSA pre-check credit.

My Favorite Strata Card

In my opinion, the Citi Strata Premier Card is the best of this group. The 3x categories of groceries, dining, and gas can help users accumulate a lot of points quickly. It has access to all of the transfer partners that the Citi Strata Elite card does, but with a $95 annual fee instead of a $595 annual fee. Also, I don’t find the credits on the Strata Elite to be enticing enough to pay an extra $500 on an annual fee. The only reason I would consider the Strata Elite is if I were a very frequent flyer, and I used those lounge passes a lot.

Being Strategic about Your Credit Card Choices

The points and miles world is extremely complicated. There are multiple banks with multiple cards, and each comes with different earning rates, benefits, and transfer partners. If you wish to turn all of your everyday purchases into great vacations, it’s important to try to be as strategic as possible.

For travel hackers who are using points to supercharge their travel, they must use the points programs that fit their travel plans the best. That really means working backwards from the destinations that you would like to visit, figuring out the best airlines that service those destinations from where they live, and then trying to figure out the best way to earn points to use with that airline. If American Airlines miles are a good fit for your travel plans, then this new partnership with Citi is a very exciting development.