When I first got into the points and miles hobby a couple of years ago, I was listening to a Frequent Miler podcast when I heard the term “sweet spot” for the first time. What they were referring to was a route, series of routes, or region in a points program where the deals were especially good. They were talking specifically about Turkish Miles and Smiles which had a number of great sweet spots:

- 7,500 miles in economy and 12,500 miles in business class within the United States including Hawaii (on Star Alliance Partners – usually United Airlines)

- 10,000 miles in economy and 15,000 miles in business class within North America including the Caribbean and Mexico (on Star Alliance Partners – usually United Airlines)

- 30,000 points in economy and 45,000 points in business class to Europe on Star Alliance Partners or Turkish Airlines.

This turned out to be the first program I that I ever used to redeem points for a flight. I had to learn how to take my Citi Thank You points, transfer them to Miles and Smiles and then use their program to book United Airlines flights. In this case, I booked Jenn and I round trip tickets from Chicago to San Jose del Cabo Mexico for 40,000 points, which was a very good deal. 10,000 miles per person one-way to Mexico was fantastic. This was a deal that wasn’t the easiest to get, but it wasn’t too hard either. It just required a little flexibility on when you took the flight.

Because of this sweet spot, I always wanted to keep some Capital One Venture miles or Citi Thank You points (Citi and Capital One transfer to Turkish 1:1) around just to make sure that I could transfer them to Miles and Smiles. It was nice to have some miles available in case we wanted to use Turkish to book flights to the Caribbean or Mexico.

Turkish Airlines Website is Frustrating

The Turkish Airlines Miles and Smiles website is notorious for having all kinds of glitches. I kept getting an error when doing an award search while writing this blog post, and based on some google searches and reddit threads, I would say this error is common and has been around for a while without being fixed.

There is also an issue where most people cannot book anyone besides themselves online the first time they use the Miles and Smiles website to book an award ticket. Most people report that they end up calling customer support the first time they book with Turkish so they can book additional passengers (I had to do this also). Travel Update wrote a blog post about how to book with Turkish, which is very informative on the subject. For the most part, if you want to book with Turkish, you probably need to be a patient person.

The Sky Is Falling!

In early February, I started to see a bunch of blog and Twitter posts about a sudden devaluation that was to take place on February 16th. I read this one by One Mile at a Time, which showed what the new award chart would look like on Turkish Airlines, and it looked bad, with rates going up in the 40%-100% range.

A favorite redemption of miles and points hobbyists was business class tickets from the US to Europe for 45,000 miles. That’s a pretty amazing price, but with the new award chart it’s going cost 85,000 miles. This was, in my mind, what I think was freaking people out the most. One of the great ways of using Citi and Capital One points – business class flights to Europe for 45,000 miles – gone.

What I hadn’t seen anyone comment on was about my favorite redemption with Miles and Smiles. What was a flight to Mexico or the Caribbean from the US going to cost in economy? I figured I would just wait until after the change and then do a quick search to find out the answer.

I wasn’t too concerned, frankly I figured if they jumped it to 15,000 each way it would still be a decent deal. Besides, I’ve seen the points and miles community overreact when it came to Delta just a few months earlier. How bad could it possibly be?

Well, As it Turns out, Pretty Damn Bad!

30,000 miles? Are you serious? My favorite sweet spot to Mexico and the Caribbean is now 3 times the amount of points as it was before! Considering that the only way flights are even available to book on Miles and Smiles is if they are a saver award from another airline, there is no way that that I would book that through Turkish, I would just book it through the other airline.

Two of the best sweet spots, business class to Europe and economy or business class to Mexico and the Caribbean are effectively dead. But is there anything still worthwhile with Turkish Miles and Smiles?

Is Any Redemption Still Decent With Turkish?

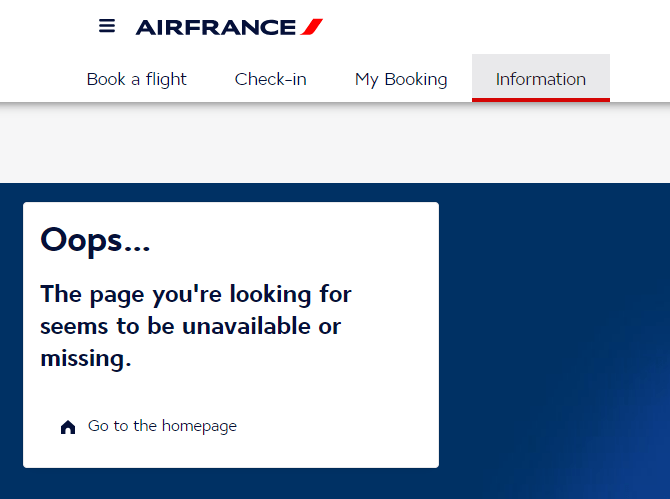

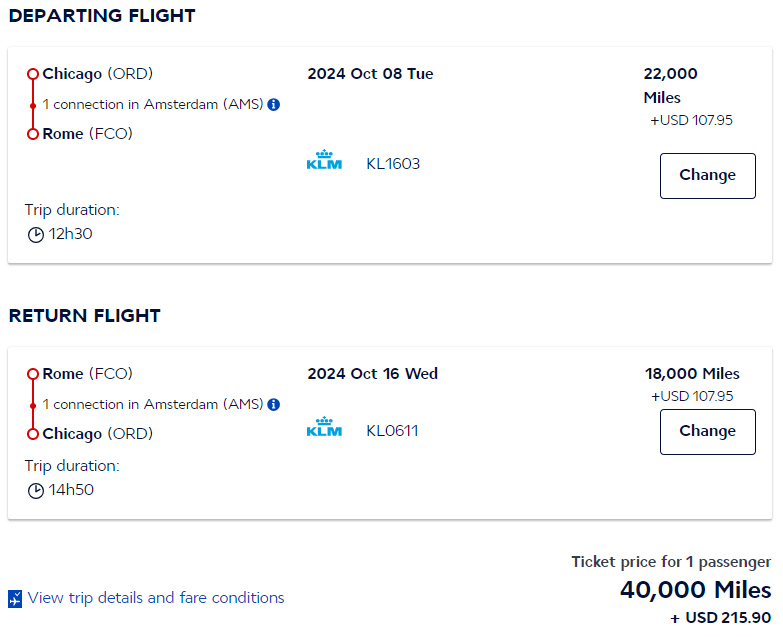

The one remaining bright spot, in my mind, is 10,000 miles for domestic flights in economy and 15,000 miles in business class. When I saw this in the chart, I thought it meant just within Turkey. However, this appears to be any domestic, Star Alliance flights within any country. In the example below, a flight from Vancouver to Montreal is 10,000 miles in economy class.

A coast to coast flight from Washington DC to San Francisco is also just 10,000 miles.

The most impressive redemption left in the Miles and Smiles program is still on flights to Hawaii from the mainland US for just 10,000 miles in economy and 15,000 in business class. This used to be 7,500 miles in economy and 12,500 miles in business class before the change. They don’t make an exception for Hawaii even though it is almost a 5,000 mile flight from the east coast of the US. I even managed to find a flight to Hawaii from my little regional airport in Moline for 10,000 miles. That shocked me.

The baffling thing is that for some reason, coming it at one tenth of the distance of the flight from Washington to Honolulu is Chicago to Toronto for 30,000 Miles and Smiles. Why 30,000? Well, that’s because since it crosses a border, it counts as a flight within North America, not a domestic flight. Because it crosses the border between the US and Canada it ends up being 3x the number of miles to redeem. It doesn’t matter in the least that this has got to be a much cheaper flight for the airline to operate.

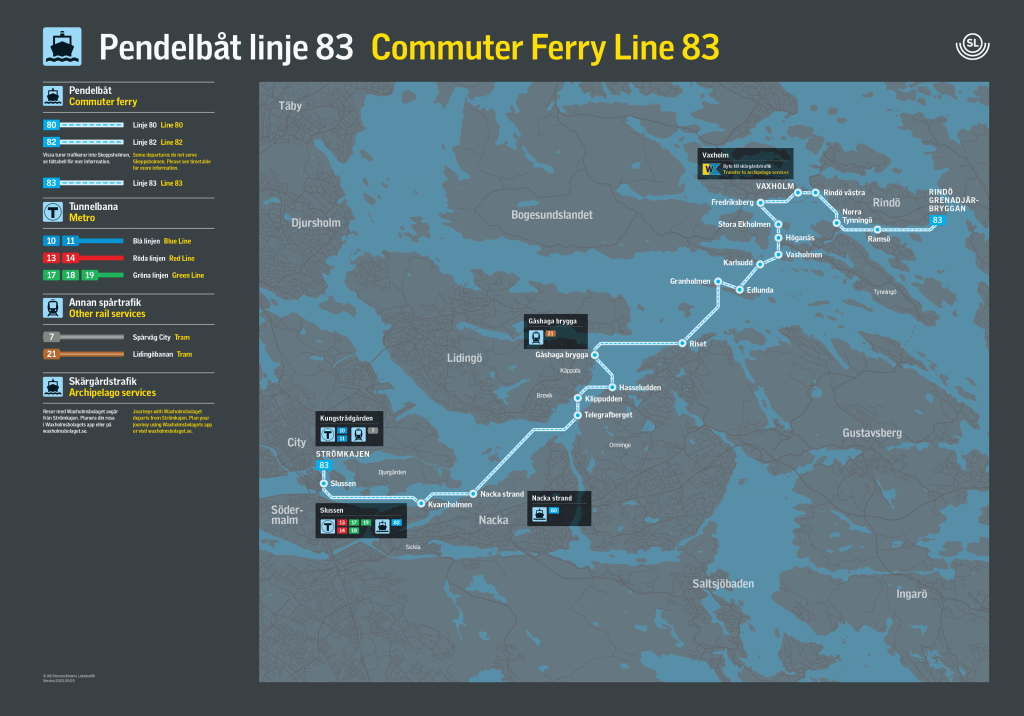

Dynamic Pricing Vs Award Charts

Most airline award programs have gone to some sort of dynamic pricing model, where they essentially calculate the price, in miles, based on the price of the ticket or the availability of award seats on the plane. American Airlines does this, and this became apparent to me when Jenn and I were trying to book 4 seats on American Airlines, 2 seats on her account and 2 on my account for the same flight. Once I booked my 2 seats, her price went up by 5,000 points each for those same flights. I assume that happened because 2 award seats had just disappeared from inventory.

This can get a little frustrating when you check the price of a flight a couple of days in a row and they change, but at the end of the day, they follow the price, in dollars, of the same flights. The cost of the flights, in points, generally makes sense.

There are some airlines, like Turkish Airlines, that still use an award chart for their award flights. This does make their award flight prices much more predictable, but can mean that some flight prices don’t make a lot of sense, such as the low cost of the flights from the east coast to Hawaii compared to a short flight across the Canadian border. For those of us who like to make the most of our miles and points, these charts often provide us with ideas on how to stretch the value of those points.

How I will Use Turkish MIles and Smiles

Turkish Airlines used to be one of the best uses of Capital One miles and Citi Thank You Points. Because you can transfer either of those programs 1:1 to Turkish Miles and Smiles, the great deals they had for flying from the US to Turkey, Europe, Mexico, the Caribbean and within the United States made this program a favorite amongst people in the miles and points hobby.

Most of the value of the program has disappeared with the increase in award prices to Turkey, Europe, Mexico and the Caribbean. That eliminates most of the usefulness for me, but knowing that I can still fly for 10,000 miles one-way within the US on United Airlines makes it still relevant. At 10,000 miles, it won’t always be a better deal than booking with United, American or Delta, but it most likely will be on the longer US routes.

Turkish Miles and Smiles, you’re not dead to me – yet.